Mainland Chinese markets are reopening after Gold Week holidays, having to navigate not only heightened geopolitical risks in the Middle East but also spiking bond yields in the United States which sapped demand for risk assets in elsewhere in the world during their closure. Ahead of key domestic data on inflation, international trade and credit demand during the week, the tricky macroeconomic backdrop will make for an interesting week for China’s A50 share index along with USD/CNH in the FX space.

China A50 breaks below range support

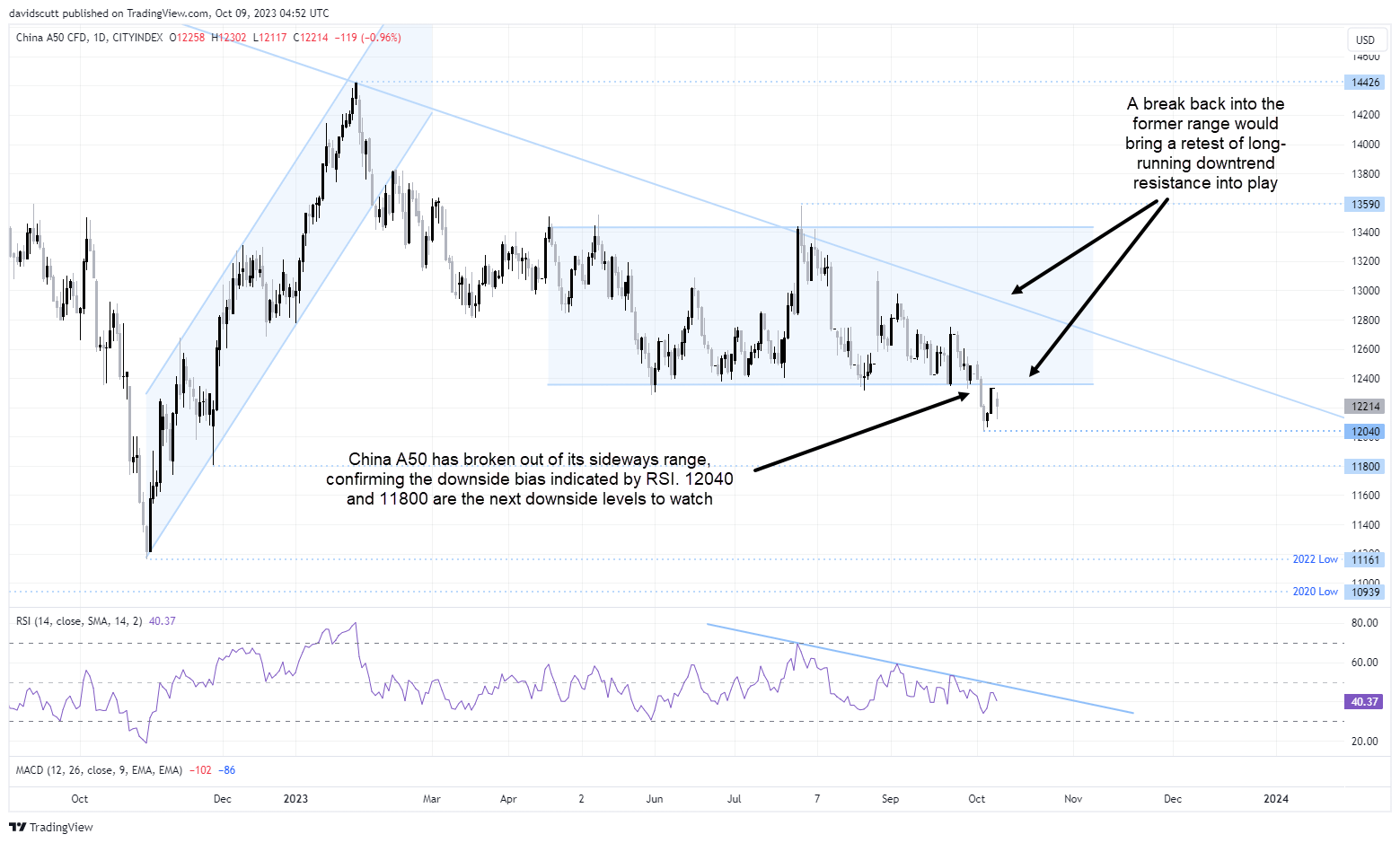

Looking at the opening of mainland equity markets, the most notable technical development has been the breakdown of several bluechip indices, including China’s A50 which has fallen through channel support for the first time since June, hitting a low of 12040 before bouncing ahead of the resumption of trade in underlying securities on Monday.

Given the range break, and with RSI confirming the downward bias, the path of least resistance appears lower right now unless the index can push back into its former range.

Traders may wish to sell rallies back towards 12360 targeting a move towards 12040 or even 11800, the low hit in November last year. A stop above 12400 would offer protection against a reversal, something that is a risk given poor near-term sentiment and positioning in Chinese assets among offshore investors.

For those waiting for more conclusive price action before entering a trade, a push back into the prior trading range would open the door for a potential retest of long-running downtrend resistance dating back several years. The trendline is currently located around 12940, having successfully repelled attempts to break higher twice this year.

CNH resilient to latest bout of USD strength

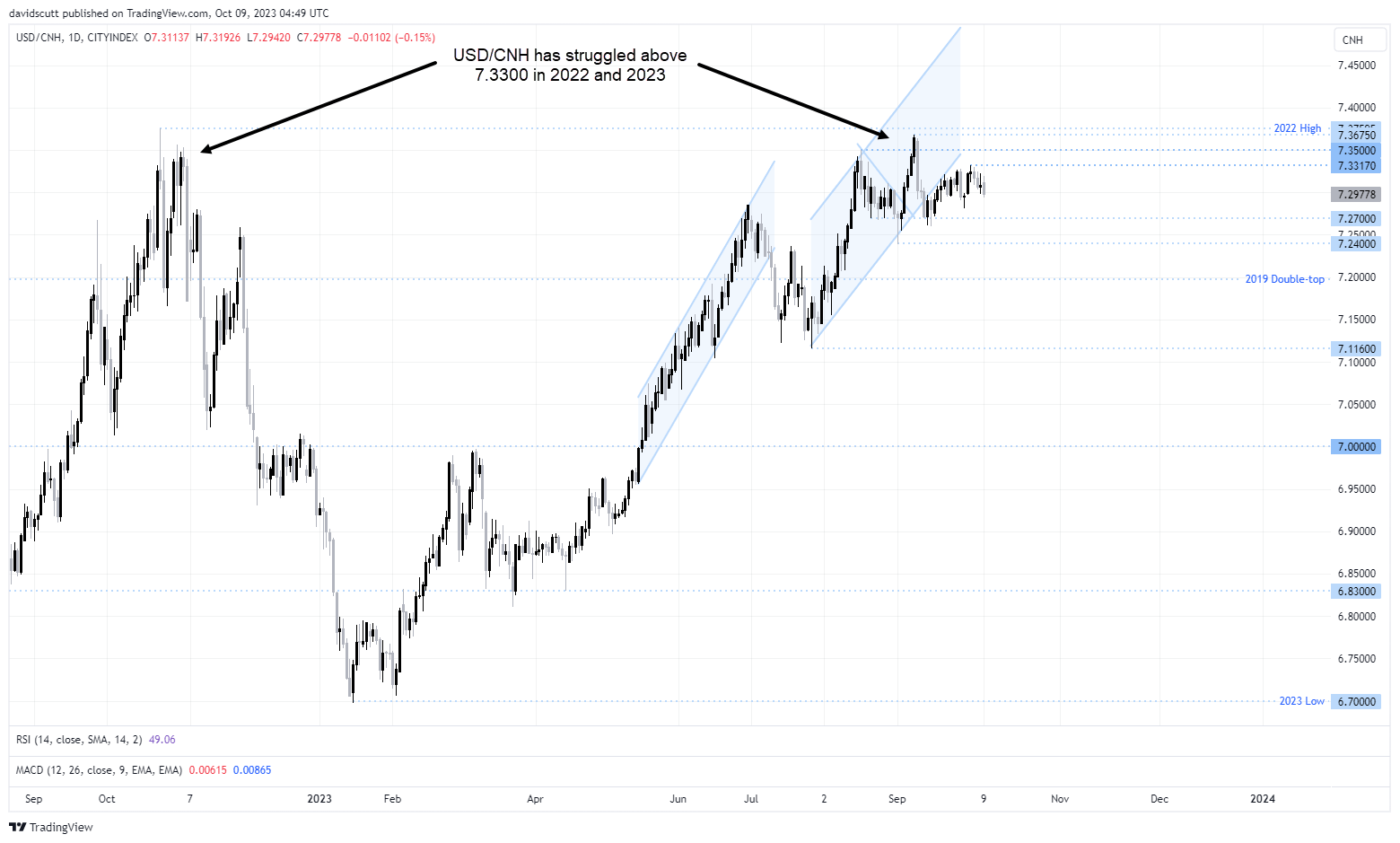

Outside equities, the price action in USD/CNH has been far more resilient, largely reflecting constant moves from the People’s Bank of China (PBOC) to push back against US dollar strength, mirroring similar measures being taken by Japanese policymakers to support the JPY against the USD.

One look at USD/CNH on the daily tells you the pair has struggled on probes above 7.3300 for much of this year, solidifying this area as a significant resistance zone having seen off a prior wave of USD strength in 2022. With the PBOC continuing to take action to support the onshore USD/CNY rate through fixing the midpoint for daily trade far stronger than what the prior day’s close would imply, it may require a significant strengthening in the USD to deliver fresh highs for USD/CNH.

Given the potential stalemate as USD strength is counteracted by PBOC support, range trading appears the most likely outcome near-term. There are multiple resistance layers located starting from 7.33170 while key downside levels to watch include 7.2700, 7.2400 and 7.1160, the low set in July this year.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade