- EUR/USD analysis: US dollar still maintains its bullish trend

- Geopolitics remains key driver behind EUR/USD and most other risk assets

- EUR/USD technical levels to watch: 1.0500 support and 1.0635 resistance

The EUR/USD was clinging onto the 1.05 handle at the start of the new week. Sentiment remains cagey with worries over the Middle East continuing to keep the markets in an overall risk-off mode. However, there has been no fresh news to drive the US dollar even higher at the start of this new week. Position squaring is probably the main reason why it has retreated a little. That’s not to say it has topped. Ongoing Middle East tensions should keep the dollar supported on the dips, against the more risk-sensitive currencies.

Keep an eye on developments in the Middle East

Like last week, geopolitics should continue to drive the markets for much of this week. Safe haven gold rallied by $64 per ounce (or 3.4%) on the session on Friday while crude oil prices rose about 5% and yields were lower amid haven flows into government bonds. Worries about Israel’s plans for a ground invasion of Gaza has sharply raised geopolitical risks in the region.

If the situation escalates further this week, then this should keep the EUR/USD and most other risk assets under pressure, except, perhaps, crude oil. Rising oil prices is good for oil-exporting nations like the US, and not good for importing nations in the Eurozone.

EUR/USD analysis: US dollar still maintains its bullish trend

Despite Monday’s slight weakness, the dollar remains inside its larger bullish trend (i.e., the EUR/USD remains in a bearish trend). Thursday’s stronger CPI data from the US helped to inspire another round of EUR/USD selling, which continued on Friday as Middle East conflict kept the dollar supported.

This ensured the Dollar Index would rise again last week, after pausing for a breather in the previous week. The latest gains were driven mainly by haven flows. Not even a sharply weaker UoM consumer sentiment survey (63.0 vs. 67.2 expected and 68.1 last) was able to arrest the dollar’s rally on Friday. Perhaps it was the UoM’s inflations expectations survey that helped to fuel the latest rally in the dollar. The 1-year inflation expectations rose to 3.8% vs. 3.2% previously, while the longer-term 5–10-year index was 3.0% vs. 2.8% prior. Elevated inflation expectations are not something the Fed wants to see, but it is a function of rising oil prices and the stickiness in CPI inflation. It looks like the dollar bears came out too early in the previous week. More dollar strength should be expected for as long as risk appetite remains weak.

Last week we also saw a slightly stronger US CPI print, adding fresh life to the dollar’s bullish trend. That said, inflation was not too hot to be a game-changer, and we have seen the odds of another Fed rate hike for this year tumble to single digits. Still, the latest inflation data (both CPI and UoM’s Inflation expectations survey) support the “higher for longer” narrative, even if we have likely reached peak interest rates in the US.

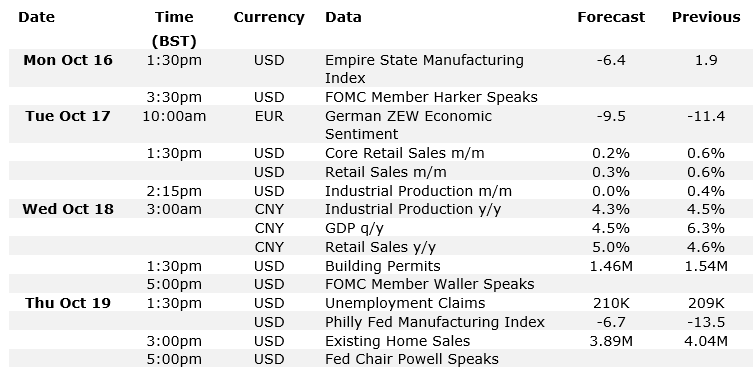

Key data to watch for EUR/USD

The dollar will remain in focus with the release of some key data this week, as well speeches by several Fed officials. US retail sales and industrial production (both on Tuesday) are among the data highlights this week, although we will also have Empire State Manufacturing Index (Monday), building permits (Wednesday), jobless claims, Philly Fed manufacturing Index and existing home sales (all on Friday) to look forward to as well.

Overall, though, the economic calendar is not too busy this week, which means much of the focus will remain on the middle east conflict and on company earnings.

Meanwhile, from the Eurozone, the key data release this week is the German ZEW survey, which is expected to show another negative print. We will also have some Chinese data, which should move the euro in the direction of the surprise on Wednesday.

Economic output in the Eurozone remains very weak and the ECB has accordingly dropped its hawkish bias, albeit rates will be held at current levels for a long time yet. This is the trouble for many foreign currencies, not just the euro. The decline in economic activity have been more severe in regions like the Eurozone and UK, than the US. This is why the dollar has remained fairly resilient, with investors reluctant to buy the euro or the pound, or the Aussie for that matter.

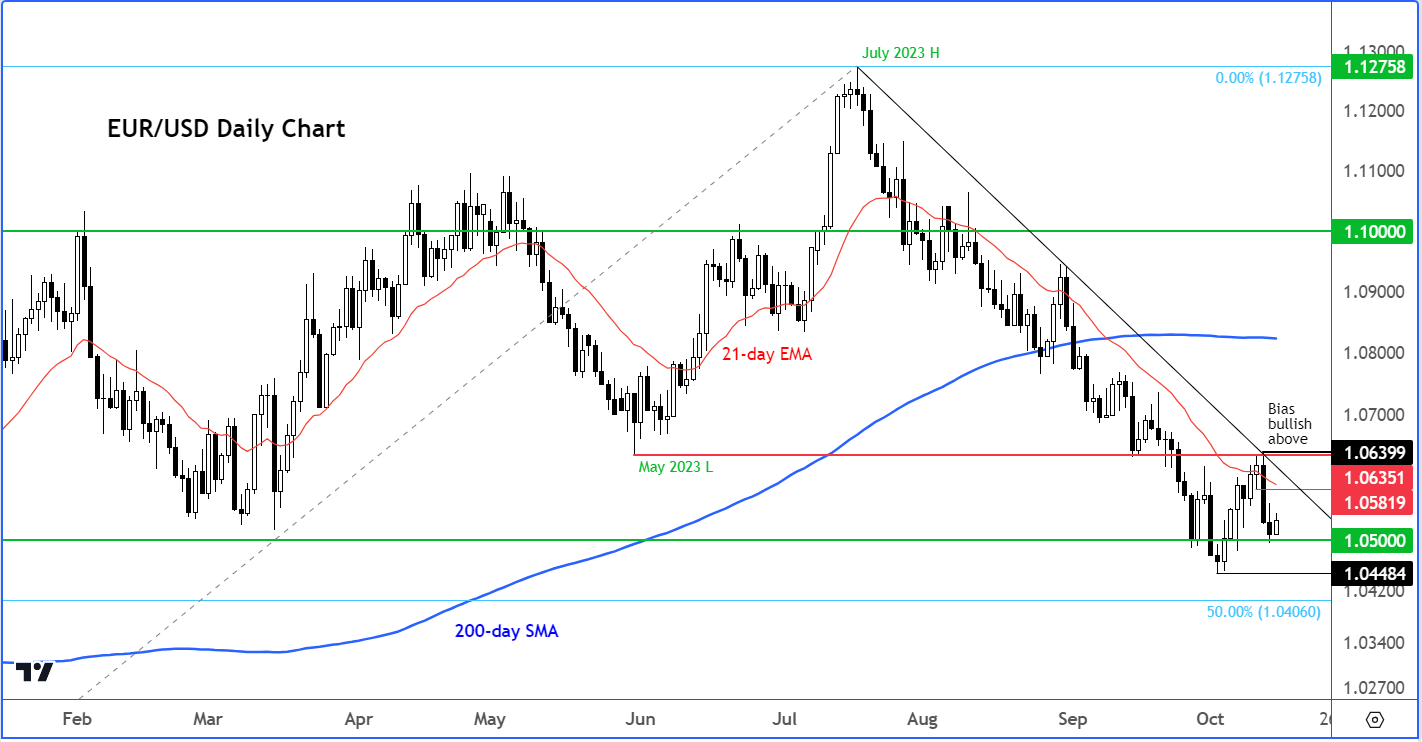

EUR/USD analysis: Technical levels to watch

Source: TradingView.com

Source: TradingView.com

The EUR/USD failed to break above its bearish trend line and key resistance at 1.0635, which was the last major low made in May, before we broke below it in late September. Once strong support, this level has turned into resistance. The directional bias on the EUR/USD remains bearish until we break above this level or form a key reversal pattern at lower levels first. On the downside, key support sits at 1.0500. This level has again held firm so far in Monday’s session, after the bulls defended this zone for the past three weeks or so on the weekly time frame.

So, the EUR/USD is stuck between a rock and a hard place. A decisive break below 1.0500 would likely trigger fresh follow-up selling below this level for some time, while a move above 1.0635 resistance could lead to a sharp short-squeeze rally. Conservative traders may therefore wish to wait for the EUR/USD to make up its mind before jumping into any trades.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade