These conditions may be the best that risk buyers will see this quarter

Brexit, Hong Kong, Italy, U.S.-China trade. These geopolitical situations are no longer like the Four Horsemen of The Apocalypse for global market risk seekers, though few will conclude that their many dangers have receded entirely. For now, quadruple de-escalation is what’s behind world shares setting up for their first fortnightly gain since mid/late June. This comes hand in hand with a broad down draft for the dollar. Like for shares, though in the opposite direction, the greenback is still set for its biggest slide since the third week of June.

It’s a strong indication that the dollar is taking a break from a ‘safe-haven’ phase that saw it come close to setting fresh 2019 highs. A softening dollar suggests any continued swing away from risk aversion would have strong cross-asset backing. Tightening global financial conditions implied by the trade weighted dollar’s 8% advance since early February 2018 were an integral part of the deepening malaise of the last few months.

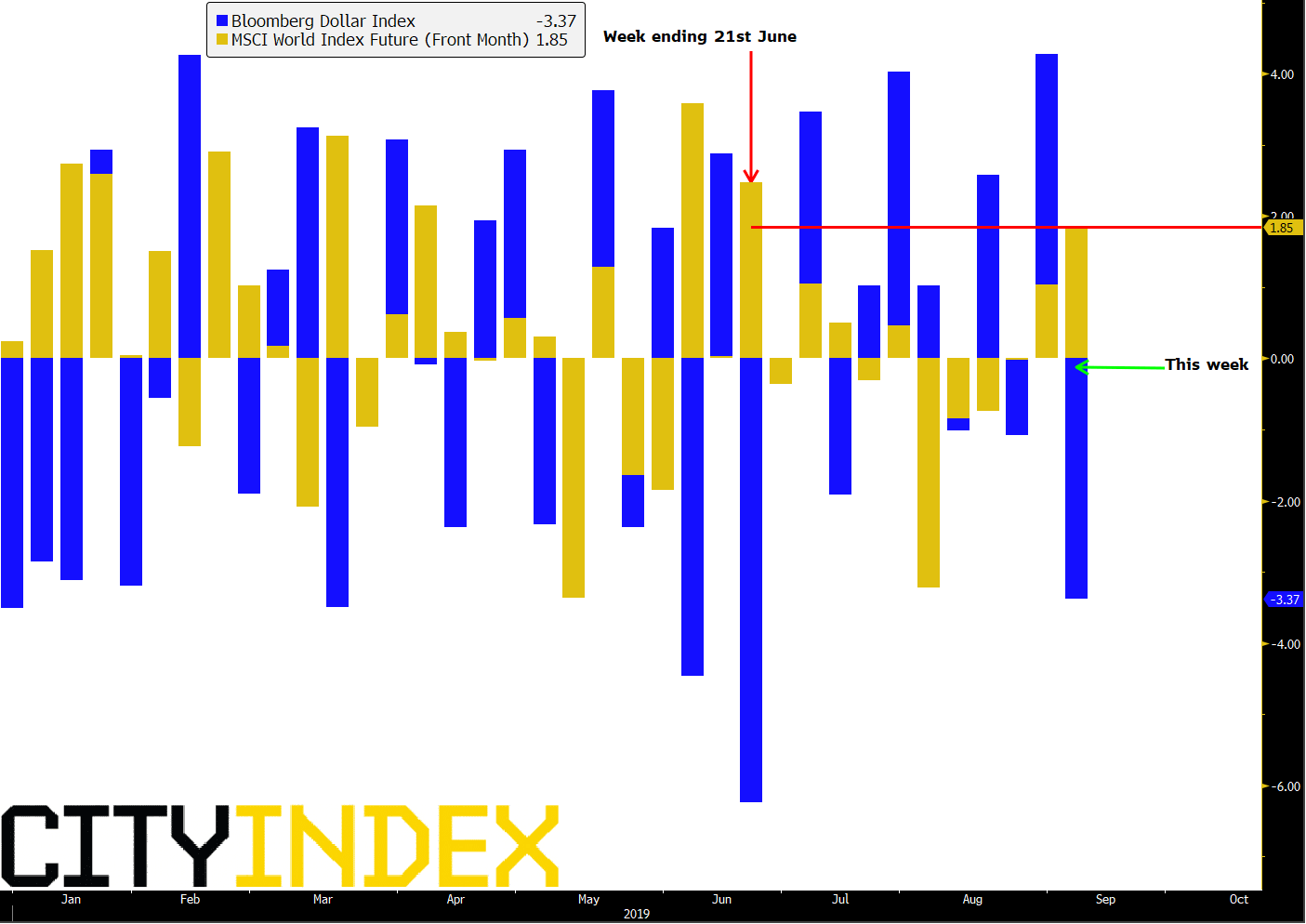

Absolute change chart: Bloomberg Dollar Index/MSCI World Index Futures (continuation) – weekly

Source: Bloomberg/City Index

Reduced anxieties can also increase perceived benefits from expected monetary easing. Signs that the U.S. economy is topping out have continued in the most up-to-date data available. A ‘goldilocks’ set of ISM service sector data in August barely plays against another round of Federal Reserve loosening, with Fed fund futures suggesting another cut in September is almost 100% certain. All ISM Non-Manufacturing components were strong apart from the employment gauge. It remains to be seen whether that outcome will be reflected in Friday’s payrolls data. But at this stage, it would take an outsize NFP beat relative to expectations to sow doubts about a September Fed cut.

Nevertheless, the hard part still lies ahead for investors. Now, the recovery of risk sentiment must be sustained. Yet the odds remain stacked against trade, Hong Kong, Brexit and Italy calming down on a sustained basis.

- Prime Minister Boris Johnson’s week of defeat over Brexit is possibly the least reason markets have to celebrate. Sterling is buoyant as the chances of Britain leaving the European Union without an agreement have ebbed. However Parliament has shown a remarkable inability in recent months to decide on the course of Brexit it does want. That is why the type of no-deal Brexit it doesn’t want keeps coming back. A similar lack of consensus will probably haunt UK politicians for several more months. So even if they succeed in forcing PM Johnson to seek a three-month extension, what then? For one thing, there’s a big chance of a snap election. A government that has lost its mandate can’t continue for long. And if there’s one thing sterling and broader risk appetite fears as much as a hard Brexit, it’s an election that could pave the way for political forces unknown or distrusted.

- Increasing hopes of a U.S.-China trade war ceasefire should also be tentative. China’s Vice Premier Liu He has agreed to visit the U.S. in “early October” for renewed talks. That’s later than the September date line widely trailed by both Washington and Beijing, though better than no talks at all. Several salvoes of escalation have occurred since relations abruptly collapsed again in May; and the U.S. is still set to keep raising tariffs through to year end. An even more aggressive trade policy may be just a few tweets away too. At the very least, further evidence will be needed that the conflict has turned a corner, before the benign assessment seen earlier in the year can return. In the meantime, a selling bias will remain near the surface for risk-exposed assets.

- The strongest signals yet that Hong Kong will withdraw its chilling extradition bill have reduced fears that one of the most pivotal Asia-Pacific economies will be hobbled. But months of protests have unleashed forces that won’t be put back in the bottle easily. Protests look set to continue. Therefore some form of confrontation with China in the near future remains a risk for market risk seekers.

- Ironically, among the four situations we’re looking at, Italian politics has the highest possibility of stability that lasts into the year end, at least. The centre-left Democratic Party and the populist-left Five Star Movement have adroitly outmanoeuvred the right-wing Northern League, after a year of almost constant mayhem. The chances of a head-on confrontation with the EU over fiscal policy have dropped dramatically, but the League probably remains the most popular party in Italy, looking at recent polls. Hence Matteo Salvini and his movement haven’t been banished for ever, whilst Italy’s economy remains fragile. The spread of 10-year Italian government bond yields over the German equivalent has dropped below 1.5 percentage points to around two-year lows. Anxieties have been reduced, not dispatched.

That leaves at least three out of four of the long-standing challenges for risk appetite still capable of playing havoc in the final quarter.

And as we have seen, if animal spirits become less care-free again, relatively tight dollar conditions can only get tighter.

Furthermore, monetary authorities that have provided policy comments in recent days have surprised on the hawkish side. It’s beginning to look like stimulus hopes are getting out of step with the extent of easing to come. Likewise, the Federal Reserve’s new loosening cycle is accompanied by ambiguous commentary. The relaxed pace of economic moderation in the U.S. implies that tension will continue. The ECB’s incoming President has also adopted a less than outright dovish tone.

Thursday’s risk asset bounce reflects relief that potential disasters are receding. Major uncertainties remain though, and policy pricing could use a second look.