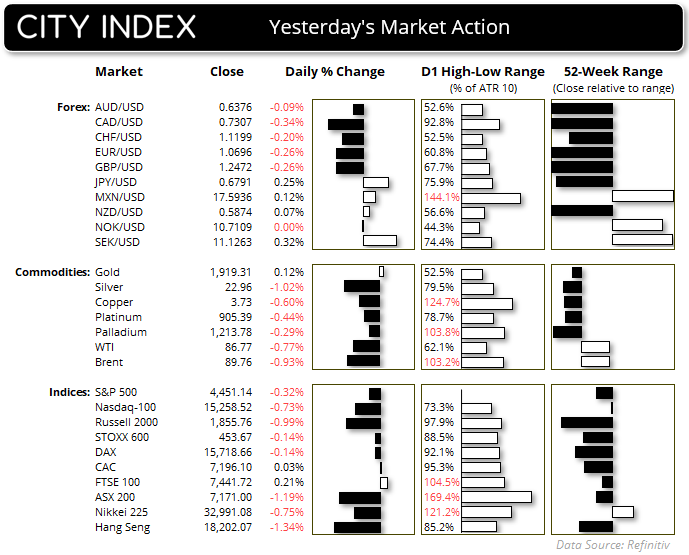

Market Summary:

- US jobless claims data was lower than expected to show the labour market remains resilient, and plays into the ‘higher for longer’ theme for the Fed’s rates

- The US dollar index rose to a fresh 6-month high despite the cooling of US yields. Although if yields struggle break above key resistance levels and march higher, I suspect the dollar’s rally could also lose steam.

- The positive employment data from the US weighed further on Wall Street, although parred losses after its lower opening gap

- Apple shares weighed further on Wall Street on reports that China’s government applied further restrictions on iPhones. Wall Street had originally reported that China had followed Russia’s lead on banning the devices at central government offices, but the restrictions have now been applied to government-backed agencies and state companies.

- The Japanese yen was the strongest forex major on Thursday, which saw USD/JPY pull back to Tuesday’s inverted pinbar low as it struggles to make a break for 148 for a third day. It also helped EUR/JPY reach my downside target on the 1-hour chart.

- The yen was stronger following comments from another BOJ official, with Nakagawa warning that the central bank is scrutinising markets and currency movements

- The Canadian dollar was the weakest forex major despite hawkish comments from BOC governor Macklem, who warned that interest rates may not be high enough to tame inflation.

- GBP was the second weakest forex major as traders digested recent comments from BOE officials which eludes to a less-hawkish central bank

- WTI snapped a six-day winning streak and formed a bearish inside day to show the rally losing steam around $88.

Events in focus (AEDT):

- 09:05 – Fed’s Logan speaks

- 09:30 – Japan’s wages data

- 09:50 – Japan’s Q2 GDP (revised)

- 16:00 – German CPI

- 22:30 – Canadian employment data

- 23:00 – Fed Vice Chair for Supervision Barr Speaks

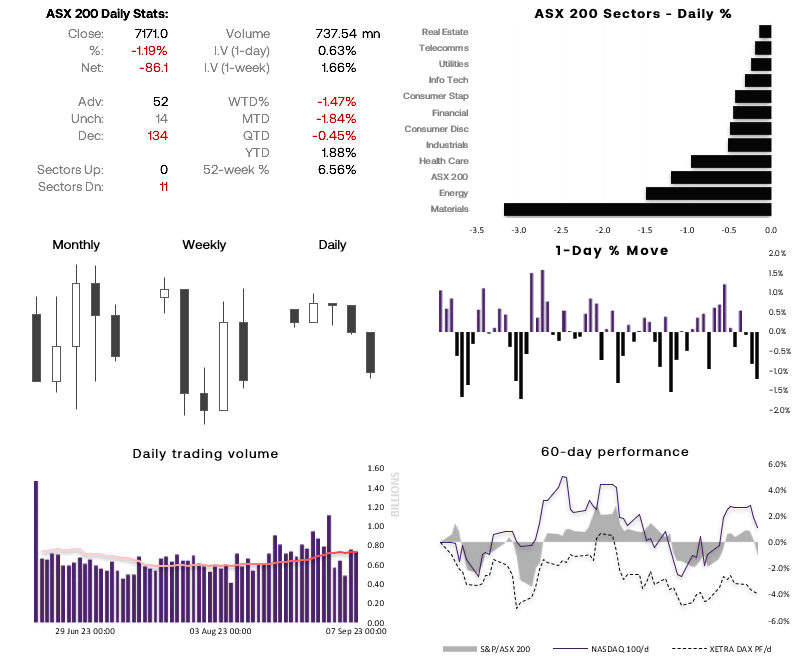

ASX 200 at a glance:

- The ASX 200 suffered its worst day in 16 and closed firmly beneath its 200-day EMA and 200-day average

- Daily trading volumes were above their 20-day average for a second day to show sellers stepping in

- 7200 / the 200-day EMA is likely to be a key area of resistance today, if the market can find the strength to retrace from its 7-day lows

- Whilst Wall Street provides a weak lead today, SPI futures suggest signs of stability for the ASX at today’s open

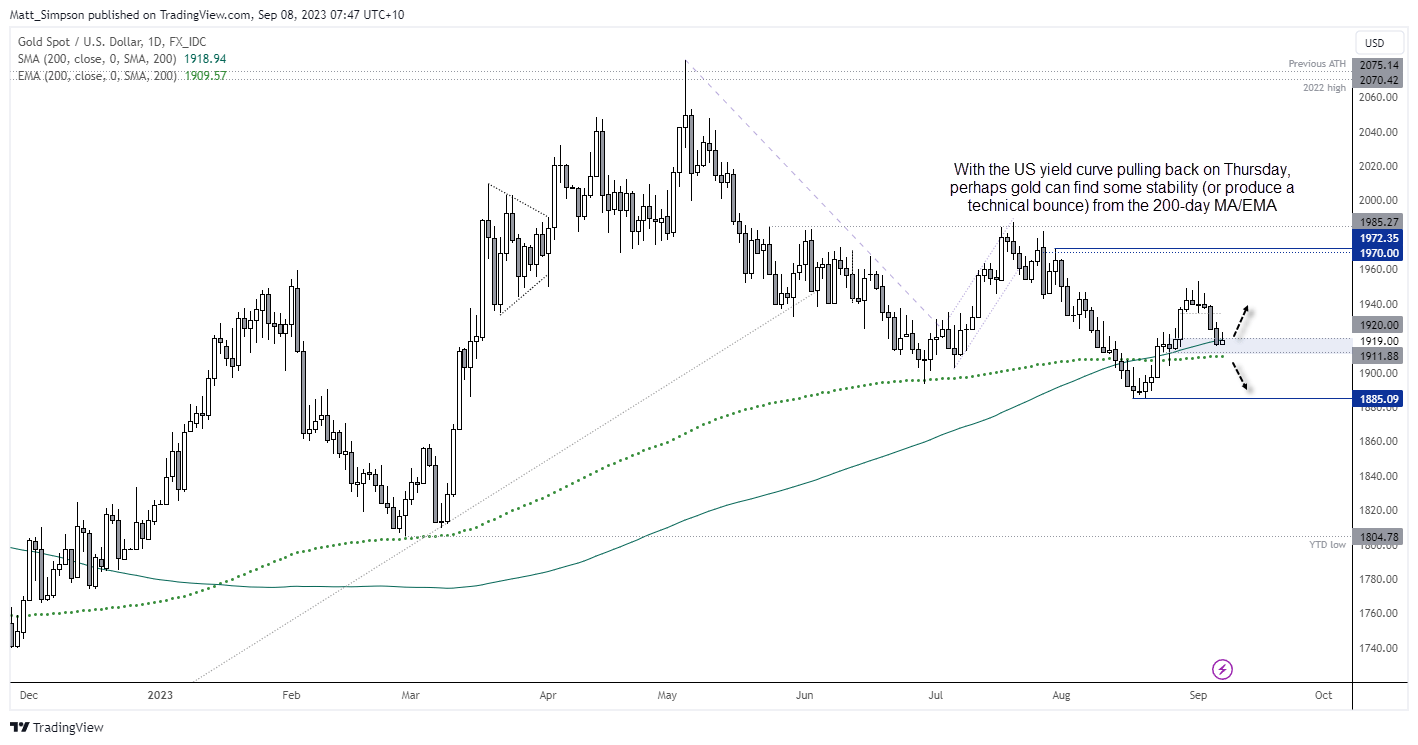

Gold technical analysis (daily chart):

We have seen gold prices pull back in line with my bias laid out earlier this week. Gold is showing signs of stability around the 200-day average and 200-day EMA, and a simple-weighed gold basket against FX majors remains near its cycle highs, to show the pullback on XAU/USD has mostly been due to the strength of the US dollar. With US yields showing signs of weakness around current cycle highs, perhaps the US dollar can low some steam and help gold print a minor bounce from current levels.

USD/CNH technical analysis (daily chart):

USD/CNH has risen back to the August high in line with my bullish bias outlined in recent weeks. Price action has remained defiantly bullish despite news that China’s state banks have been actively USD/CNH. But we enter today’s session with a clear level around 7.35 to monitor to see if it can break higher and head for the 2022 high, or further headlines arrive to shake bulls out of their positions and pull back. Either way, it could be argued that Beijing are more than happy to have a weaker yuan to boost exports (even if they do say they want a domestic-demand driven economy). And theories aside, this trend is bullish and there are no immediate signs of a top – although bulls may want to trade with caution given the headline risk.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade