- Australian inflation topped expectations across the board

- The odds for an RBA rate hike in November have swung to more likely than not

- Services inflation remains sticky and elevated, as seen in other nations

- ASX 200 is trading lower while the AUD/USD is higher

Australian underlying inflation has come in hot for the September quarter, seeing the odds for a 25 basis point rate hike from the RBA in November lift to 60%, up from 25% prior to the release. The AUD/USD has moved higher as a result while the ASX 200 has reversed earlier gains, turning negative for the session.

The details

The Australian Bureau of Statistics (ABS) reported trimmed mean inflation – the RBA’s preferred measure of underlying price pressures – jumped 1.2% in the September quarter, above the 0.9% pace forecast by the RBA and 1.1% level expected by economists. The result left the year-on-year rate at 5.2%, again higher than the 4.9% figured eyed by the RBA.

Other measures of underlying inflation also came in hot; the weighted median rose 1.3% for the quarter and 5.2% through the year.

Importantly, market based services inflation ex-volatile items rose 1.3% for the quarter and 6.2% over the year, signaling tight labour market conditions are feeding through to sticky services inflation, mirroring trends seen overseas. Headline inflation increased 1.2% for the quarter and 5.4% over the year, again above market forecasts.

Put simply, it was hot. Too hot.

Cash rate futures agree, pushing the odds of a 25 basis point hike in the RBA cash rate in November to 60%, up from 25% prior to the data. Ominously, when you look back at the history books, rarely do you see the RBA adjust the cash rate in isolation. Often when there’s one there’ll be more.

AUD, ASX 200 reaction

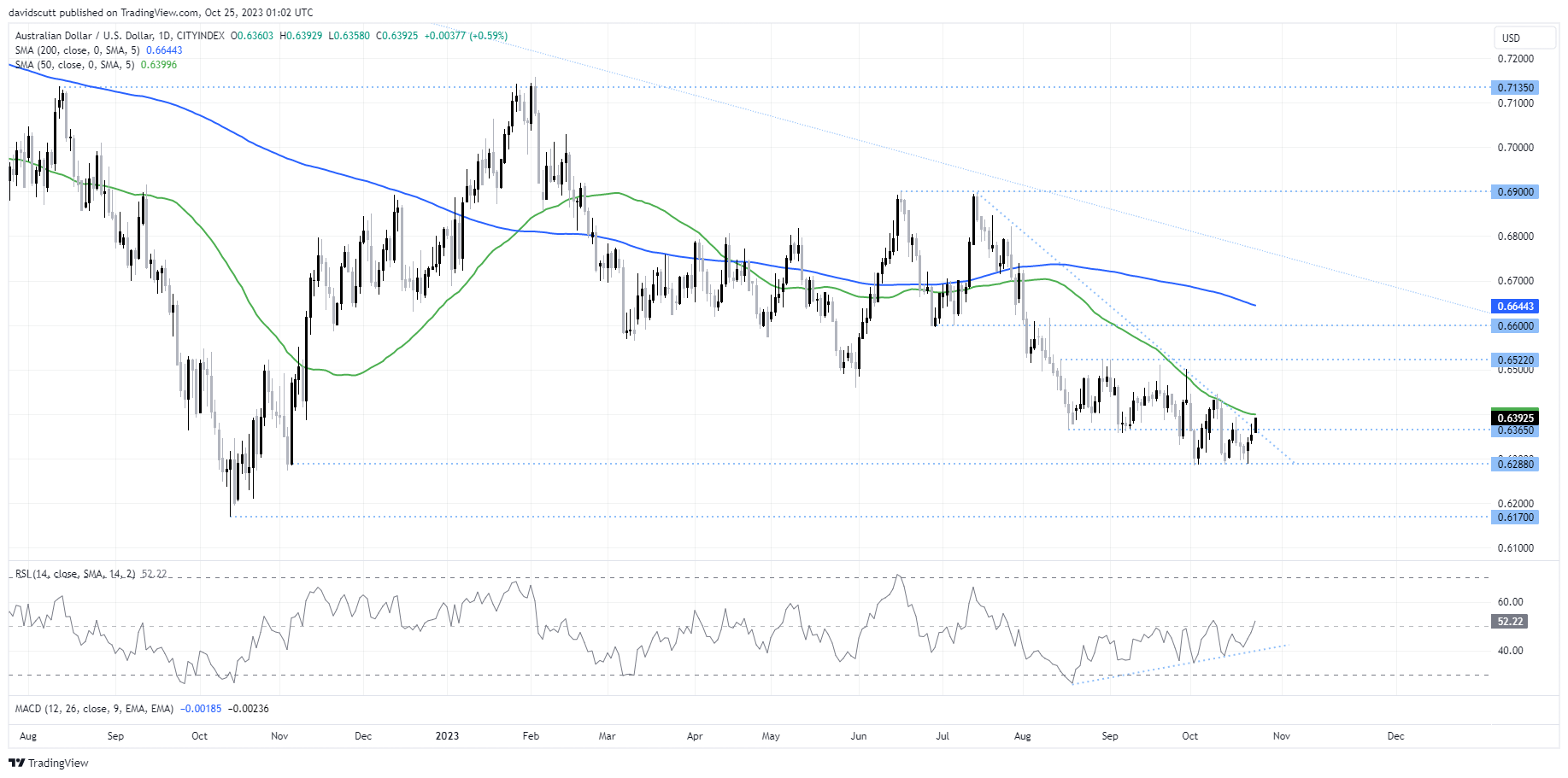

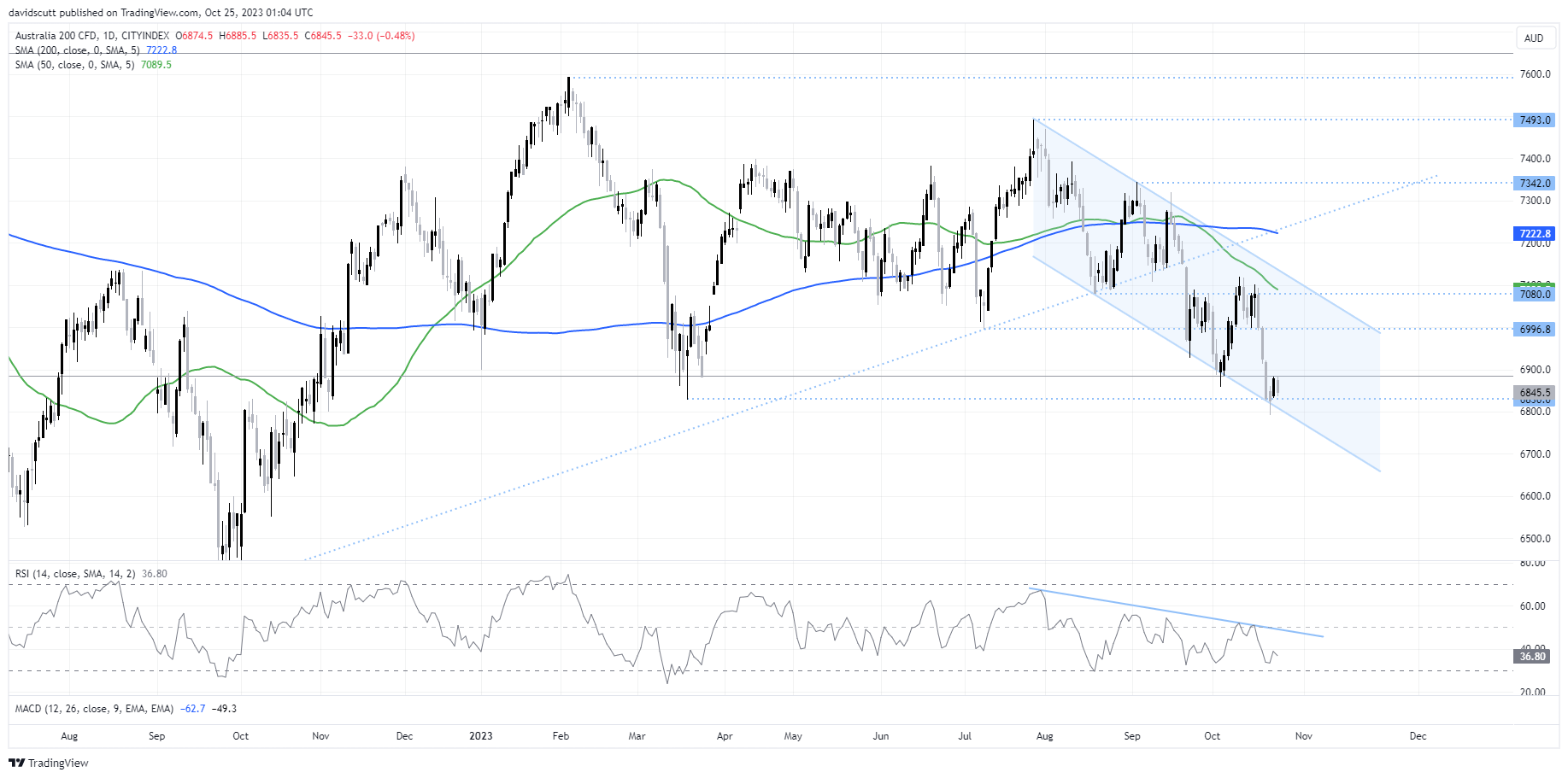

The market reaction to the data is largely in line with what we wrote in our preview: the AUD/USD is trading higher while the ASX 200 has fallen.

For the AUD/USD having broken the downtrend running from the start of August, it’s now tangoing with the 50-day MA, a level it’s struggled to overcome of late. It’s also broken horizontal resistance at .6365, suggesting it may now act as support. A break of the 50-day may see the pair push back towards resistance located above .6500.

For the ASX 200, early enthusiasm has fizzled with the index now lower for the session, seemingly destined for a possible test of support located at 6830. There’s not much support beyond this level before 6400, so watch for a potential break. On the upside, resistance is found at 6884 and again at 6996.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade