- Gold analysis: Bears in charge amid hawkish Powell and strong NFP

- ISM PMI up next but don’t expect a quick US dollar reversal

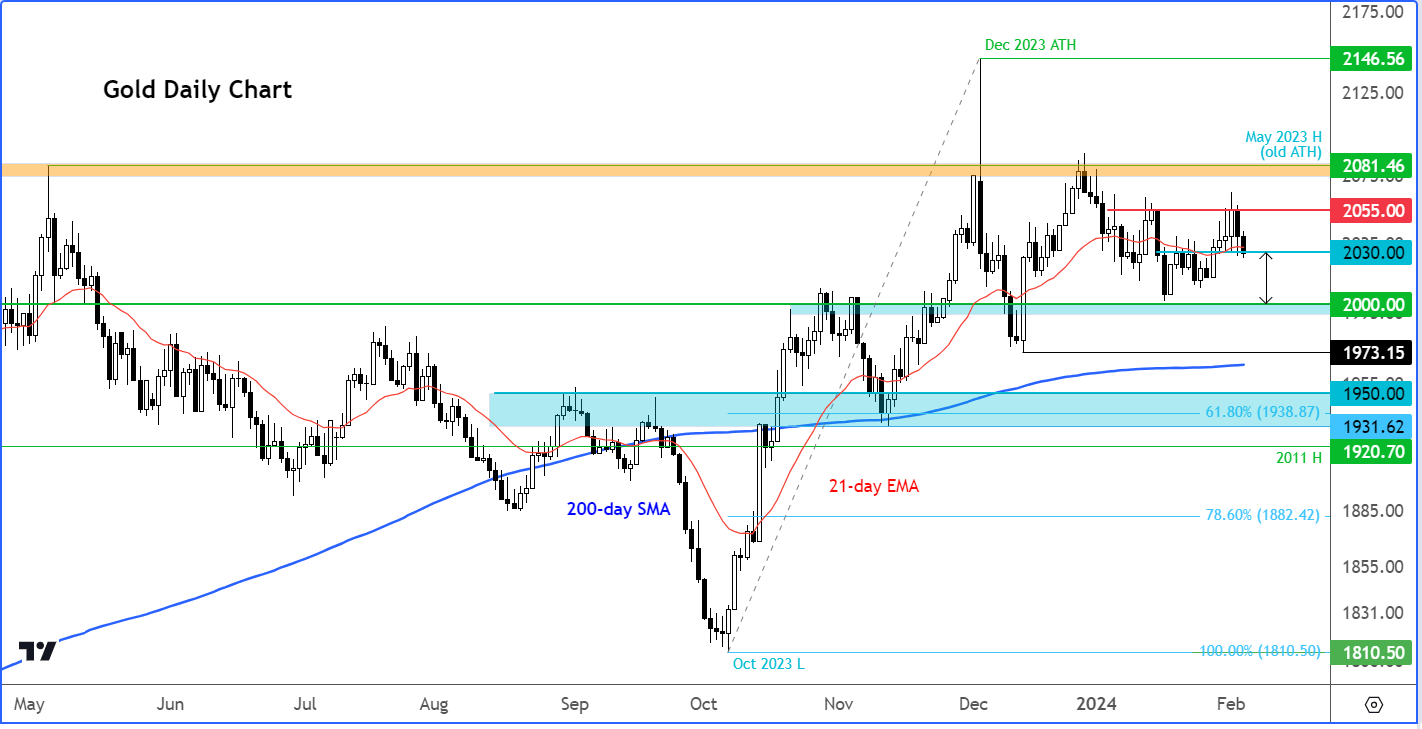

- Gold technical analysis point to a potential drop towards $2K

There is a decent chance for gold to surrender additional gains at the beginning of this week, following its decline on Friday that was triggered by a strong US jobs report. The limited economic events scheduled for this week make a swift dollar reversal unlikely, which may mean gold will maintain its downward trend in the short-term perspective.

Gold analysis: Bears in charge amid hawkish Powell and strong NFP

There are no real reasons for investors to sell the dollar this early after a strong jobs report that was published on Friday all but ended talks of an early rate cut. That being said, you would have thought that investors wouldn’t sell the dollar post a hawkish Fed meeting last week, but they did. So, let’s see if there will be any real commitment from the dollar bulls this time. So far, it looks like there may well be with Powell admitting on Sunday that the Fed is wary of cutting interest rates too soon.

In an interview that was aired Sunday evening, Powell said that the “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.” He added that “the prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

US jobs report was a game changer

Powell’s interview was conducted a day before the January jobs report was released. The January jobs report showcased broad strength, prompting investors to shift from bonds to the dollar on Friday, a trend that is unlikely to reverse without any major deterioration in US data. The yield curve reverted to a bearish flattening mode, contradicting the prevailing belief in an early Fed rate cut, with the likelihood of a March trim pushed down to around 20%.

It will be interesting to see whether these initial post-NFP moves would last. Fundamentally, there is little reason to fade these moves, but there was an interesting reaction that followed the FOMC meeting in mid last week, when US bond yields fell even though Chairman Powell downplayed the chances of an early rate cut. In response, the US dollar weakened as falling yields helped to underpin foreign currencies, and gold.

But those moves more than reversed post-NFP reaction. Based on the price movements observed last week, it appears that the market misinterpreted the situation. Investors had convinced themselves that interest rates would decrease this year, and consequently, yields should not remain high simply because the Fed sounded somewhat cautious. To some extent, this perspective is understandable, especially considering we had a couple of recent data misses that supported such a belief. After all, the market tends to anticipate future developments, and evidently, investors do not perceive a high likelihood of inflation persisting as a significant risk. This could be the reason why the US dollar struggled to extend its gains from January. However, with the release of Friday's data, there is now the potential for a new bullish trend for the greenback and a bearish one for gold.

US ISM services PMI up next

Contrary to the post-FOMC reaction, Friday’s post-NFP price movements have shown some follow-through in the early European trade.

Looking ahead, today’s key data is the ISM services PMI. The data is anticipated to improve to 52.0 from 50.5. A strong report should keep the dollar bulls happy although even a modestly soft report is unlikely to reverse Friday's moves.

All told and given a relatively light calendar week for US data, the renewed strength in USD should keep the dollar bears at bay. In turn, gold, a dollar-denominated commodity, should remain out of favour, especially as investors continue to favour the racier equity markets with the major US indices hitting fresh highs on Friday.

Gold analysis: Technical levels to watch

Source: TradingView.com

Gold’s attempted breakout failed last week with the sellers returning around the previous short-term resistance in the zone around $2055/60 area to send prices back down to $2030 where it was trading earlier today, before pushing through it. So a breakdown and a bit of correction looks likely now towards $2000, which could make things a bit interesting after what has been a side-ways chop for several weeks. Below the $2000 level, the next downside target could potentially be the December low at $1973.

The bulls will have to remain patient now and await a fresh ‘buy’ signal in light of Friday’s bearish reversal. This could take a while to form given the recent moves in the bond markets.

So, I would favour looking for downside in gold in the short-term outlook, until such a time that the dollar starts looking heavy again.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade