Market Summary:

- The US dollar began the week on another soft note, which allowed EUR/USD to rise for a second day and GBP/USD drift higher for a fifth, although volatility was on the low side due to a lack of market-driving news

- We may also be in for another quiet day looking at the calendar, ahead of RBNZ’s monetary policy meeting on Wednesday and US PCE inflation on Thursday

- Wall Street indices closed slightly lower for a second consecutive day, but once against daily ranges were on the low side and these markets remain just off of their all-time highs

- The Nikkei 225 reached a new record high on Monday just after the open before retracing and handing back around half of the weekend gap higher

- If prices gap lower today it will leave prominent bearish reversal pattern at is all-time high called an Island gap reversal

- NZD/USD and AUD/USD were the weakest FX majors on Monday ahead of tomorrow’s RBNZ monetary policy decision.

- It seems bets of a hike have been scaled back to weaken the Kiwi dollar and inadvertently weigh on the Australia dollar, and I stick with my bias that a tightening bias will be added but the central bank will stop short of an actual hike

Events in focus (AEDT):

- 10:30 – Japan’s inflation report

- 18:00 – German consumer climate (Gfk)

- 23:30 – Canadian corporate profits

- 00:30 – US core durables

- 00:40 – MPC Member Ramsden Speaks

- 02:00 – CB Consumer Confidence

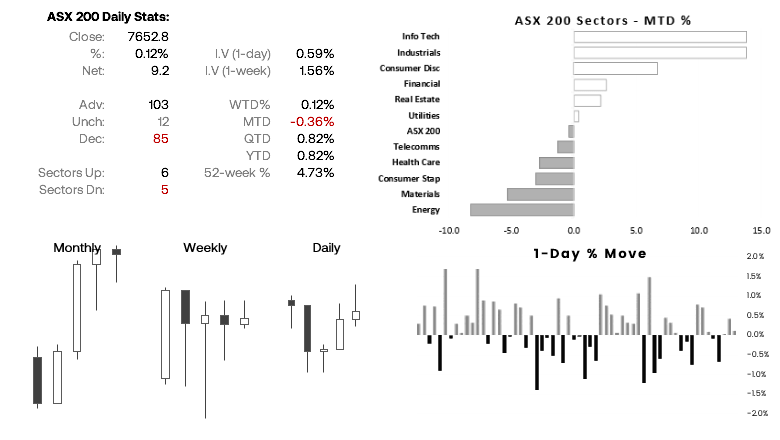

ASX 200 at a glance:

- The ASX 200 is on track to form a hanging man reversal candle on the monthly chart. Which would snap its 3-month rally at its own record high

- Six sectors have risen in February (led by Info tech and industrials) whilst five are trading lower (led by energy and materials are the weakest), which doesn’t provide much confidence of an imminent breakout to a new record high

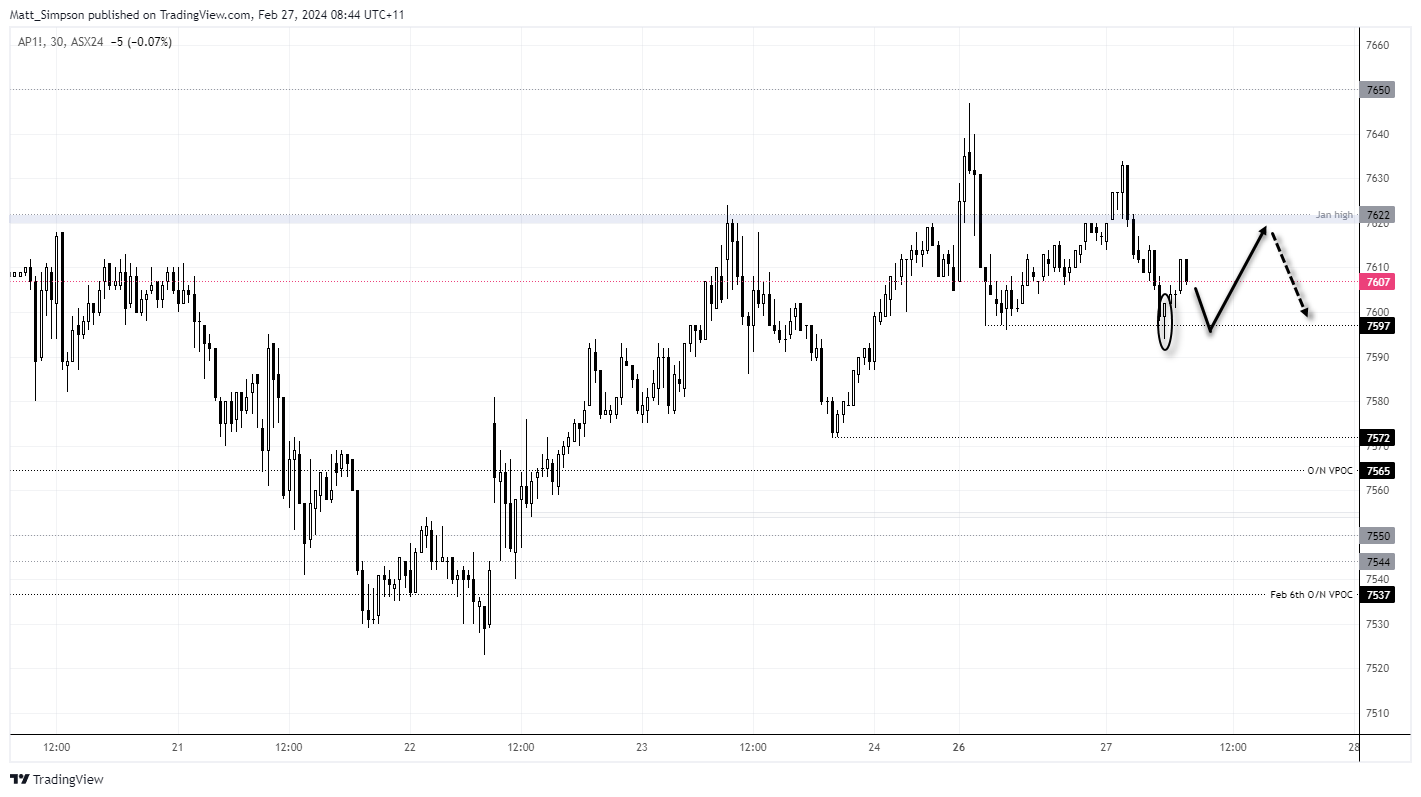

- The SPI 200 saw a false break of the 7597 low on Monday, and as I’m expecting another range-bound day then any dips towards the 7595 – 7600 level could pique my interest for another rebound towards the January high.

- I’m not overly confident that the market has enough juice to simply head for new highs so bulls way want to be cautious around the January highs

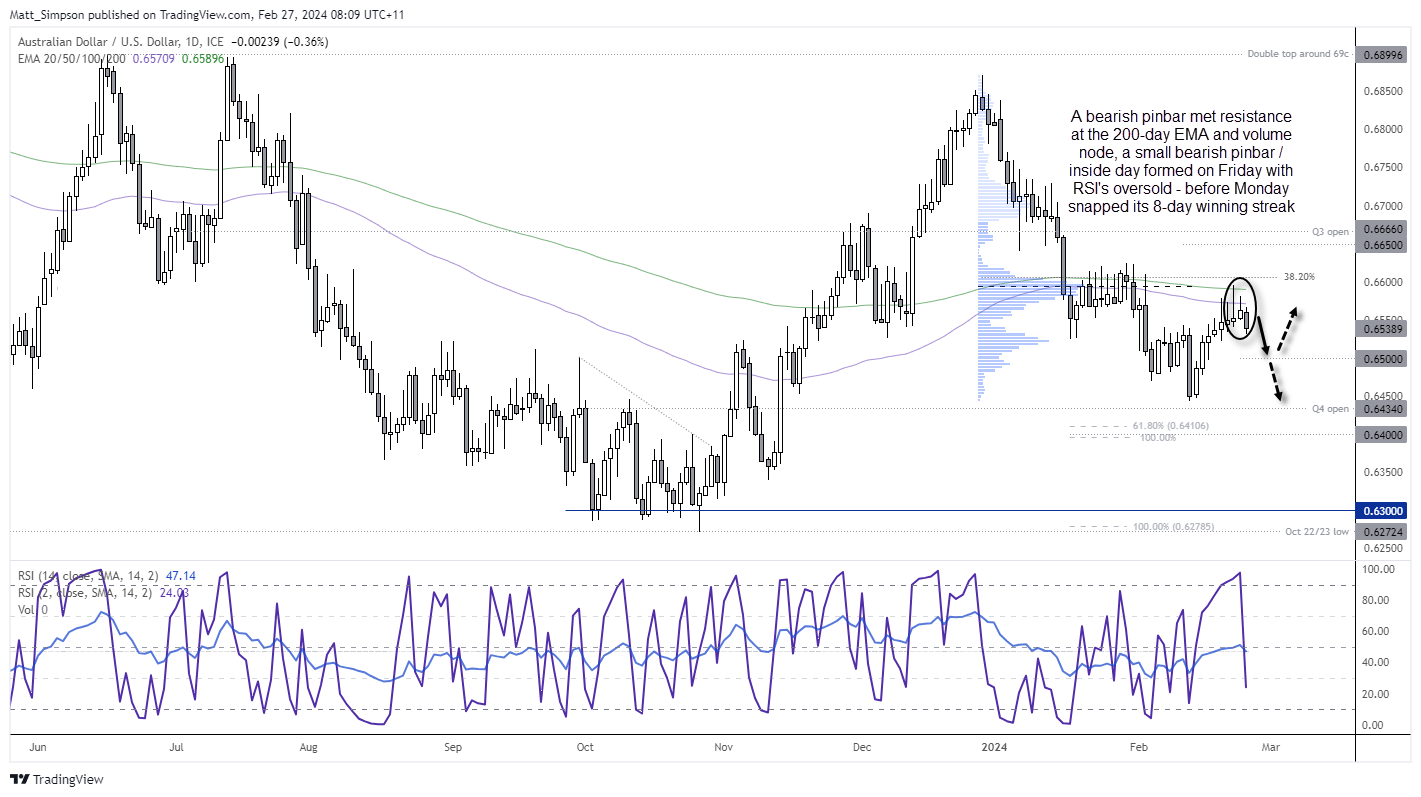

AUD/USD technical analysis:

The rally on the daily chart lasted an impressive eight days, even if the apparent bullish momentum which took it back to its 200-day EMA lacked conviction in recent days. Friday’s bullish inside day which also coupled as a shooting star candle acted as a warning that AUD/USD could be topping out, and yesterday we saw AUD/USD retrace lower to finally snaps its 8-day rally. Note that RSI (2) and RSI (14) has both tapped their respective oversold zones on Friday ahead of Monday’s selloff.

From there the bias remains for an initial move to 0.6500. Bears could consider fading into retracements within yesterday’s range.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade