- AUD/USD has fallen over 100 pips in less than 24 hours, threatening to break to fresh lows

- Neutral comments from RBA Governor Michele Bullock and tumbling US stock futures are behind the move

- RBA November rate hike odds have been slashed in halt to around 30%.

Tumbling US stock futures and neutral language from RBA Governor Michele Bullock has seen AUD/USD plunge in early Asian trade, continuing the sizeable reversal seen on Wednesday following the release of Australia’s Q3 hot inflation report. The pair is now threatening to push to fresh 2023 lows as money markets pare back expectations for a November RBA rate hike, slicing the odds from around 60% before Bullock started her appearance before parliamentarians in Canberra.

Bullock tones down the hawkish commentary

Bullock said the RBA Board was yet to decide on whether to increase interest rates again, adding she was unsure whether the Q3 consumer price inflation (CPI) report would lead to a material change to the bank’s upcoming forecasts. However, she said the longer inflation remained outside the bank’s target band, the more likely longer-term expectations would change. Bullock also said services inflation – which makes up a majority of the inflation basket and influenced by labour market conditions – was higher than what the bank are comfortable with.

With three of Australia’s big four banks forecasting a November hike and markets also favouring the option, it was noteworthy that Bullock played a straight bat, toning down the hawkish comments made prior to the inflation release.

Put simply, she had every opportunity to guide expectations towards a hike and didn’t.

AUD/USD reversing at speed

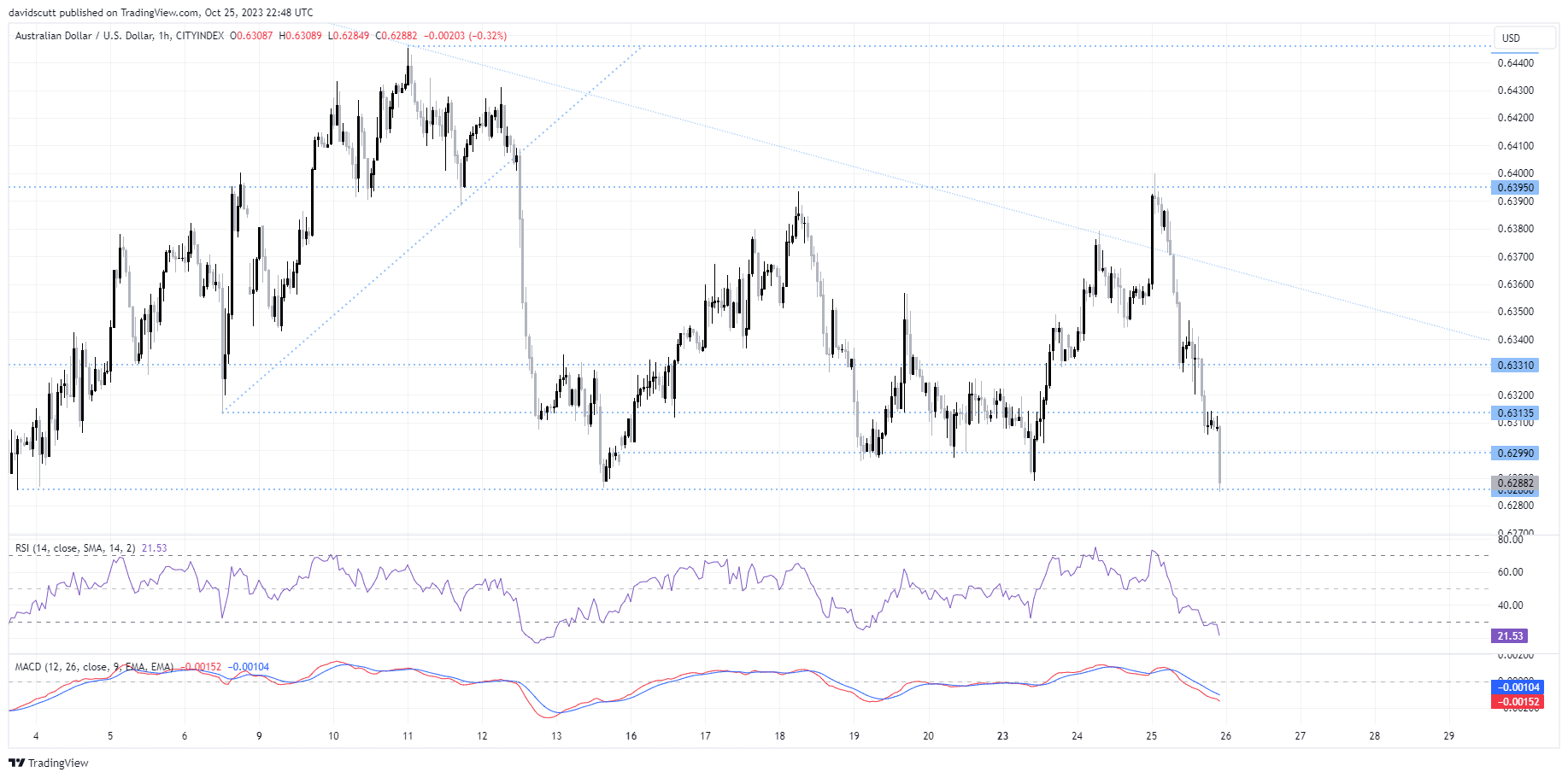

You can see the scale of the reversal on the hourly chart below, seeing AUD/USD fall around 115 pips from the highs hit a little over 24 hours ago. A break of .6286 opens the door for a move back to 2022 low of .6170 with only minor support around .6220 evident on the charts.

While MACD suggest momentum of the reversal remains strong, RSI is oversold on the hourly, pointing to the risk of a near-term squeeze higher. .6300, .6314 and .6331 are first layers of topside resistance.

RBA, China markets like to dictate AUD/USD direction

Bullock will continue answering questions for the remainder of the morning, creating the potential for headline-driven movements. Given the AUD is acting like a barometer of sentiment towards China, the performance of the USD/CNH and Chinese stock indices may be influential later in the session. With USD/JPY trading above of 150, the outlier risk would be for some form of FX intervention from the Bank of Japan, a scenario that would likely lead to short-term USD weakness against most currency pairs.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade