Asian Indices:

- Australia's ASX 200 index rose by 31.4 points (0.45%) and currently trades at 6,993.20

- Japan's Nikkei 225 index has fallen by -129.8 points (-0.46%) and currently trades at 28,321.13

- Hong Kong's Hang Seng index has fallen by -260.23 points (-1.33%) and currently trades at 19,243.02

- China's A50 Index has fallen by -79.02 points (-0.58%) and currently trades at 13,513.10

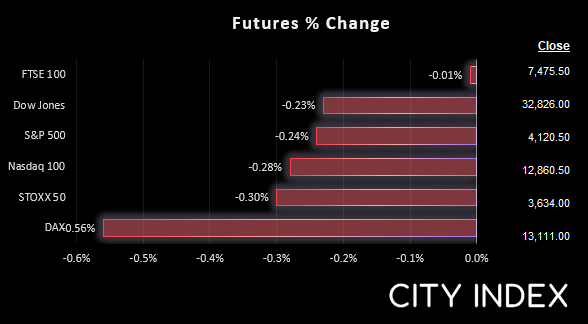

UK and Europe:

- UK's FTSE 100 futures are currently down -4.5 points (-0.06%), the cash market is currently estimated to open at 7,483.61

- Euro STOXX 50 futures are currently down -13 points (-0.36%), the cash market is currently estimated to open at 3,639.52

- Germany's DAX futures are currently down -83 points (-0.63%), the cash market is currently estimated to open at 13,111.23

US Futures:

- DJI futures are currently down -105 points (-0.32%)

- S&P 500 futures are currently down -55.25 points (-0.43%)

- Nasdaq 100 futures are currently down -14.25 points (-0.34%)

ASX bucks the bearish trend of the overnight session

The baulk of Asian indices were lower overnight following weak data from the US. On one hand, weak data provides less reasons for the Fed to be so aggressive (which has typically been a bullish cue of late) yet on the other, weak data brings home the reality of a recession. On balance it appears equities are continuing to retrace ahead of key data points this week including US inflation data and the Jackson Hole Symposium.

An exception was the ASX 200, which has caught a few bids from yesterday’s low after a couple of days of selling. It’s making a minor effort to reclaim 7,000, but not by enough for me to hang my hat on it. The ASX energy and technology sectors outperformed the broader market, whilst higher commodity prices also supported the materials sector.

The yen attracted safe-haven flows ahead of the European open

Given we’re fast approaching key inflation data from the US and Jerome Powell’s speech at the Jackson Hole Symposium on Friday, I’d expect traders to be less willing to take a directional punt on the markets. So we could be in for a couple of days of choppy trade until we see just how hot (or not) inflation is, and whether Jerome Powell will be forced to retain hawkish on rates whilst sending a warning signal for the US economy.

Over the past hour the yen has strengthen across the board, seemingly with no obvious news being the trigger. Given equities are lower, we could assume the yen is attracting safe-haven flows. We outlined a bearish case for USD/JPY in an earlier report today and, looking across the yen pairs, NZD/JPY looks appealing for a potential breakout.

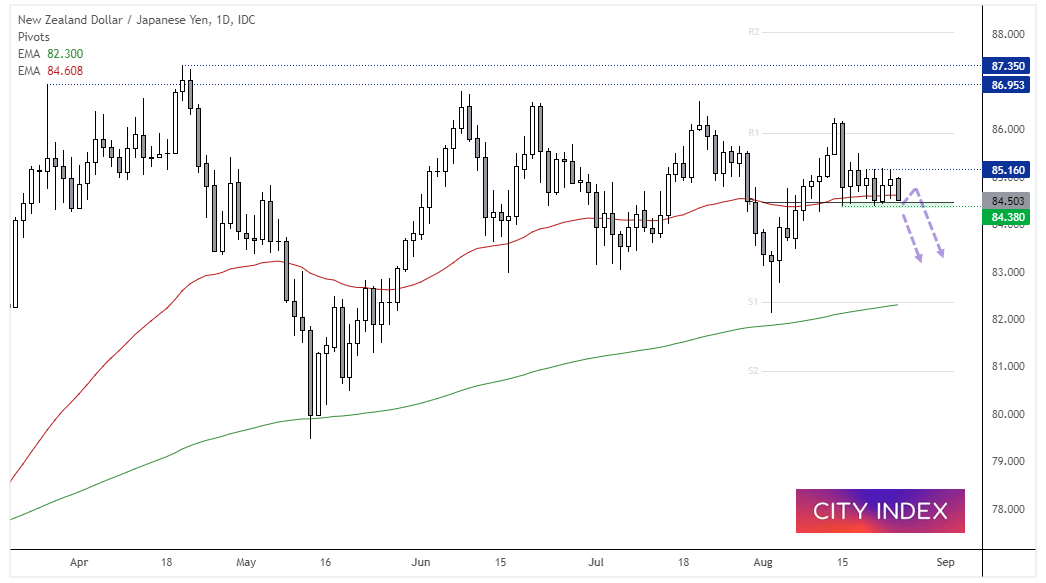

NZD/JPY daily chart:

NZD/JPY is a decent barometer of risk for FX traders. And the fact it has turned south and now teasing the lows of a sideways channel means we’re on guard for a bearish breakout. It trades below its 200-day eMA and is about to probe the monthly pivot point, with a break below 84.35 confirming our bearish bias (which remains valid whilst price remain below the 85.16 high).

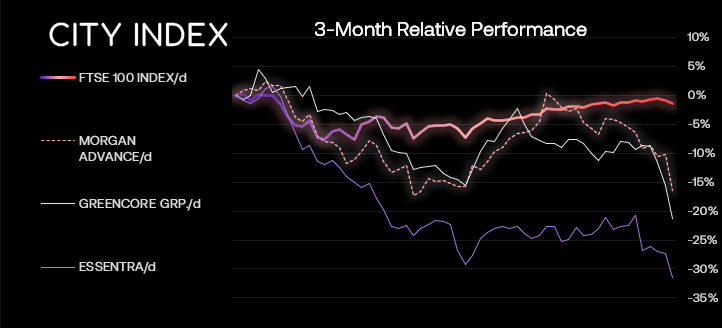

FTSE 350 – Market Internals:

FTSE 350: 4145.38 (-0.61%) 23 August 2022

- 65 (18.57%) stocks advanced and 274 (78.29%) declined

- 3 stocks rose to a new 52-week high, 21 fell to new lows

- 29.43% of stocks closed above their 200-day average

- 69.14% of stocks closed above their 50-day average

- 2% of stocks closed above their 20-day average

Outperformers:

- + 5.98% - Tullow Oil PLC (TLW.L)

- + 4.90% - Energean PLC (ENOG.L)

- + 4.38% - Harbour Energy PLC (HBR.L)

Underperformers:

- -7.02% - Morgan Advanced Materials PLC (MGAMM.L)

- -6.75% - Greencore Group PLC (GNC.L)

- -5.78% - Essentra PLC (ESNT.L)

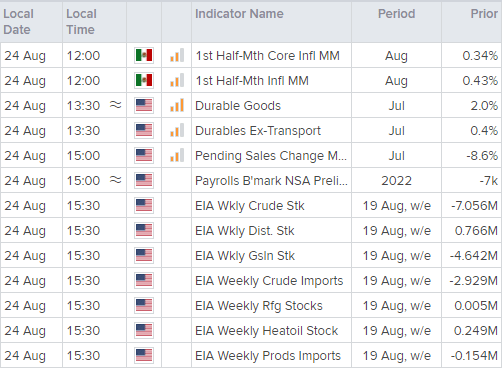

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade