DAX extends gains ahead of EZ, US inflation data

- Eurozone inflation is expected to ease to 2.7% YoY from 2.9%

- US core PCE is set to cool to 3.5% YoY

- DAX rises above 16044 resistance

The DAX is heading higher for a third straight session, building on yesterday's 1% rally after stocks were buoyed by cooler-than-expected German inflation.

Today, German retail sales figures came in stronger than expected, supporting the German index. Sales rebounded 1.1% MoM in October after falling 0.8% in September. Forecasts had been for a 0.4% gain.

Attention is now turning to inflation figures for the eurozone, which are expected to cool further to 2.7% YoY in November, down from 2.9%. The data comes after German and Spanish inflation came in below forecasts yesterday signaling that the eurozone inflation could also be cooler than expected.

Easing inflation has boosted bets that the ECB has finished its rate hiking cycle and may need to think consider cutting interest rates. The market is piecing in a rate cut in June next year; cooler inflation could bring this forward.

Cooler inflation, together with recent data from Germany showing that the downturn in the economy appears to have bottomed out, is lifting the index, which is on track for strong gains in November.

Looking ahead to the US session core PCE, the Federal Reserve's preferred gauge for inflation will be in focus and is expected to cool to 3.5% YoY, down from 3.7%. On a monthly basis, core PCE is expected to rise just 0.1% after rising 0.4% in September.

Cooling US inflation could boost sentiment further, adding to evidence that the next move by the Federal Reserve will likely be a rate cut. Dovish comments from Federal Reserve officials this week have the market is pricing in around 100 basis point cuts by the Fed in 2024.

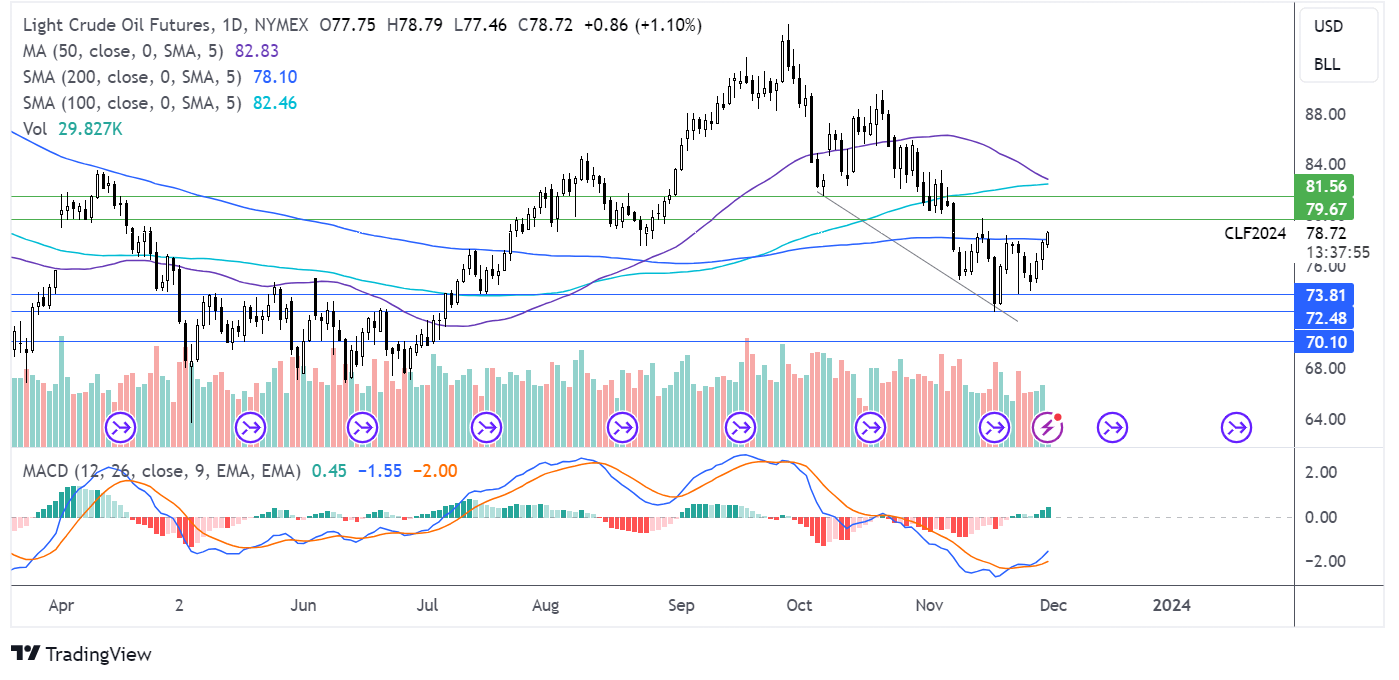

DAX forecast - technical analysis

The DAX trades within a rising channel and has extended gains to test 16200, the early July high. Buyers will look to rise above here to bring 16430 the June high, into focus. A rise above here brings 16480 the 2023 high.

It is worth noting the RSI is overbought. Should the price face rejection at 16200, the price could fall back to 16044 – 16000 zone, the August high and psychological level. Below here is 15850 last week’s low, and 15675, the 200 sma come into focus.

Oil holds steady ahead of the OPEC meeting

- OPEC+ could extend or deep supply cuts

- China data highlights slowing demand concerns

- Oil tests 200 sma resistance

Oil prices are holding steady in cautious trade ahead of the OPEC+ meeting later today and after weaker-than-expected Chinese factory data highlighted slowing demand concerns.

Oil prices have rallied this week on optimism that the OPEC+ group could deepen or extend production cuts, although details are unclear given that some African oil-producing countries are keen to expand output. Still, optimism surrounding the meeting is sufficiently strong that investors are brushing off bearish news, including a larger-than-expected build in inventories and a downside surprise in China's PMI data. However, with supply cut optimism driving prices higher, the great risk is that OPEC+ disappoint, which could pull prices back to the monthly low.

Chinese manufacturing PMI contracted for a second straight month in November and saw a steeper contraction than expected, suggesting that more policy support measures are needed to help support the economy of the world's largest importer.

Meanwhile, EIA data showed that US crude oil and gasoline fuel stocks unexpectedly rose, which points to weak demand.

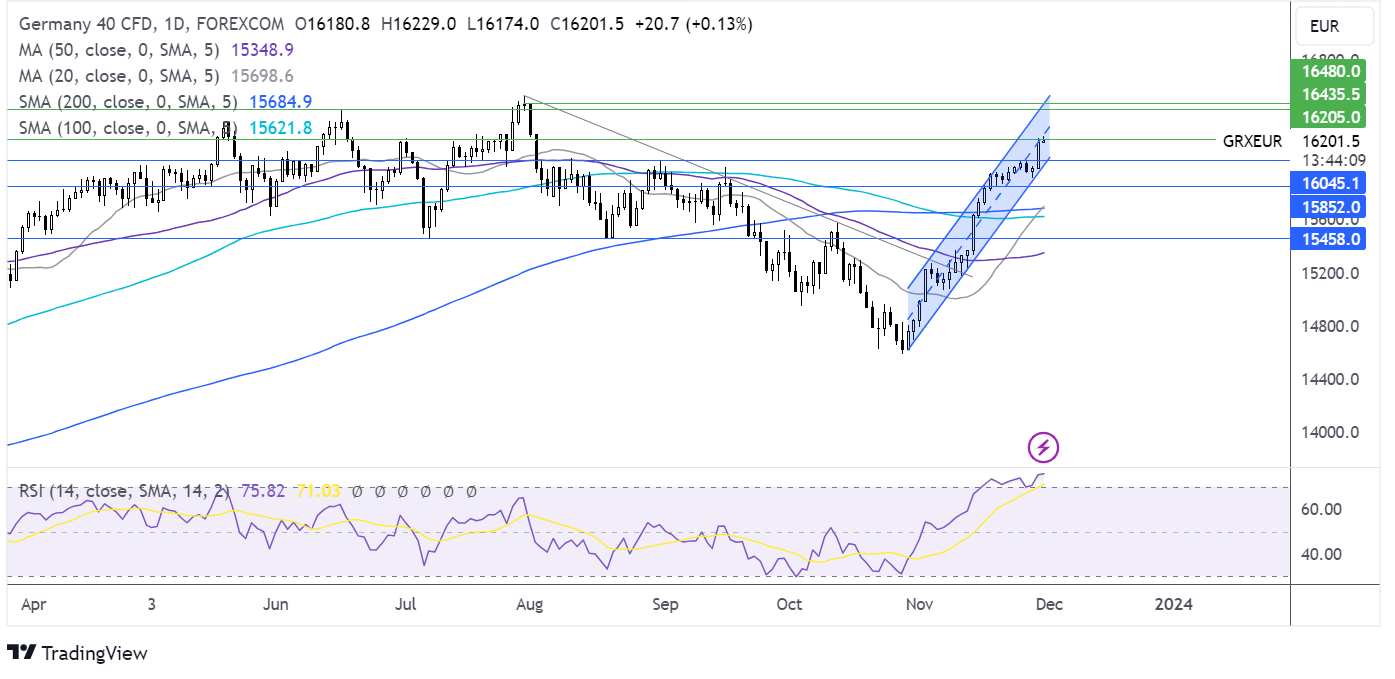

Oil forecast – technical analysis

Oil prices have recovered from the November low and are rising above the key 200 sma resistance. This combined with the bullish MACD, keeps buyers hopeful of further gains.

A rise above the 200 sma, brings 79.77, last week’s high into focus, ahead of 81.60.

Should sellers successfully defend the 200 sma, a fall back towards 73.80, last week’s low, could be on the cards ahead of 72.40 the November low.