When will Exxon Mobil report Q3 earnings?

Exxon Mobil will release third quarter earnings on Friday October 28. A conference call will be held at 0730 CST.

Exxon Mobil Q3 earnings consensus

Wall Street forecasts Exxon Mobil will report a 40% year-on-year rise in revenue in the third quarter to $103.14 billion and expect EPS to more than double to $3.91 from just $1.57 the year before.

Exxon Mobil Q3 earnings preview

The oil and gas sector is expected to deliver the strongest profit growth of any industry this earnings season thanks to higher prices. However, having delivered record profits in the last quarter, the question is whether we have reached the peak and how long prices can remain elevated.

Revenue is expected to be aided by a 2.6% rise in production volumes and significantly higher prices. Estimates suggest average oil prices will be some 39% higher than last year while natural gas prices will be more than double. That will be partly countered by weaker refining margins as they have eased since hitting record levels earlier this year, as well as a more challenging environment for chemicals.

Earnings will be some 2.5x times higher this quarter than last year, although down from the second quarter when EPS was among one of the highest on record.

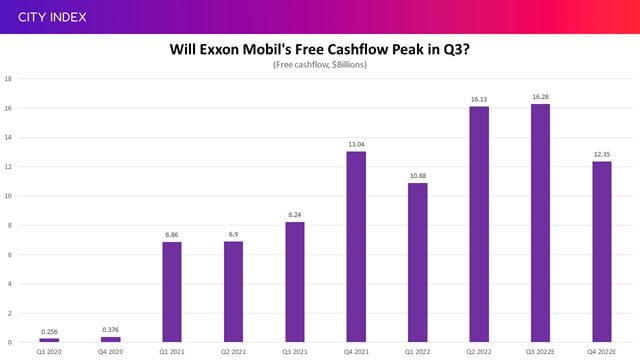

Free cashflow has been growing thanks to the more favourable price environment since the global economy rebounded from the pandemic but, with oil prices having waned since June, we could be about to reach the peak. Free cashflow is forecast to almost double from last year to $16.3 billion in the third quarter, more than enough to cover the quarterly dividend worth around $3.7 billion as well as share buybacks, which are currently running at just under $4 billion per quarter.

However, Wall Street believes this will start to decline in the fourth quarter, although still at levels that can more than cover shareholder returns:

(Source: Estimates from Bloomberg)

Still, Exxon Mobil is expected to have ended September with around $26.1 billion in cash and debt is at the very bottom of its target range, which should allow it to sustain its buyback programme that will stretch into 2023. That provides a healthy buffer for Exxon Mobil should we see any fall in demand or prices as recession fears grip the outlook for next year. It is still good times for the oil and gas industry, but it is not clear how long this will last. Markets currently believe Exxon Mobil can continue to generate over $10 billion of quarterly cashflow throughout 2023, suggesting earnings and cashflow have both peaked but still remain high enough to keep the balance sheet bolstered and shareholders satisfied.

Where next for XOM stock?

Exxon Mobil shares have been testing fresh all-time highs over the past week but appear to have found some resistance after breaching the $107 mark. A move above $107.68 puts us in unknown territory, but Wall Street believes there is limited potential upside from here considering the average target price among the 28 brokers that cover the stock sits at $109.88. With that in mind, the RSI is still in bullish territory but is approaching overbought territory.

Any renewed pressure could see the stock fall back toward the $104.50 peak we saw when oil prices peaked back in June and then back to the August-high of $100. The 100-day moving average, which sits at $96.30 and is aligned with the level of support-turned-resistance seen in recent months, would then be back in play. The $83.90 level of support seen last month should be treated as a firmer floor should the stock experience a notable decline.

How to trade Exxon Mobil stock

You can trade Exxon Mobil shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘XOM’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.