DAX eases from its record high

- China's growth targets fail to impress the market

- German composite PMI is expected to confirm 46.1

- Eurozone PPI is set to fall -0.1% vs -0.8%

The German DAX is edging lower, moving away from its record high amid jittery trade ahead of the ECB rate decision later in the week and after China fell to impress with its economic goals.

Beijing set a 5% GDP target for this year, which is in line with 2023, but with a lower fiscal deficit, leaving investors questioning how achievable these targets are, especially given that the economy no longer has the lower base for comparison that it enjoyed this year following the pandemic.

While the Chinese government pledged more stimulus, there was little clarity surrounding this matter, which failed to inspire investors. China is a key trading partner with Germany.

Looking ahead, attention will be on German PMI data, which is expected to confirm that the service sector contracted at a slightly slower pace in February of 48.2. Meanwhile the composite PMI which is considered a good gauge for business activity is expected to confirm a fall to 46.1 after the manufacturing sector contracted it faster pace in February.

Also in focus will be the eurozone PPI, which is expected to cool -0.1% MoM in January after falling -0.8% in December. Cooling PPI bodes well for a continued fall in inflation. The data comes ahead of Thursday's ECB interest rate decision, where the central bank is expected to keep rates on hold but could give some clues about when the central bank is planning to start interest rate cuts. The market is pricing in the first rate cut in June.

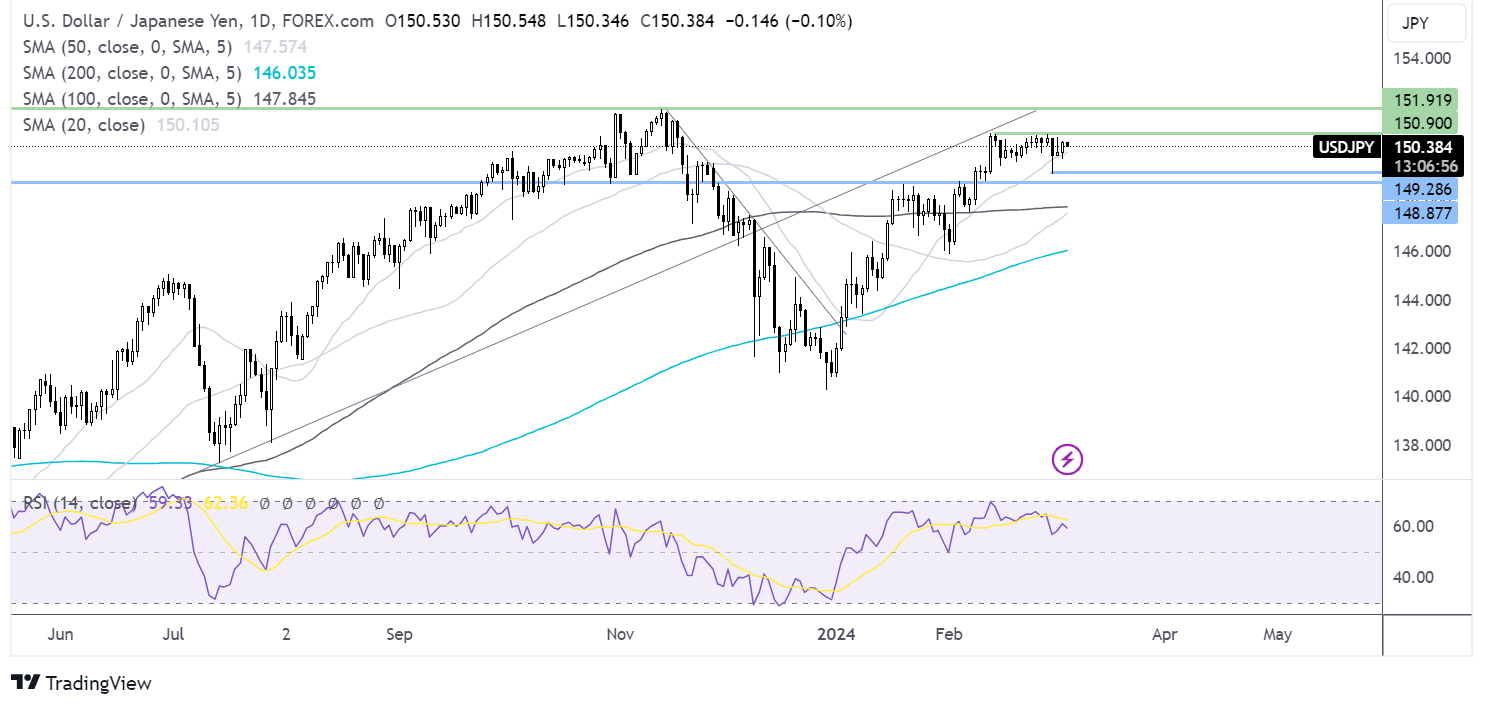

DAX forecast -technical analysis

After a steep rally higher, reaching a record high of 17817, the DAX is easing lower in a move that is bringing the RSI out of overbought territory. While the price holds above 17370, last week’s low, buyers will retain control. Below this level, support can be seen at 17000. Meanwhile, buyers will look to push the price back up towards 18000.

USD/JPY hovers around 150.50 after sticky Tokyo inflation & ahead of US services PMI

- Tokyo core inflation rises to 2.5% YoY

- US ISM services PMI is set to cool to 53 from 53.7

- USD/JPY consolidates around 150.50

The USD/JPY is holding steady around the 150.50 level as investors digest the latest Tokyo inflation figures.

The yen hovers around a four month low despite data showing Tokyo’s core inflation rate, which is considered a leading indicator for national trends, rose to 2.5% in February up from 1.8% in January. This was well above the central bank's 2% target. Meanwhile, headline inflation cooled slightly but still remained well over 2%.

The data supports the view that the Bank of Japan could soon start talking about a move away from ultra-loose monetary policy and negative interest rates.

However, Bank of Japan governor Kazuo Ueda said last week that it was too early to conclude that the central bank's 2% inflation target has been sustainably achieved and that more data is needed. This raises some uncertainty over when the BoJ may eventually start to tighten monetary policy.

Attention will now turn to the US ISM manufacturing PMI data, which is expected to ease slightly in February to 53, down from 53.7.

Given that service sector inflation is proving to be sticky, the ISM PMI will be keenly watched, particularly the prices paid subcomponent.

The data comes after manufacturing PMI fell by more than expected at the end of last week, causing investors to reassess when the Federal Reserve may start to cut interest rates.

Looking across the rest of the week, there are plenty of catalysts for the US dollar, including Federal Reserve chair Jerome Powell testifying before Congress tomorrow and Thursday, where any clues over the timing of the first-rate cut could influence the US dollar. Non-farm payrolls are on Friday and come as the US economy continues to show a resilient labour market, which could prevent the Fed moving to cut rates early.

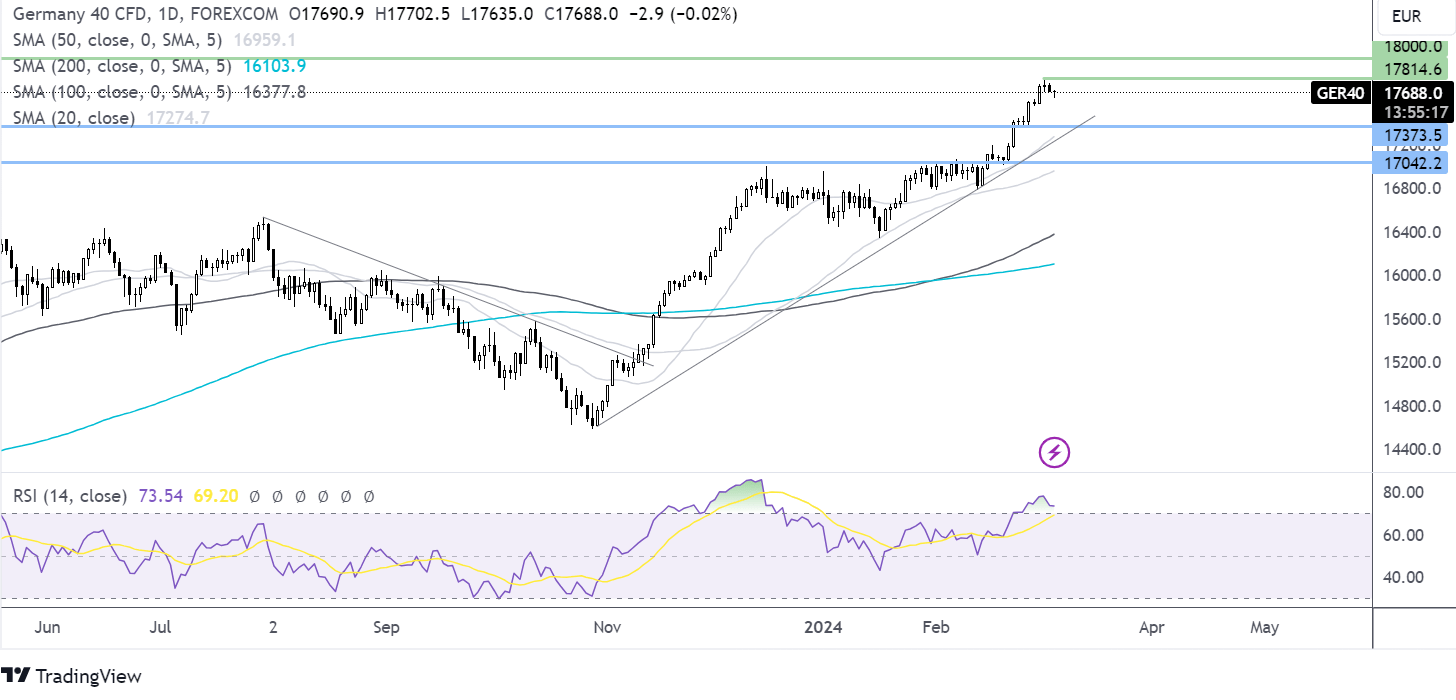

USD/JPY forecast – technical analysis

USD/JPY continues to consolidate below 150.50 after an impressive run-up across 2024. The bulls will look to take the price over this level to bring 151.90, the multi-decade high, into focus.

Sellers, meanwhile, will look to take out 149.50 and 149.20, last week’s low, to extend the selloff towards 148.80, the January high.