- Risk appetite tentatively improves despite geopolitical risks

- Headline risk is elevated in the current environment

- Not the kind of environment where ASX 200 and AUD/JPY tend to thrive

No further escalation in the conflict between Israel and Hamas in recent days has seen hedges put in place over the weekend unwound on Monday, assisting the risk rally seen to start the week. But given an incursion by the Israelis into Gaza remains a high probability scenario, it’s questionable whether this period of relative calm will last. For the ASX 200 and AUD/JPY, until the geopolitical situation in the Middle East improves, adopting a sell-on-rallies approach remains the most appropriate strategy for those and other cyclical asset classes.

Known knows create potential for better trade entry points

When we’re talking about a possible escalation in the Israel-Hamas conflict to surrounding nations, even with hopes for a diplomatic solution driven by the United States and other global superpowers, it will ensure any additional information will play second fiddle for Australian equities and AUD/JPY. However, what this information may provide is opportunities for better entry levels for trades playing the broader macro thematic, making them worthwhile to remain on the radar.

RBA events, jobs report key AUD events

For Australian markets, the September jobs report on Thursday, along with the RBA October meeting minutes on Tuesday and a ‘fireside chat” with new RBA Governor Michele Bullock on Wednesday, are the headline act. While there’s always room for surprise, these events appear inconsequential to the Australian market with the RBA likely on hold for the foreseeable future in the absence of an unlikely strengthening in labour market conditions, even with the board retaining a hawkish bias that’s as believable as the Tooth Fairy for anyone aged over eight-years-old. It means any knee-jerk reaction to these events is unlikely to stick unless it brings forward the expected timeline for when the RBA begins to cut rates.

Japan CPI out Friday

In Japan, the only meaningful event on the calendar is the nationwide consumer price index (CPI) for September on Friday. While market chatter about the Bank of Japan (BOJ) normalising policy settings persists, the trends coming from forward-looking Tokyo readings suggests that while inflation remains well above the BOJK’s 2% target, the momentum in the annual rate is already subsiding. Geopolitical tensions also diminish the risk of the BOJ moving towards tightening policy settings.

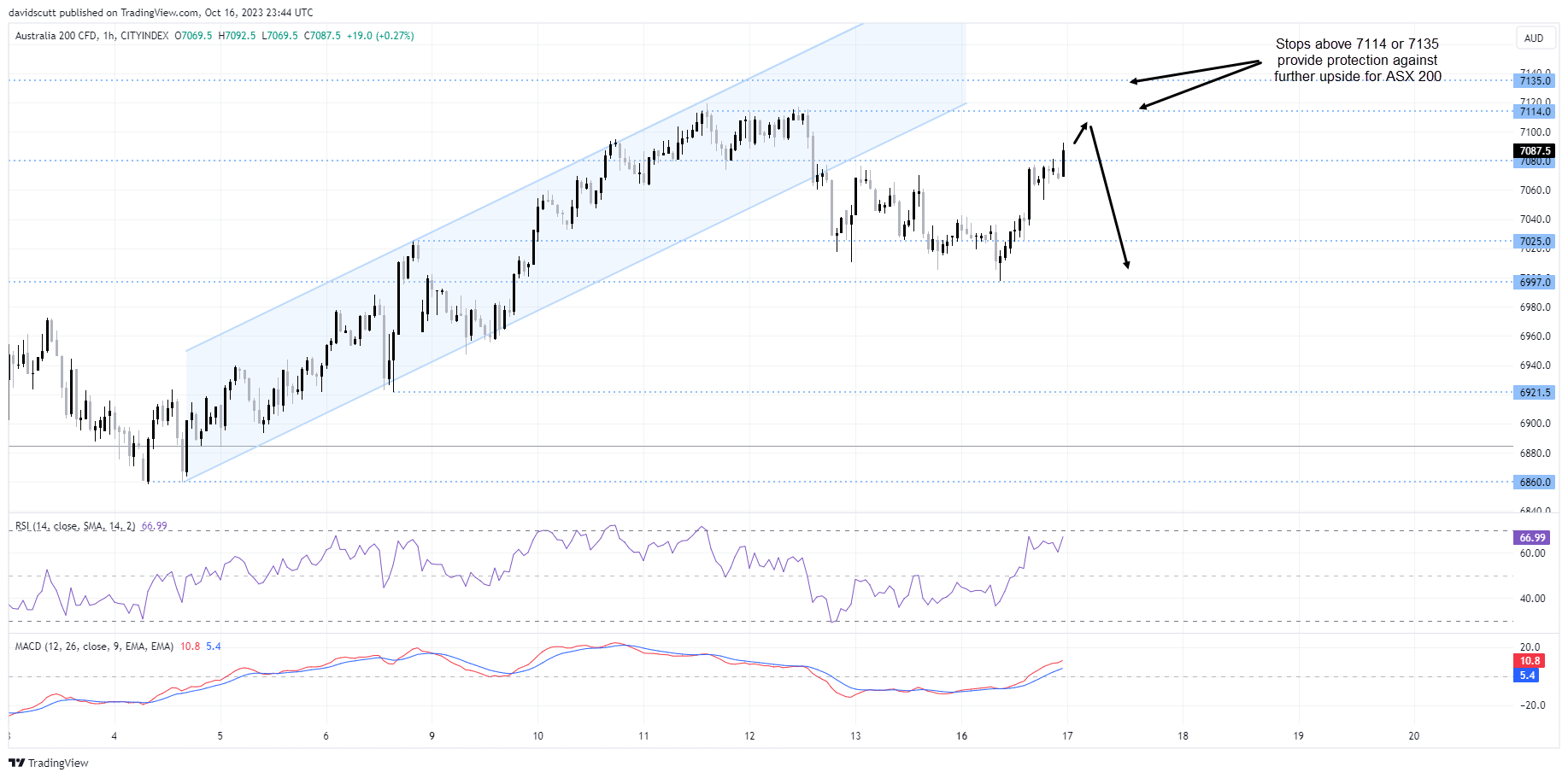

ASX 200 resilient… for now

Looking at the ASX 200 on the hourly chart, the index is being respectful of support and resistance lines despite the fluid environment, breaking to one-week highs today on the back of the strong rebound on the S&P 500 on Monday. But in an environment where one headline can change the entire outlook for broader financial markets, the fundamental backdrop remains poor.

Before the Israel-Hamas conflict, the narrative was about the damage higher borrowing costs may deliver to economic activity. That hasn’t gone away. And while there’s continued chatter about more stimulus measures in China, that hasn’t moved the needle meaningfully for Chinese markets which remain weak. As such, it’s hard to get excited about the index in this type of environment, even with the resilient price action seen in October.

For traders seeking to sell rallies, pops towards 7100 offer decent risk-reward, allowing for stops to be placed above 7114 or 7135 targeting a potential retrace towards support located at 7000.

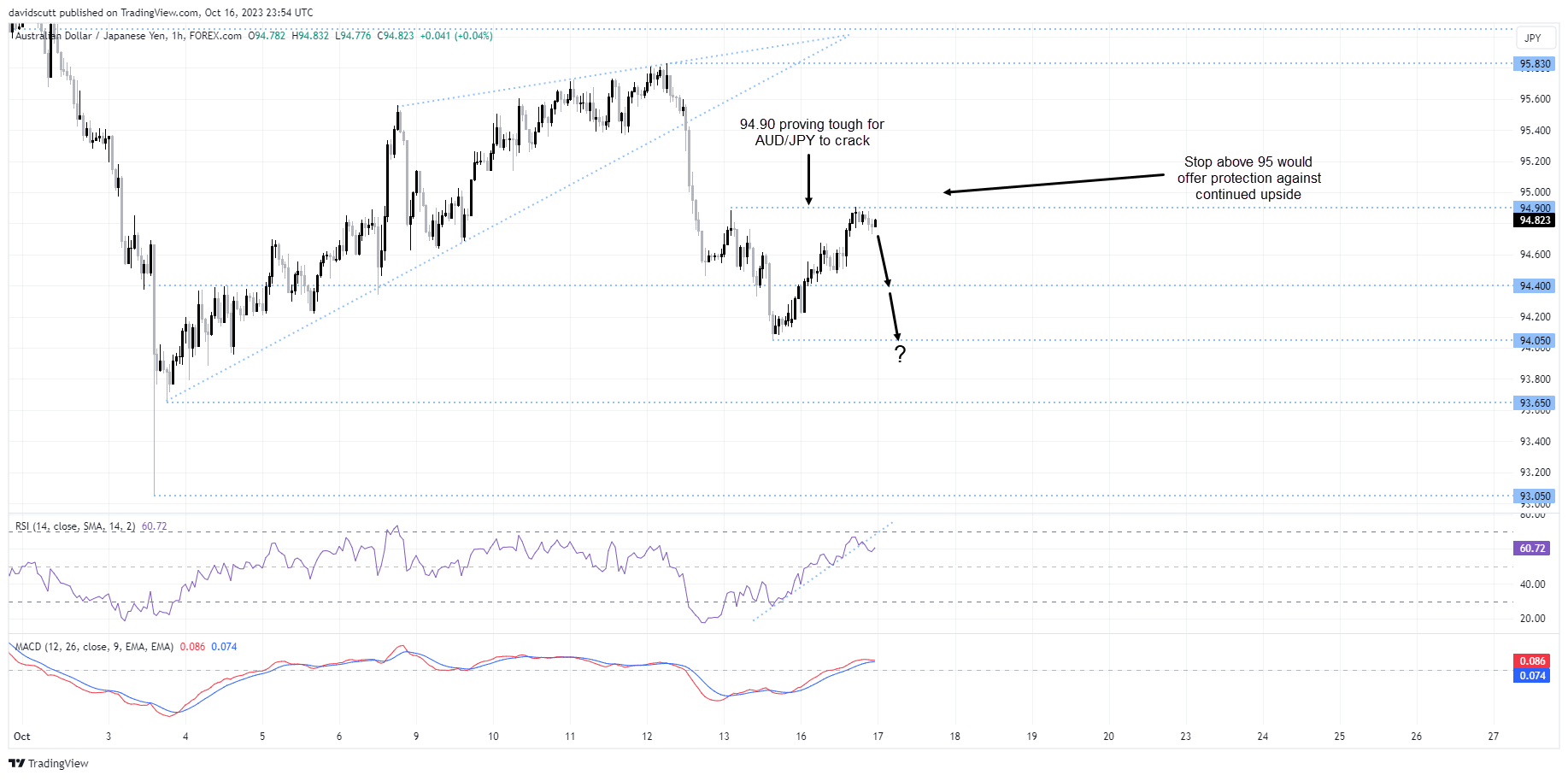

AUD/JPY heavy despite tentative improvement in risk appetite

For AUD/JPY, the pair has struggled to crack resistance above 94.90 despite the tentative improvement in risk appetite, suggesting ample downside risks may be present should we see even a modest deterioration in the geopolitical picture. Those considering entering shorts around these levels could place a stop-loss at 95.00 targeting a move back towards 94.40 or even 94.05. Momentum indicators are also warning of downside risks with RSI breaking its uptrend on the hourly with the signal line on MACD also set to crossover from above.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade