Asian futures:

- Australia’s ASX 200 index rose by 56.2 points (0.83%) to close at 6,834

- Japan’s Nikkei 225 index rose by 445.25 points (1.5%) to close at 30,116.95

- Hong Kong’s Heng Seng index has risen by 558.72 points (1.88%) currently trades at 30,276.96

- FTSE 100 is set to open 0.5% lower this morning at 6,299.6

European futures:

- The Euro STOXX Index futures are currently up 22 points (0.59%), the cash market is currently estimated to open at 37,27.99

- France’s CAC 40 futures are currently up 32 points (0.24%), the cash market is currently estimated to open at 5,829.98

- Germany’s DAX is called to open broadly flat today at 13,928.0

US futures:

- The Dow Jones index fell -29.03 points (-0.22%) to close at 31,537.35

- The S&P 500 index rose 44.06 points (1.14%) to close at 39,25.43

- The Nasdaq 100 index fell 0 points (0%) to close at 13,302.19

It’s a positive lead for Asian equities, with South Korea’s Kospi 200 (+3.3%) leading the pack. The Hang Seng has recouped +2.2% of yesterday’s losses, where it came under domestic pressure after Hong Kong’s finance minister raised stamp duty to partly fund their $15.5 stimulus program.

The ASX 200 moved to a 4-day high with large caps leading the way, with the ASX 20 rallying 1.21% versus the ASX 200’s 1%. The service and energy sectors were the strongest performers.

The FTSE 100 is expected to gap up to a 4-day high. A swing low has formed at 6,546 on the daily chart, 6,800 is the next resistance level and a break above it brings the 6960.60 high into focus. The DAX is expected to gap above 14,000 and shows the potential to retest its highs around 14,200.

Commodities and yields continue to dominate

Copper futures extended their bullish reach overnight, currently trading around 4.35 and trade at a near-10 year high. At some point, it will inevitably come crashing down until then, the trend clearly points higher.

Oil prices are also moving higher in tandem with yields. WTI is currently trading around 36.29 (+0.1%) and Brent at 67.08 (-0.05%). The US 10-year currently yields 1.40 % ad the Australian 10-year has risen to 1.40%.

Forex: Yen pairs approaching inflection points

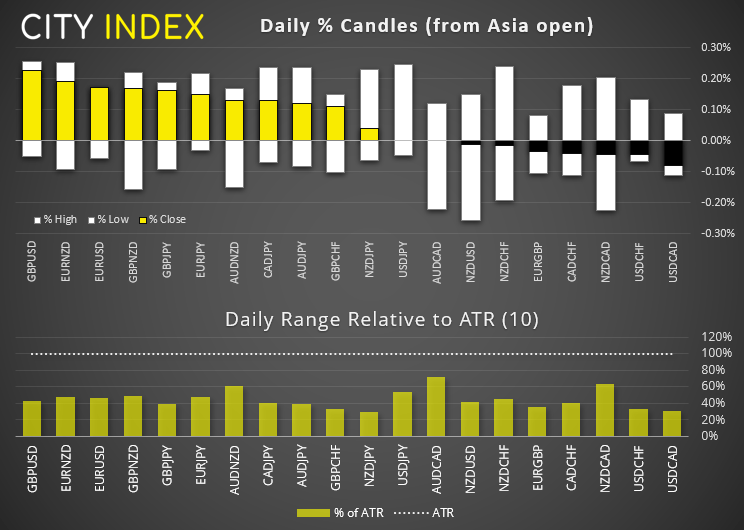

Trading ranges across FX markets have been relatively tight, with most majors and crosses we track achieving around 40-50% of their ATR’s (average true ranges). And it is these quieter periods which allow traders to regroup and gather their thoughts whilst prices consolidate.

The Swiss franc and Japanese yen have been heavily sold but most related crosses are at or near key levels. When you see this, it usually indicates the potential for retracements. Taking AUD/JPY for example, its meteoric rise has found resistance at the June 2018 high and began a retracement already. Given its strong rally, a corrective phase could finally be due. Counter-trend targets (or support for patient bulls) is around 84.00. A break above 84.54 assumes bullish continuation.

The US dollar index (DXY) continues to tease a break below 90, which could prove pivotal for markets. Yet the longer it drags its heels, the greater the odds for a pop higher. And we’d want to see DXY break beneath 90 before assuming EUR/USD can finally break out of its inverted head and shoulders pattern on the daily chart. (Also take note of a potential head and shoulders top on USD/NOK – a break beneath 8.3630 confirms).

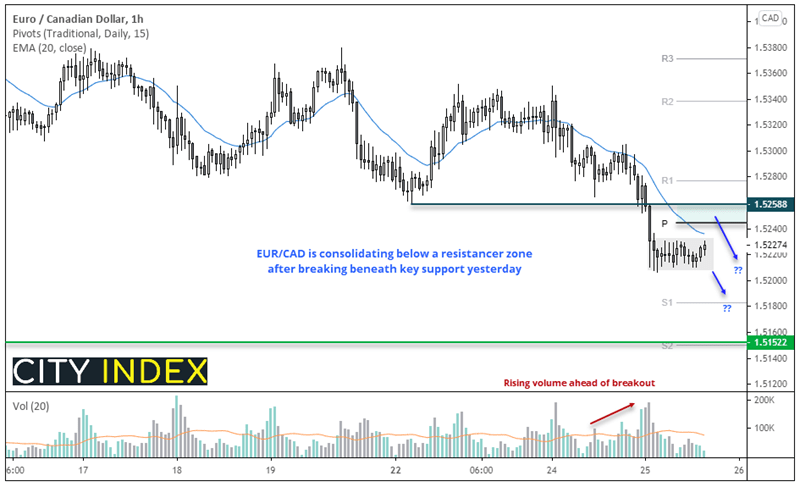

EUR/CAD: Bearish breakout of interest to bears

EUR/CAD broke to a 7-month low overnight. Unlike other crosses it doesn’t look extensively stretched, so we are seeking bearish opportunities over the near-term beneath the 1.5288 resistance level.

We can see on the hourly chart that prices are consolidating in a tight range beneath the daily pivot and 10-bar eMA. A viable target for bears is around 1.5150 where a historical swing low coincides with the daily S2 pivot.

- The bias remains bearish below the resistance zone (daily pivot and prior support)

- Bears could enter a break beneath the current consolidation area or seek to fade (short) into minor rallies towards the resistance zone

- The daily S1 and S2 are our near-term bearish targets around 1.5180 and 1.5120 respectively

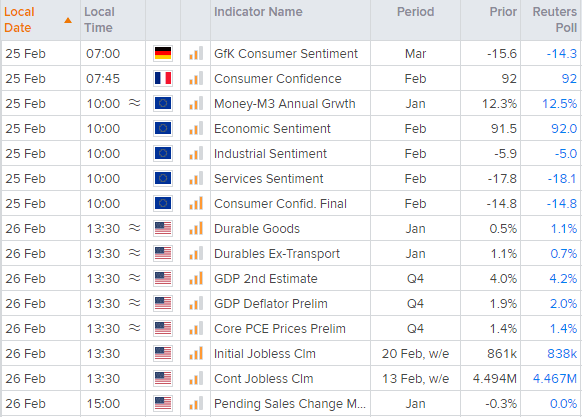

Up next (times in GMT):

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

With no major economic news schedule for today, traders may need to rely on large deviations from expectations of second tier data, or a fresh catalyst. Absent that, it then comes down to whether the current sentiment can be sustained, or whether traders will agree that some markets (namely commodities, bonds and JPY pairs) have become too stretched and provide technical repositioning.

On that note, US G4 GDP is expected to be upwardly revised to 4.2% QoQ. Given the Fed are in no hurry to change policy, an even softer GDP print could be ‘beneficial’ for asset prices because it reinforces the view that inflation is not a concern.

Watchlist update:

CHF/JPY: Second bearish target near the 116.13 – 17 lows reached, after prices rolled over with strong momentum and reached our second bearish target. With prices now in a corrective phase we will monitor its potential for a swing high. The core bias remains bearish below 188.60 on the weekly charts.

GBP/CHF: Initial target around 1.2900 reached after breaking out of a multi-month basing pattern. Given the high wick on yesterday’s daily chart, we’re happy to step aside and reconsider longs after a retracement or period of consolidation.

AUD/NZD: Initial target reached after a strong sell-off yesterday following the RBNZ meeting. With prices now retracing higher we will continue to monitor its potential for another leg lower (and seek a low volatility, bearish reversal pattern).

GBP/NZD: Initial target reached around 1.9000. We’re now seeking a swing high to form on the four-hour or hourly chart after a period of consolidation, or retracement.

EUR/GBP: Its retracement has approached a pivotal level. Whilst we’d be keen to explore bearish setups beneath 0.8620 resistance yesterday’s bullish pinbar suggests a bounce higher may be due. A break above 0.8620 assumes a deeper counter-trend rally.

EUR/JPY: Prices are approaching our initial target around 129.17 – 129.38. A break beneath the 128.65 low on the hourly chart invalidates the bullish bias. We’re too close to target to consider fresh long until prices break above 129.38 resistance.