U.S stock markets are on track to lock in their worst first-half performance in decades. The S&P500 is currently down over 15% in the second quarter and on track to lock in an ~20% decline for the first half of the year.

Amongst the gloom, flickers of peak Fed Rate interest rate hike expectations and inflation are burning a little brighter after events overnight.

On a panel discussion in Portugal, Fed Chair Powell reiterated the Fed will do what it takes to get inflation down. He also noted that market pricing is "pretty well aligned with where we're going".

Currently, the interest rate market is almost fully priced for a 75bp rate hike at the July 27/28 FOMC, which would take the Fed Funds to a range of 2.25-2.50%.

Another 110bp of hikes are then priced over the final three meetings of 2022, taking the terminal rate to the 3.35%- 3.60% range. Critically 50bp of rate cuts then appear from May 2023 until December 2023.

Elsewhere mixed inflation data in Europe has raised hopes (again) an inflation inflexion point is nearing. German CPI was lower than expected (Harmonised inflation printed at 8.2% YoY vs expectations for an 8.8% rise). On the other hand, Spanish CPI was higher, rising by 10% YoY vs expectations for an 8.7% rise.

As a reminder, higher interest rates, higher inflation, and growth concerns have been behind the rerating lower equities in 2022. However, before getting carried away on prospects of a Q3 rally, a new headwind will soon begin to blow.

As noted by analysts at Goldman Sachs, "Profit margins for the median S&P 500 company will likely decline next year whether or not the economy falls into recession." And "while investors are focused on the possibility of recession, the equity market does not appear to be fully reflecting the downside risks to earnings."

Traditionally, analysts' earnings revisions lag in both bull markets and in bear markets. Downside earnings revisions appear set to become the next challenge for U.S equities, just as other headwinds are easing.

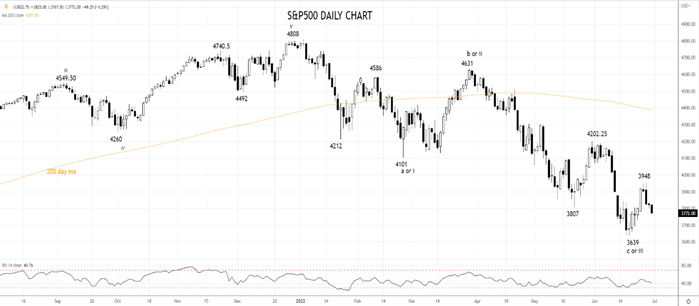

What do the charts say?

Despite the rally from the mid-June 3639 low stalling earlier this week at 3950, we are not quite ready to give up on the current countertrend rally extending towards the 4000/4100 resistance zone.

Providing a potential rally does not extend above resistance at 4200/20 coming from the late May, and early June highs, it will be viewed as a short-covering rally with scope to retest the June lows.

Source Tradingview. The figures stated are as of June 30th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade