NFP Preview: Another Solid Report on Tap?

Background

Seemingly every month, we remind traders that the Non-Farm Payrolls report is significant because of how it impacts monetary policy. In other words, the Fed is the “transmission mechanism” between US economic reports and market prices, so any discussion about NFP should start with a look at the state of the US central bank.

This month, the best single-word summary of the Fed’s position is besieged. In a controversial Bloomberg opinion article last week, former NY Fed President Bill Dudley argued that the central bank should not “enable” President Trump by cutting interest rates to offset the impact of the escalating trade tensions with China. The President has repeatedly accused the Fed of bias, and this article partially vindicated his view. While Dudley has since tried to “walk back” his argument, the article helped cement the probability of an interest rate cut from the Federal Reserve next month, lest the apolitical institution be accused of bias.

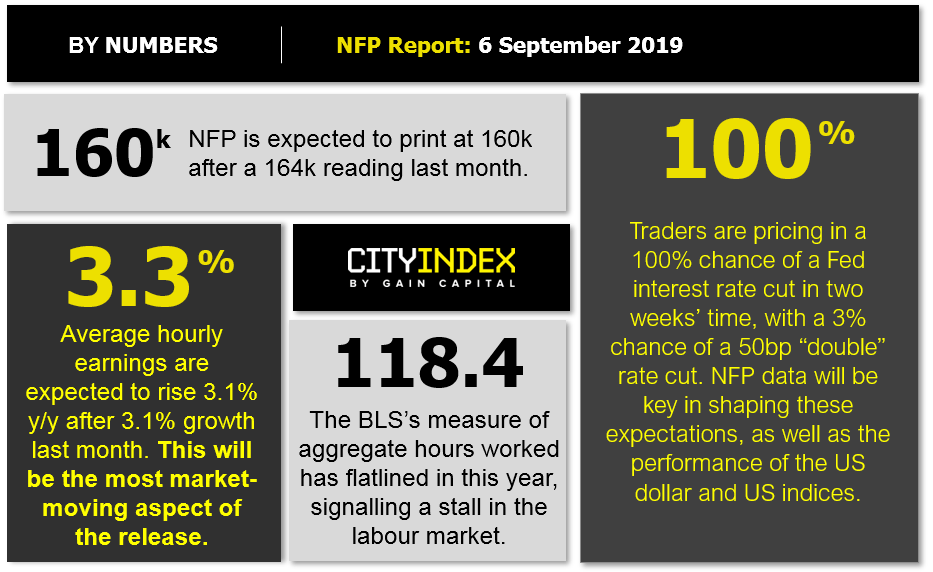

In that light, this week’s NFP report may have a smaller-than-usual impact on markets unless it’s truly shocking. At this point it seems like a 25bps interest rate cut in the middle of the month is a “done deal,” and any jobs report that is reasonably aligned with market expectations is unlikely to change the immediate outlook for the Fed.

NFP Forecast

Unlike last month, we have access to all four of our historically-reliable leading indicators for Non-Farm Payrolls:

- The ADP Employment report improved to 195k from a downwardly-revised reading of 142k last month.

- The ISM Manufacturing Survey employment component fell to 47.4, down nearly 4 points from last month’s 51.7 reading.

- The ISM Non-Manufacturing Survey employment component fell to 53.1, down 3 points from last month’s 56.2 reading.

- The 4-week moving average of initial unemployment claims edged higher to 216,250, up from last month’s historically-low 211,500 reading.

On balance, these leading indicators point to another solid month of job growth, with a reasonable forecast above expectations in the 180-200k range. That said, the recent deterioration in the ISM surveys could overwhelm the historically strong ADP and initial claims readings and bring the headline reading back toward consensus expectations in the 160k range.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). Most importantly, readers should note that the unemployment rate and (especially) the wages component of the report will also influence how traders interpret the strength of the reading.

Source: TradingView, City Index

Potential Market Reaction

See wage and job creation scenarios, along with the potential bias for the USD dollar below:

|

Earnings < 0.2% m/m |

Earnings = 0.3% m/m |

Earnings > 0.4% m/m |

|

|

< 120k Jobs |

Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

120k-200k Jobs |

Slightly Bearish USD |

Slightly Bullish USD |

Bullish USD |

|

> 200k Jobs |

Neutral USD |

Bullish USD |

Strongly Bullish USD |

In the event the jobs and the wage data beat expectations, then we would favor looking for short-term bullish setups on the dollar against the Japanese yen with USD/JPY recently stabilizing around the 106.00 handle. But if the jobs data misses expectations, then we would favor looking for bearish setups on the dollar against the Swiss franc, given the medium-term bearish trend and potential for safe haven demand for the Swissie.