- China’s data dump handily beat expectations in September

- Weakness for Chinese markets such as A50 and USD/CNH may be limited given their poor performance in 2023

- The conflict in Israel and Gaza remains the primary focus for markets

Activity levels in China’s economy look to be slowly picking up, providing momentary relief for cyclical assets amidst a deteriorating macro backdrop due to events in Gaza overnight. While the latter will likely dictate the broader direction for markets near-term, given how poorly Chinese markets such as USD/CNH and the A50 have fared this year, downside risks appear limited relative to those in markets which have not adjusted by the same margin,

China’s ‘data dump’ beats in September

The ‘data dump’, the nickname for China’s monthly industrial output, retail sales, unemployment and fixed asset investment reports which are released simultaneously on the same day, beat expectations in September, adding to an improvement in recent PMI surveys and ongoing strength in Chinese commodity demand.

China’s National Bureau of Statistics (NBS) said industrial production increased 4.5% in September relative to a year earlier, accelerating from 3.9% in August. The result was two-tenths ahead of the median economist forecast offered to Reuters. Retail sales strengthened over the same period, accelerating from 4.6% to 5.5%, topping the 4.9% pace expected.

Urban fixed asset investment was the only disappointment, lifting 3.1% in the first nine months of the year relative to the same period in 2023, down a tenth on August and a slight miss on expectations. Of note, the miss continues to reflect weakness in private investment which fell 0.6% from a year earlier. In contrast, infrastructure investment – primarily reflecting public sector capex, rose 6.2% over the same period.

GDP growth accelerates

China’s backwards-looking Q3 GDP figure also impressed, although the result was largely reflective of a 0.3 percentage point downward revision to the Q2 estimate. The NBS said the economy expanded 1.3% between July to September, stronger than the 1% pace expected. On a year-on-year basis, GDP lifted 4.9%, up 0.5 percentage points relative to consensus.

Cyclical markets such as AUD/USD, ASX 200 and crude are trading higher on the details of the data dump, although the latter largely reflects heightened tensions in the Israel-Hamas conflict along with a sizeable draw in US crude oil inventories, according to the latest API report released late Tuesday.

USD/CNH, China A50 market reaction

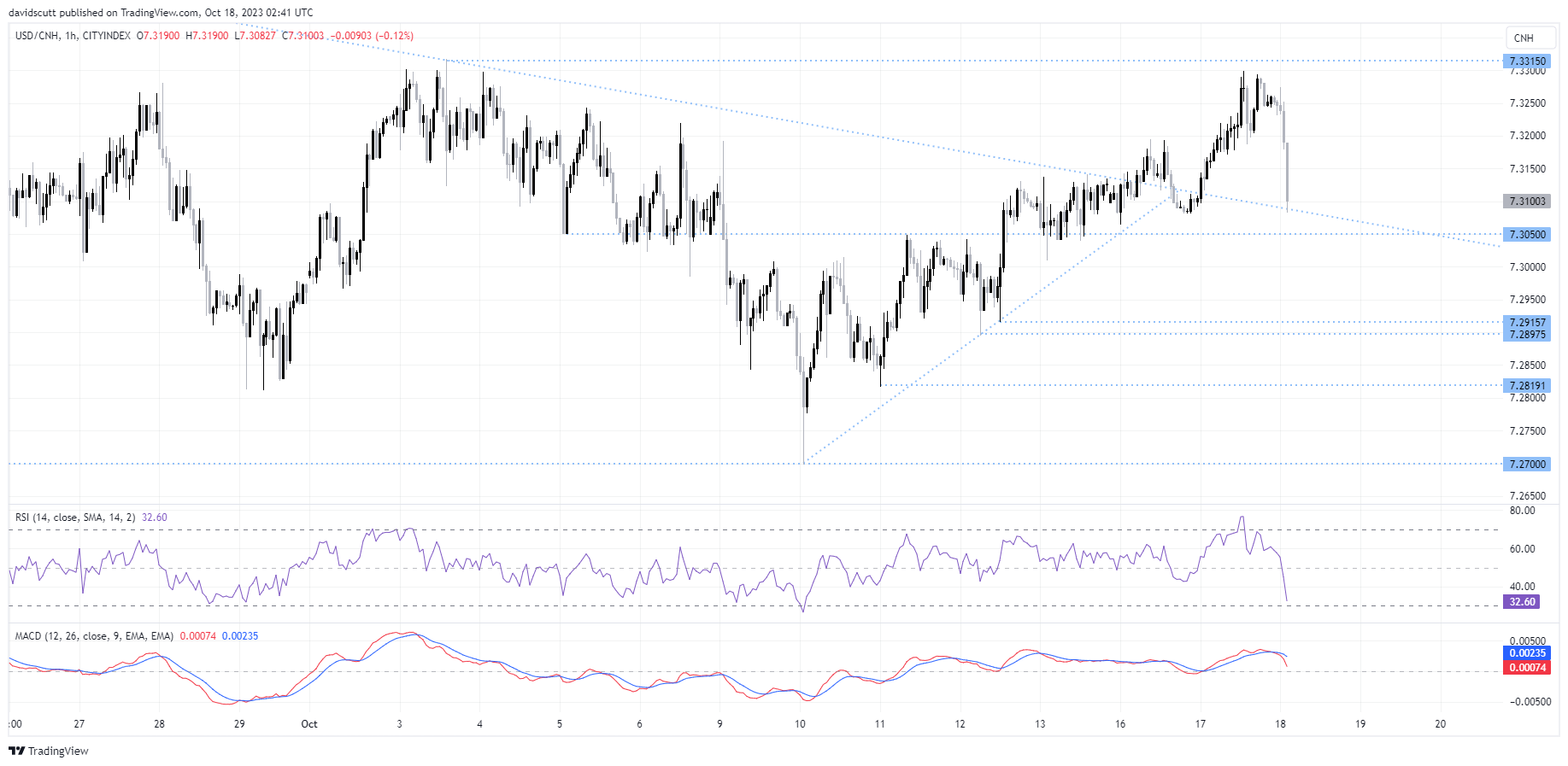

For Chinese markets, the reaction so far has been mixed with USD/CNH moving lower, stopping abruptly at long-running downtrend support located just below 7.3100. Should it break, the next levels to watch include 7.3050 and 7.2700, with minor support scattered in between. On the topside, moves above 7.3300 have proven to be unsuccessful of late.

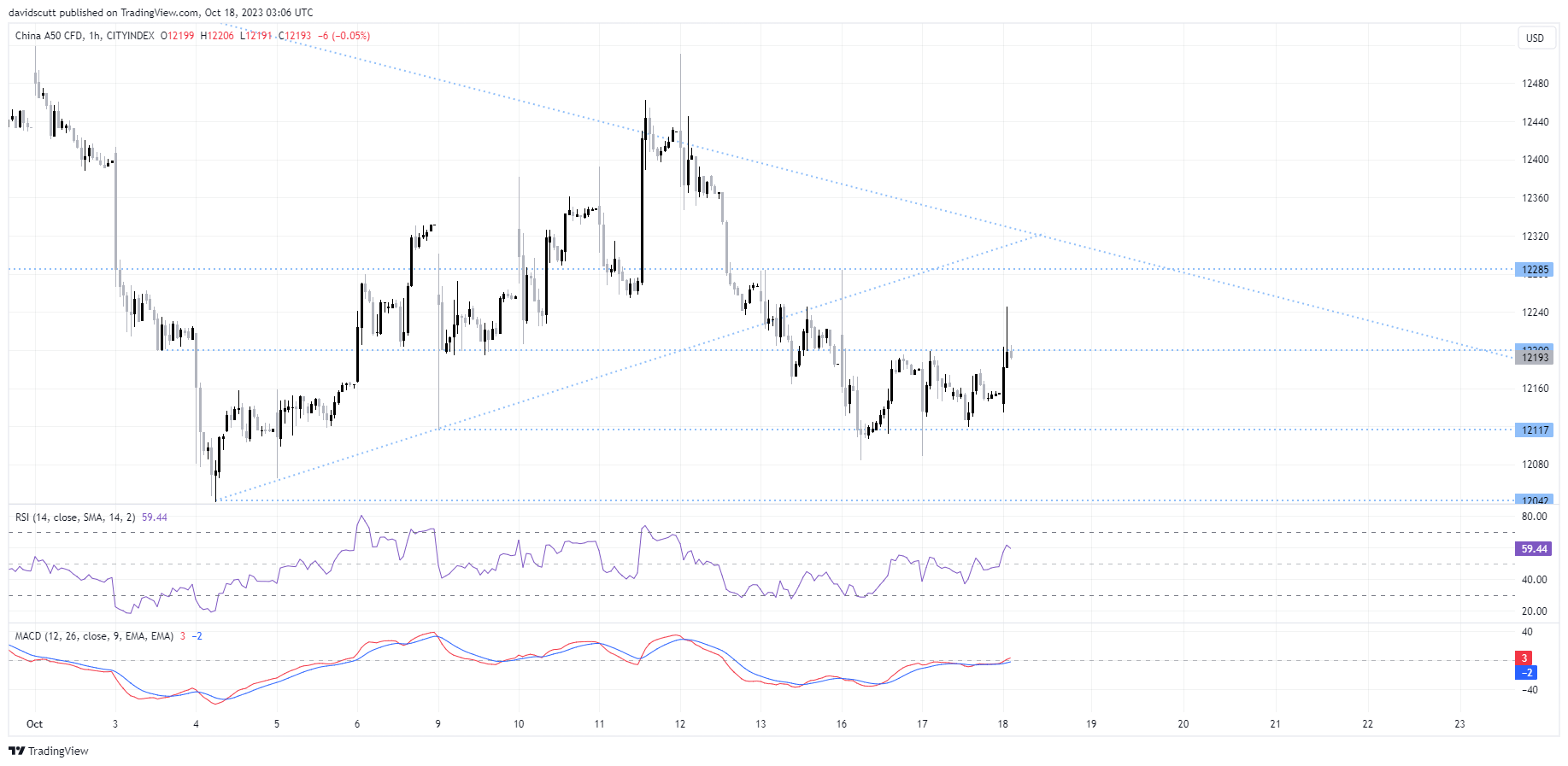

For the A50, an initial break above 12200 resistance was reversed just as quickly, although the index is now back testing the resolve of sellers above this level. However, the bearish hourly hammer suggests bears remain in control for now. On the topside, resistance is seen at 12285 and around 12320, the intersection of downtrend resistance and former uptrend support. Below, the index has attracted bids on probes below 12120 with further support located just above 12000.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade