Asian Indices:

- Australia's ASX 200 index rose by 55.6 points (0.84%) and currently trades at 6,661.20

- Japan's Nikkei 225 index has risen by 145.18 points (0.54%) and currently trades at 26,788.47

- Hong Kong's Hang Seng index has risen by 523.15 points (2.58%) and currently trades at 20,820.87

- China's A50 Index has risen by 159.87 points (1.13%) and currently trades at 14,254.85

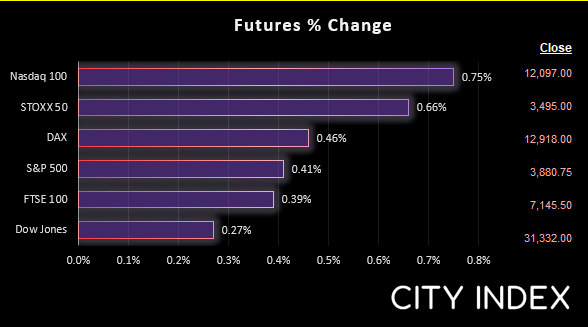

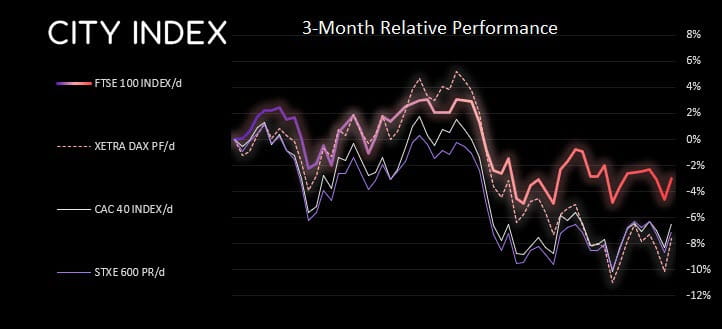

UK and Europe:

- UK's FTSE 100 futures are currently up 29 points (0.41%), the cash market is currently estimated to open at 7,188.01

- Euro STOXX 50 futures are currently up 22 points (0.63%), the cash market is currently estimated to open at 3,499.20

- Germany's DAX futures are currently up 59 points (0.46%), the cash market is currently estimated to open at 12,923.72

US Futures:

- DJI futures are currently up 86 points (0.28%)

- S&P 500 futures are currently up 92 points (0.77%)

- Nasdaq 100 futures are currently up 16.5 points (0.43%)

Asian share markets followed Wall Street higher after they bounced on Friday following weaker inflation expectations from a consumer sentiment report. Index futures markets for US and Europe are also higher ahead of the open.

The US dollar was the weakest major as traders questioned the trajectory of expected Fed rate hikes. New Zealand’s inflation rose to its highest level since 1990, raising the prospect of rates to rise to 4% by 2023 instead of 3.5%.

Earnings season in the US is underway with banks such as Bank of America and Goldman Sachs due to release reports.

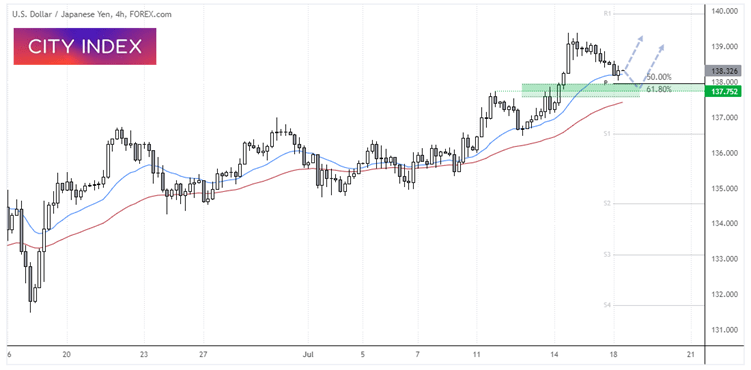

USD/JPY 4-hour chart:

USD/JPY remains in a bullish trend on the 1-hour chart. Although it is within a retracement phase. A small bullish candle has formed on the 20-bar eMA and above the weekly pivot point, so perhaps we are close to a corrective low around 138. We are no looking for further signs that momentum has turned higher, or a series of bullish reversal candles around the 18 support zone.

FTSE 350 – Market Internals:

FTSE 350: 3975.18 (1.69%) 15 July 2022

- 327 (93.43%) stocks advanced and 21 (6.00%) declined

- 1 stocks rose to a new 52-week high, 22 fell to new lows

- 17.71% of stocks closed above their 200-day average

- 94.57% of stocks closed above their 50-day average

- 12.86% of stocks closed above their 20-day average

Outperformers:

- + 23.70% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 8.79% - Ferrexpo PLC (FXPO.L)

- + 7.04% - discoverIE Group plc (DSCV.L)

Underperformers:

- -7.65% - BT Group PLC (BT.L)

- -5.36% - Britvic PLC (BVIC.L)

- -3.76% - Burberry Group PLC (BRBY.L)

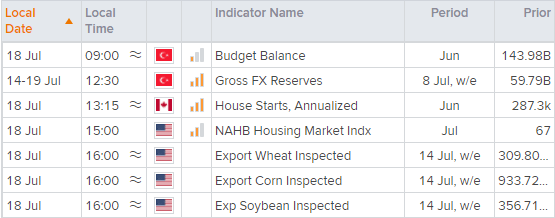

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade