Unlike their larger rivals in the Dow Jones Industrial Average or S&P 500, the smaller-capitalization stocks that make up the Russell 2000 index tend to have less market power, and by extension, less ability to pass on increased prices to their competitors. Therefore, it’s not surprising to see the small-cap Russell 2000 index (-8.0% year-to-date) trailing the performance of the Dow (-4.9%) and S&P 500 (-5.7%) so far this year.

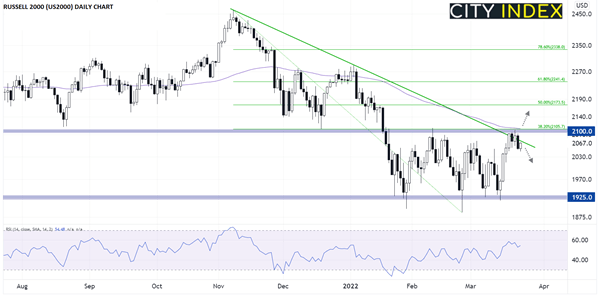

More to the point for short-term traders, the index is currently testing a tight confluence of at least four different resistance levels:

- The 38.2% Fibonacci retracement of the November-February drop is at 2106.

- The 100-day exponential moving average (purple in the chart below) has consistently provided resistance dating back to December and sits at 2106.

- Previous resistance at the top of the 2-month range looms near 2100.

- Bearish trend line resistance off November’s record high currently comes in around 2070.

Source: TradingView, StoneX

In essence, traders using four different styles of technical analysis can all project a higher likelihood of prices finding a cap near 2100, so there is an elevated probability of the Russell 2000 forming a near-term top around that zone. If prices do indeed sell off from here, the most important level to watch will be the bottom of the 2-month range near 1925.

Meanwhile, if bulls are able to muster enough strength to break through the confluence of resistance levels near 2100, it would signal significant buying pressure and likely point to a continuation toward the next Fibonacci retracement levels at 2175 (50%), 2240 (61.8%) or even 2340 (78.6%) next.

Either way, readers trading the Russell 2000 should keep a close eye on the 2100 area in the coming days!

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade