The ASX200 has started the new week, shedding 86 points (-1.19%) to be trading at 7119 at 3.15 pm Sydney time.

The month of May has a reputation as a tough one for the local bourse, and after just six trading days, the ASX200 is down over 4% for the month.

Today's sell-off comes as Chinese leaders doubled down on their Covid Zero strategy, rolling out a new series of intense restrictions in Shanghai and Beijing and warned citizens against questioning a strategy that the rest of the world has long since abandoned.

China's damaging restrictions look set to extend until the end of May. Bad news for the citizens of Shanghai, global growth, and ASX200 investors overweight the resource and materials sector.

Following a 6% fall in Chinese Iron ore futures today, Fortescue Metals (FMG) fell 6.1% to $19.56, Mineral Resources (MIN) fell 3.83% to $54.18. Rio Tinto (Rio) fell 2.78% to $106.24. BHP Group (BHP) fell 1.3% to $46.18.

Crude oil has reversed early losses to be trading above $110 p/b on news that Japan would move to halt crude oil imports from Russia. Despite this, the oilers on the ASX200 have etched out only small gains. Santos (STO) added 0.04% to $8.08. Beach Energy (BPT) added smalls to be trading at $1.66, and Woodside Energy (WPL) added 0.03% to $31.40.

Fresh year-to-date lows for the ASX200 IT sector, now almost 40% below its November highs as the rally in long end U.S interest rates and growth concerns intensify.

Sezzle (SZL) fell 7% to $0.80c, Megaport (MP1) fell 6.45% to $7.54, Afterpay owner Block (SQ2) fell 5.88% to $134.50, Life 360 (360) fell 4.83% to $3.15, Tyro Payments fell 3.72% to $1.03, and software company Wisetech Payments fell 3.5% to $39.91.

A mixed session for Healthcare stocks. CSL added 0.6% to $269.55, Ramsay Health Care (RHC) added 0.5% to $78.18. Elsewhere Resmed DRC(RMD) fell 1.35% to $28.41, Cochlear (COH) fell 1.16% to $216.84 and Sonic Health (SHL) fell 0.83%% to $35.64.

After reporting a $3.1bn cash profit for the first half, Westpac (WBC) added 3% to $24.55. National Australia Bank (NAB) added 0.36% to $31.73. Commonwealth Bank (CBA) added 0.02% to $102.39. Elsewhere ANZ fell 2.88% to $25.99, and Macquarie (MQG) fell 1.9% to $183.35.

Stocks in the Lithium space have tumbled again, led by Lake Resources (LKE), which fell 9.39%% to $1.50, Liontown (LTR) resources fell 7.25% to $1.28, Core Lithium (CX0) fell 6.85% to $1.16. Vulcan Energy (VUL) fell 6.25% to $7.20, and Allkem (AKE) fell 5.68% to $11.37.

Newscorp (NWS) is the worst-performing stock today on the ASX200, trading 9.66% lower at $24.04 after reporting earnings on Friday.

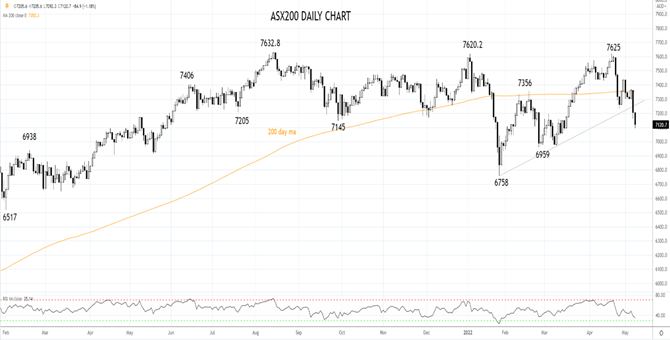

Last week's break of uptrend support and recent lows at 7230 resulted in us moving to a short-term bearish stance in the ASX200, looking for a test of support at 7000/6950.A break and close above resistance at 7350/70 is needed to indicate the correction is complete and that a stronger recovery can unfold.

The AUDUSD is trading at .7007, looking increasingly vulnerable to a look below support at .7000c, a level it's mostly held above since July 2020.

Source Tradingview. The figures stated are as of May 9th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade