The week that was:

- China’s loan growth fell to its weakest level since 2009 and retail sales, industrial production and fixed-asset investment missed the mark

- In what was seen as a panic response, the People's Bank of China (PBOC) cut the one-year medium-term lending facility (MLF) rate by 15 basis points to 2.50% (its second cut in three months). The PBOC also cut the seven-day reverse repo rate by 10 basis points to 1.90%

- China’s Premier Li hinted at further stimulus to aid the Chinese economy hitting their growth target of ‘around’ 5%, although the market response ahead of the weekend was lacklustre

- The July FOMC minutes were more hawkish than expected, with some members feeling that further hikes may be warranted to combat persistent inflation

- Surging bond yields and a stronger US dollar kept markets under pressure in the first half of the week, sending spot gold below $1900

- Rising unemployment and negative job growth and risk-off sentiment sent AUD/USD below 64c for the first time since November, building to the case the RBA may have reached their peak rate of 4.1%

- A member of Japan’s Ministry of Finance (MOF) warned that they were closely watching FX as USD/JPY approached 145. Regardless, widening interest rate differentials between the US and Japan saw USD/JPY break above 145 and tap a 9-month high before pulling back at a key resistance level

- Evergrande filed for bankruptcy protection in New York, less than a week after rumours swirled that large corporations in China were in a liquidity crunch

- Inflation reports for the UK and BOC were hotter than expected, which piles on the pressure for another 25bp hike from the BOC (Bank of Canada) or even a 50bp hike from the BOE (Ban of England)

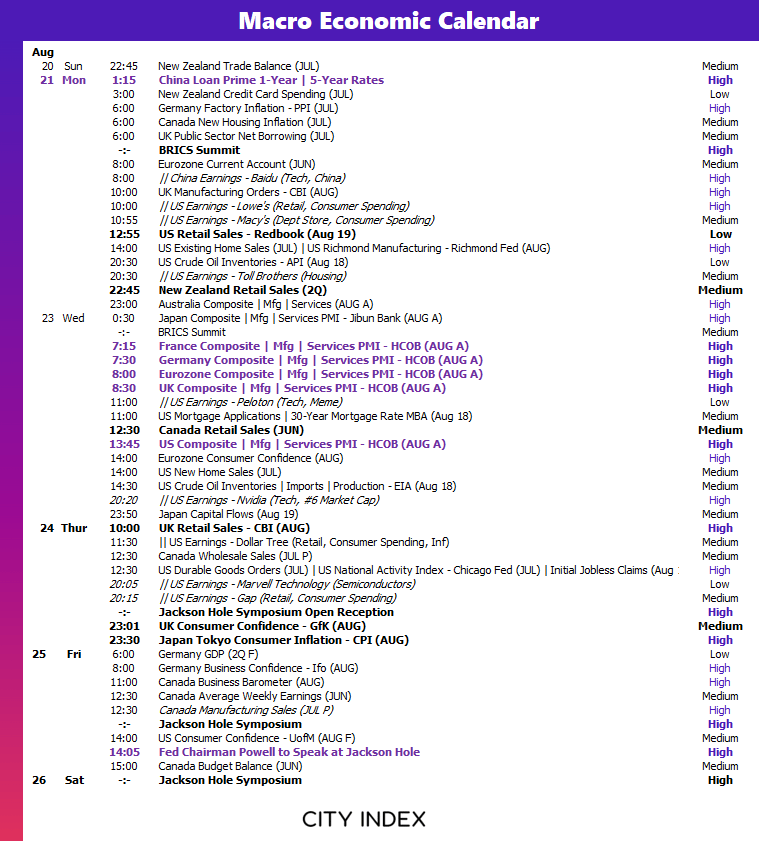

The week ahead (calendar):

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- Jerome Powell’s speech as the Jackson Hole symposium

- Flash PMIs for US, Europe, Japan, Australia

- China’s loan prime rate

- Tokyo CPI, retail sales (UK, US, CA), earnings (GAP, Lowe’s, Macy’s, Nvidia)

Jerome Powell’s speech as the Jackson Hole symposium

The Jackson Hole symposium is an annual gathering of central bankers and economists from around the world. It is a forum for the Fed chair to discuss the state of the economy and the Fed's monetary policy plans.

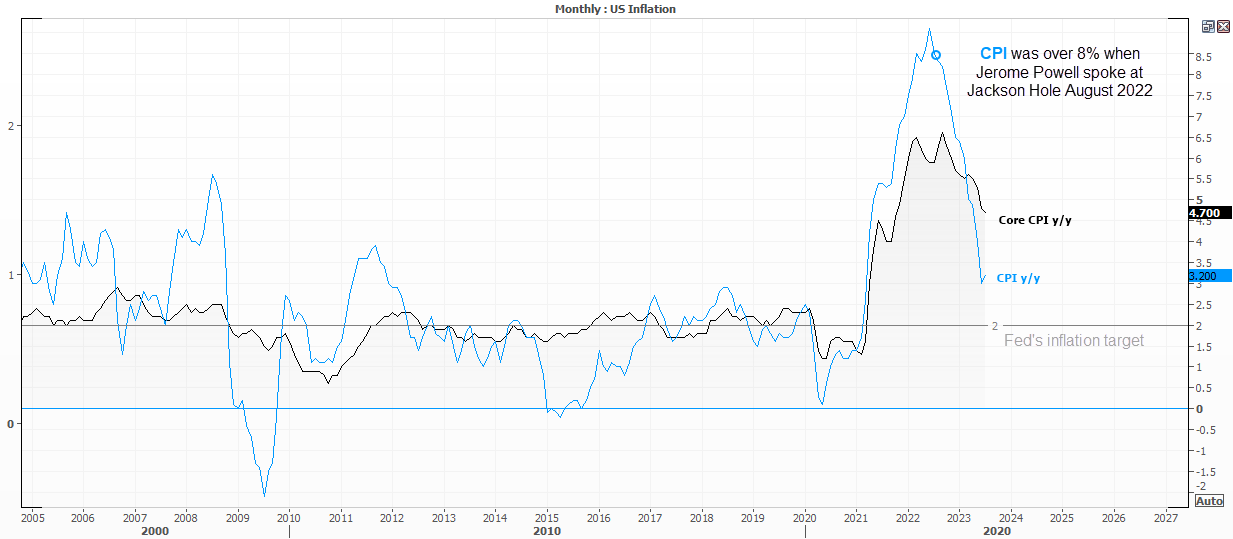

Jerome Powell's speech at the Jackson Hole symposium in 2022 was a major policy announcement, in which he outlined the Federal Reserve's plans to combat inflation “forcefully and rapidly” and was committed to bringing inflation back down to its 2% target. Powell's speech was well-received by markets, which interpreted it as a sign that the Fed is serious about fighting inflation. However, some economists warned that the Fed may be too aggressive in its tightening cycle, and that this could lead to a recession.

We can see that CPI was over 8% when Powell delivered this speech and has now cooled to a cycle low of 3%. And this has been achieved without the “economic pain” that many, including the Fed, were concerned about. In fact, one year on and the economy remains robust with strong employment figures and above-expected growth. Sure, we know that manufacturing is contracting, but it appears the US is on track for a soft landing, black swans aside.

The highlight of the symposium with be Jerome Powell’s speech on Friday 25th August at 14:05 GMT (00:05 AEDT). Simply titled “Economic Outlook”, traders will be on tenterhooks to see if there are any significant changes to the Fed’s outlook.

As things stand, most believe the Fed delivered their final hike in July and Fed Fund futures imply ~89% chance that the Fed will hold interest rates steady in September. The latest FOMC minutes revealed a division within the Fed, with some members expecting to have to hike further whilst some thought they may have gone overboard. Then perhaps Powell’s outlook will serve as vindication of current market pricing if hints are dropped that much of the work is done (peak rate is here), and cause quite a US dollar selloff if he dared to discuss cuts. But let’s be realistic. It is not in the Fed’s interest to let on that they’re even thinking of cutting (even in the unrealistic scenario where they are). If anything, there may be some risks that Powell’s speech may be more hawkish than expected if hints are dropped that tightening is not yet over.

Either way, his speech will have the potential to move all asset classes one way or another. And it can be watched live here.

Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

Flash PMIs for US, Europe, Japan, Australia

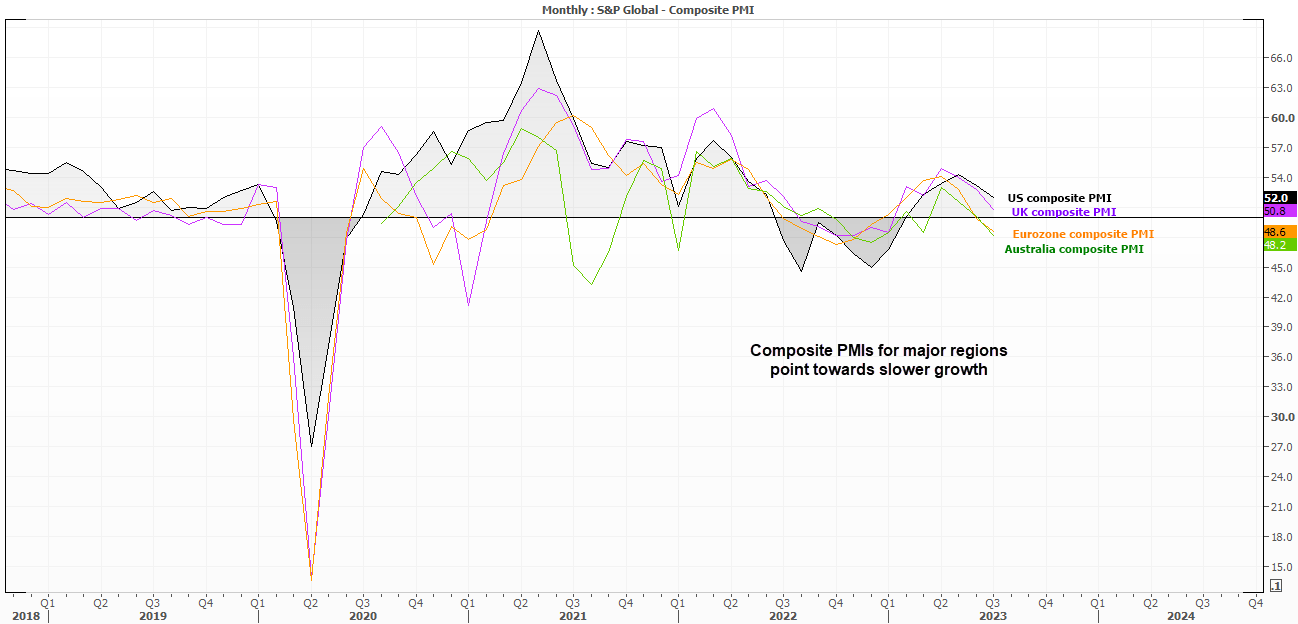

Traders like to keep a close on Purchase Manager Index surveys (PMIs) as they provide a forward look to how growth an inflation is likely to perform for their respective regions. They consist of three major reports; manufacturing, services and composite (overall) with a read above 50 denoting expansion and below 50 contraction. But their trends can be more important that their absolute level, unless we see a PMI unexpectedly drop below or rise above 50.

We can see that composite PMIs have been trending lower these past few months. If we’re to see PMIs contract at a faster pace (or slow at a faster pace) then it suggest growth is under threat. And as that is deflationary, or removes pressure for central banks to hike. For example, a particularly weak PMI report for the UK could signal a slowdown and lower levels of inflation and weigh on GBP/USD. Conversely, if we saw a surprise rise on Australia’s PMIs and it were to break above 50 to denote expansion, it could support AUD/USD. And with PMIs released for Japan, Australia, France, Germany, eurozone and the US next week, it places several forex major pairs in focus.

Wednesday:

- Judo Bank Flash Australia Composite PMI

- au Jibun Bank Flash Japan Composite PMI

- HCOB Flash PMI for France, Germany and Eurozone

- S&P Global / CIPS Flash UK PMI

- S&P Global Flash US Composite PMI

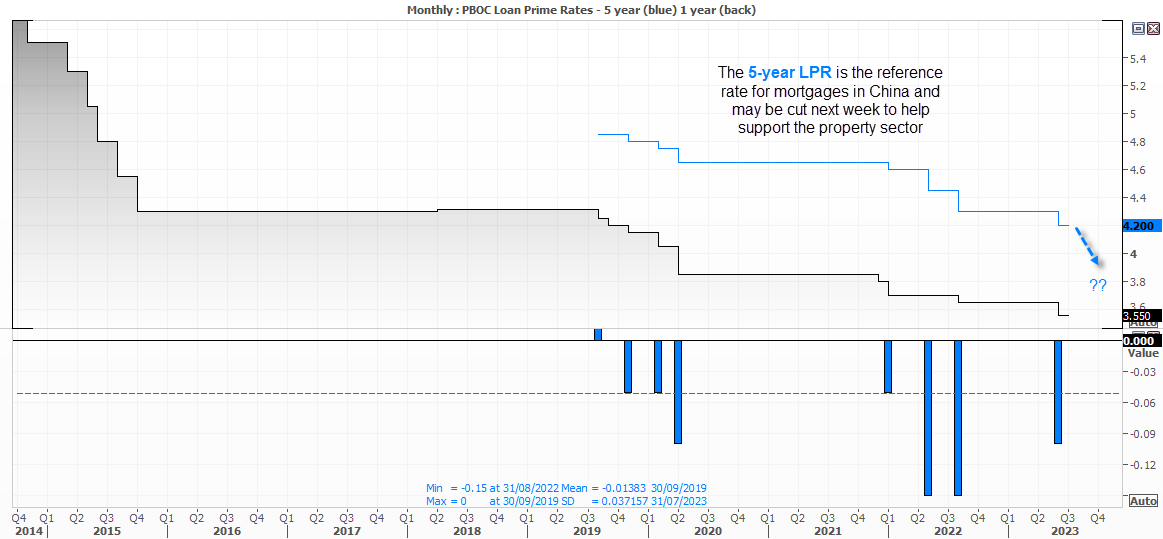

China’s loan prime rate

With all the excitement (or concerns) over weak China data lately, the loan prime rate will garner attention next week. The LPR is the benchmark rate for corporate and household loans, and it seems reasonable to assume that the LPRs could be lowered again in an attempt to boost much-craved demand to kick start the economy.

This week we saw markets go into a bit of a tailspin when the PBOC (People’s Bank of China) unexpectedly cut their medium-term lending facility (MLF) rate by 15 basis points to 2.50%. IN what was seen as a panic move, we may find that an aggressive cut of the 1 or 5-year LPRs next week trigger a similar reaction. The PBOC have cut the 5-year LPR seven times at an average rate of -13bp, and they may decide to cut it more aggressively given it is the reference rate for mortgages and house prices contracted for the first time in a year.

Market to watch: USD/CNH, USD/JPY, AUD/JPY, Hang Seng, China A50

And as for the rest…

There’s plenty second-tier data which is worthy of a look, in case we get any large deviations relative to expectations. With the BOC (Bank of Canada) mulling over Canada’s latest hot inflation report, a surge in retail sales on Wednesday could increase the odds of another 25bp hike and support the Canadian dollar. And the same could be said for the BOE (Bank of England) if UK shoppers continue to defy higher interest rates and keep spending their high wage increases.

Tokyo’s inflation report on Friday also warrants a look as it can provide a 3-week lead on nationwide CPI. And that is quite relevant, given Japan’s GDP and inflation data far exceeded expectations this week.

As for earnings, US listed GAP sheds light on consumer spending in the apparel section. Lowe’s and Macy’s also release earnings and will provide forward guidance for their expectations of performance of the US consumer.

Market to watch: EUR/USD, USD/JPY, GBP/USD, USD/CAD, S&P 500

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade