EUR/USD looks to ECB rate decision

- ECB is expected to leave rates unchanged

- The focus will be on staff projections for clues over rate cuts

- EUR/USD hovers around a 5-week high

EUR/USD is holding steady at a five-week high as the markets digested Federal Reserve chair Powell's comments yesterday and ahead of the ECB interest rate decision.

The ECB is expected to keep interest rates at a record 4%. Policymakers insist it's premature to discuss cutting interest rates even though inflation is cooling closer to the 2% target.

The focus will be on the new staff projections for growth and inflation, which could provide further clues about the timing of the first cut. A downward revision to the inflation forecasts could suggest that the ECB will look to cut interest rates sooner, which could pull the euro lower. The market is currently pricing in a June rate cut.

Meanwhile, the US dollar is holding steady after mixed messages from the Federal Reserve. Fed Chair Jerome Powell testified before Congress that the Fed would be cutting interest rates in 2024. However, he provided a few clues about the timing and scale of those cuts.

Meanwhile, Minneapolis Fed president Neel Kashkari reined in rate cut bet expectations saying he only sees two, maybe even one, rate cuts this year.

Jerome Powell will testify again before Congress today, and he is expected to reiterate yesterday’s remarks.

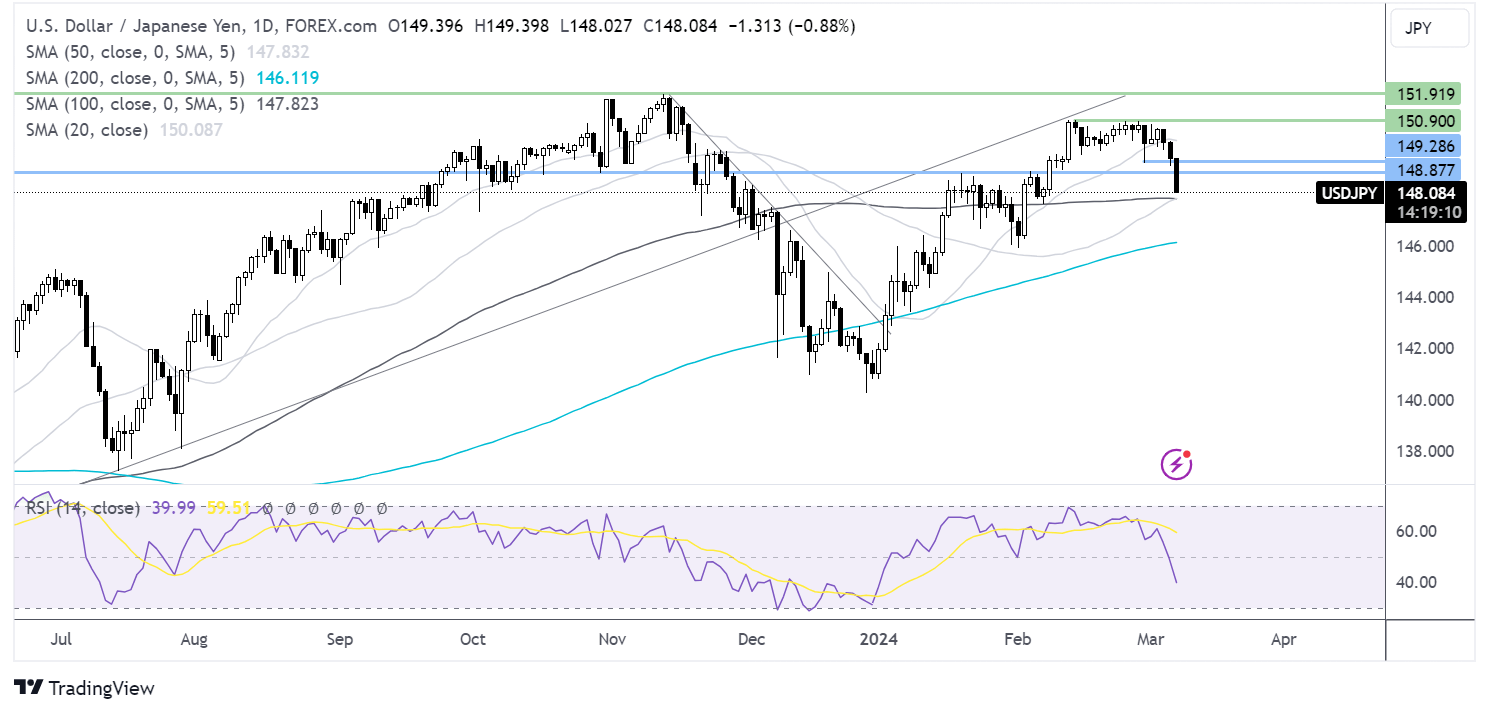

EUR/USD forecast – technical analysis

EUR/USD has extended its rebound from 1.07, the 2024 low, rising above the 200 SMA to a 5-week high of 1.0915.

Supported by the RSI above 50 and the 100 SMA crossing above the 200 SMA, buyers will look to push the price towards resistance at 1.0930, the later January high, ahead of 1.10, the psychological level.

Should EUR/USD face rejection at its current 1.09 level, support sits at 1.0830, the 200 SMA. A break below here could open the door to 1.08, the March low, and 1.07, the 2024 low.

USD/JPY falls after Powell and as hawkish BoJ bets build

- Japan's average cash earnings rose more than expected

- BoJ could hike rates this month

- USD/JPY falls towards 100 SMA

The yen has risen to its highest level in a month on growing speculation that the Bank of Japan could start to hike interest rates this month.

A series of factors have resulted in the market expecting a more hawkish stance from the central bank later this month. The latest data showed that cash earnings in Japan rose by a more-than-expected 2% in January, the highest reading in seven months.

Meanwhile, one of Japan’s largest unions secured big pay hikes for some of its members, pointing to higher wages in the coming months.

Wage growth and inflation are two of the primary considerations for the Bank of Japan when raising interest rates. BoJ governor Kazuo Ueda had previously stressed the need for more data before considering a shift away from ultra-easy monetary policy, stressing the need for a positive wage inflation cycle. Following today’s data, this looks more likely.

Meanwhile, the US Dollar trades at a one-month low against its major peers after confirmation from Powell that it would be appropriate to cut interest rates at some point this year. However, this message was mixed with Neel Kashkari who downplayed rate cut expectations.

ADP data also showed that private payrolls rose less than expected in February, and the JOLTS report showed job openings came in slightly below forecasts. Jobless claims figures will be due today ahead of the non-farm payroll on Friday.

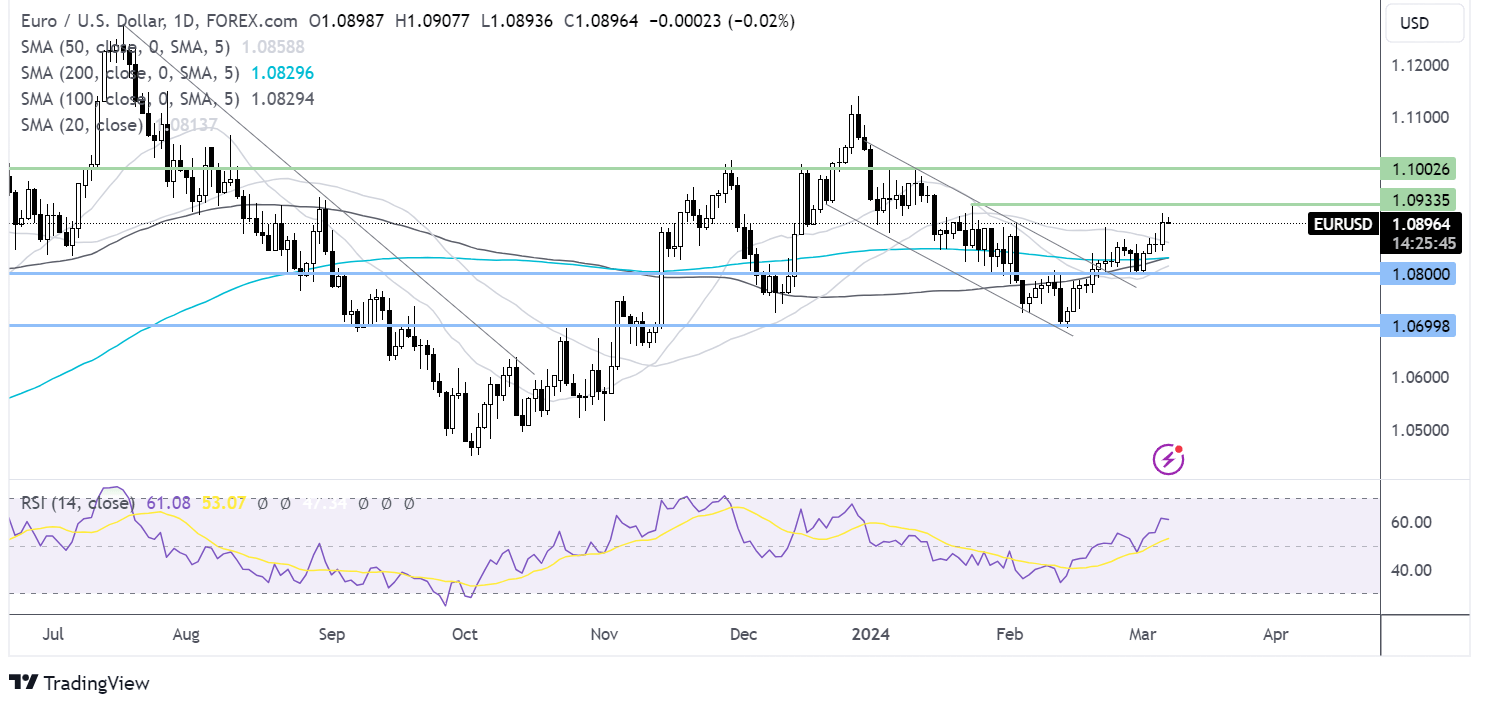

USD/JPY forecast – technical analysis

USD/JPY has broken out of its recent holding pattern, breaking down several key levels. This, combined with the RSI below 50, keeps sellers hopeful of further downside.

Immediate support can be seen at 147.70, the 100 SMA, with a break below here, and 147.00, exposing the 200 SMA at 146.15.

A recovery would need to see bulls retake 148.80, the January high, ahead of 149.20, the February low, to retest 150.00.