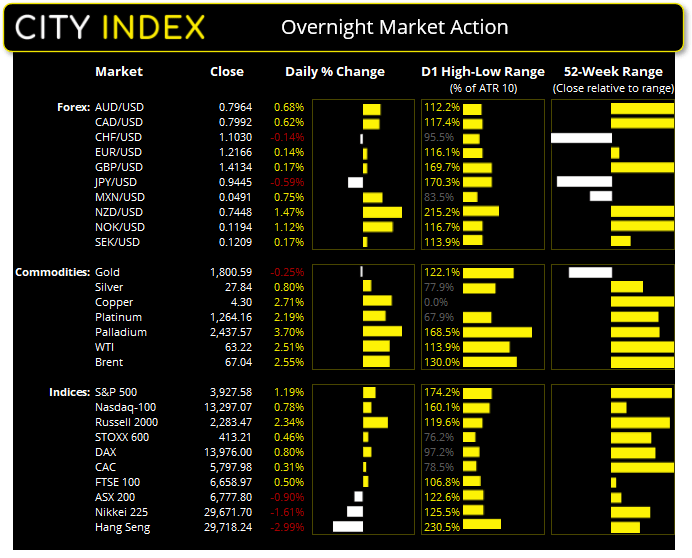

Asian futures:

- ASX 200 futures are trading 44 points higher (0.65%), the cash market is currently expected to open at 6,821.8

- Nikkei 225 futures are trading 460 points higher (1.55%), the cash market is currently expected to open at 30,131.7

- Heng Seng futures are trading 273 points higher (0.92%), the cash market is currently expected to open at 29,991.24

FTSE 100 futures:

- FTSE 100 futures are trading 58.5 points higher (0.89%)

European futures:

- Europe’s Euro STOXX 50 futures are trading 32 points higher (0.87%)

- France’s CAC 40 futures are trading 32 points higher (0.87%)

- Germany’s DAX futures are trading 169 points higher (1.22%)

US Indices:

- Dow index rose by 53.07 points (2.38%) to close at 31,961.86

- S&P index rose by 44.06 points (1.13%) to close at 39,25.43

- Nasdaq index rose by 107.482 points (0.81%) to close at 13,302.189

Trial results for Johnson and Johnson’s (J&J) vaccine showed 100% effectiveness at preventing hospitalisation after 28 days after vaccination, and 85% effectiveness within 14 days. They also claim their vaccine reduced asymptomatic infections and separate reports from South Africa also garnered positive feedback. J&J expect to have 4 million doses ready for an FDA approval and estimate 20 million will be ready by the end of March. If all goes well, it is another reason for investors to be bullish on the recovery. And placed alongside the Fed’s ultra-easy policy, zero concern with inflation and Biden’s upcoming stimulus, the path of least resistance for equities continues to point higher.

They don’t make corrections like they used to

Global benchmark indices were broadly higher overnight, with US indices breaking above ‘Powell’s’ Turnaround Tuesday hammers and now trading within striking distance of record highs. Well, they don’t make corrections like they used to, considering the ‘overdue correction’ with indices is compete. In less than a week.

The S&P 500 used the 50-day eMA as a springboard and is now back above its 10-day eMA. The Russell 2000 (which didn’t even bother moving nears its 50-day eMA) notched up a 6-day high, sits just below its record high and the Dow Jones sits at a new record high. Oh, and the ‘great rotation’ out of technology is taking nap with the Nasdaq 100 lazily anchored to its 50-day eMA and beneath its 10 and 20-day eMA’s. Still, we’re not saying the rotation is over as the Nasdaq appears the more vulnerable should sentiment sour. And if there were a US index to consider fading minor rallies (shorting into) the Nasdaq appears to the better contender.

German GDP surprises to the upside

Germany’s Q4 GDP was upgraded from 0.1% QoQ to 0.3% and, on annualised basis from -2.9% to -2.7%. Strong exports, demand from China and construction were the key drivers behind the positive revision. Whilst these numbers in isolation may not appear to set the world alight, when you consider there was genuine concern GDP would contract in Q4 then these numbers all of a sudden appear quite strong. But, we shall not get our hopes up for Q1 GDP with Germany’s current lockdown being extended to March 7th. The Dax led gains in Europe, closing 0.8% higher and just below 14k. The Euro Stoxx 50 (+0.5%) produced a small bullish outside day and the CAC (+0.3%) sits just below its 2021 high.

Commodity currencies remain on a tear

AUD, NZD and CAD all made new high against the flailing dollar overnight. With all three now at a 3-year high against the greenback, NZD/USD is the strongest major, AUD/USD is just 40 pips below 80c and USD/CAD finally broke beneath 1.2587 support.

And to underscore the strength of the Kiwi dollar this week, AUD/NZD (-1.00%) fell to a 2-week low overnight amidst its most bearish session in 3-months, and came close to hitting our initial 1.7000 target outlined in yesterday’s Asian Open report.

EUR/USD continues to grind away with a potential breakout from an inverted head and shoulders pattern, but is making hard work of it. Bears failed to keep prices lower after an initial drive to its 50-day eMA and has closed the session with a bullish hammer beneath its neckline. Given the messy price action near the neckline, we’d prefer to see a break above the 1.2200 handle before confirming the bullish reversal on the daily chart.

And, to underscore the weakness of the yen, USD/JPY managed to rally 0.6%, break convincingly above its 200-day eMA and poke its head above 1.06. Yet as this is not technically appealing form a risk/reward potential, this is where EUR/JPY may come in.

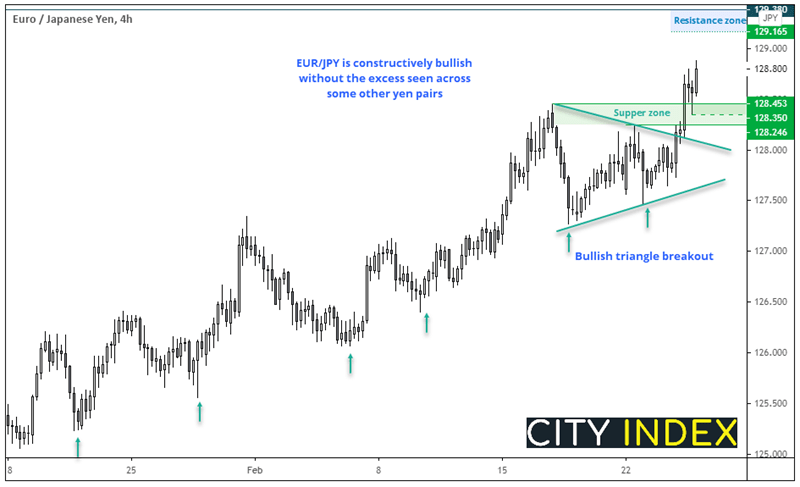

EUR/JPY: Structurally bullish (minus ‘excessive exuberance’)

With commodity currencies making minced meat out of the yen, its hard not to look at their rallies in awe yet also feel side lined. When such moves turn, they tend to do so ferociously and they do have an ‘excessive exuberance’ quality about them. Yet EUR/JPY is now making a constructively bullish argument without looking excessively overbought.

Prices broke above key resistance overnight, following its breakout from a bullish continuation triangle yesterday. If successful, the triangle projects a target around 129.17, although the 129.38 high also makes a viable target. With a wide-ranged Doji confirming support between 128.24/45, the corrective low could be in place.

- The near-term bias remains bullish above the 128.35 low

- Initial target is 123.17 (measured move form triangle) but bulls can also target the 129.38 high

- Bulls could seek to enter on minor retracements or periods of consolidation (the Asian session usually provides such consolidation patterns but traders must then ride out the Euro and US opens)

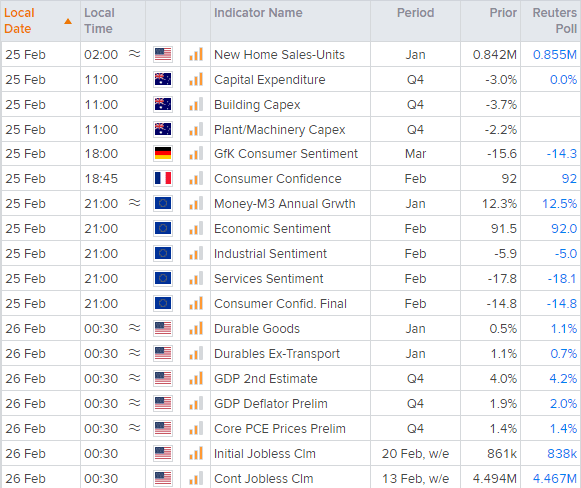

Up Next (Times in AEDT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- No ‘top tier’ data is scheduled for today.

- Although an improved economic sentiment report would be a nice to see for euro pairs (namely EUR/USD and EUR/JPY).

- US GDP is the final revision and, generally, the least volatile unless an extreme revision is made. Currently the forecast is for Q4 GDP to be upwardly revised to 4.2%.