Key takeaways

- The positive impact from higher interest rates is approaching its peak, and the boost to margins may have already peaked.

- Uncertain economic outlook is expected to see the amount of provisions put aside jump by 50% in 2023, and the macro environment will be key to the outturn this year.

- Profit growth will be more muted as a result, although HSBC could shine.

- Lloyds, NatWest, Barclays and HSBC are all trading at a discount to the wider market.

What to expect from UK bank stocks in 2023

UK-listed banks struggled to grow profits in 2022 despite benefiting from a boost in income from higher interest rates as this was countered by rising costs in the inflationary environment and higher provisions that banks put aside because of the uncertain economic outlook in fear more loans will turn sour.

We have seen Lloyds, NatWest and Barclays all plunge 4% to 9% since releasing their results over the past week and this is being primarily driven by the cautious outlook to 2023, when consumers and businesses are expected to see their finances stretched.

The boost from interest rates will be smaller and much more money will need to put in the rainy-day fund given the clouded outlook. That will heighten the need to get a grip on costs.

Let’s have a look at what to expect from UK-listed banks in 2023.

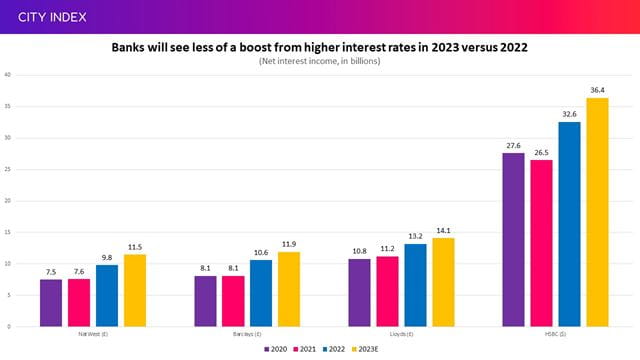

Smaller boost from interest rates

Central banks began raising interest rates in late 2021 and early 2022 as they initiated their fight against rampant inflation. Interest rates are now at their highest level since the global financial crisis, and this has boosted income for banks because it allows them to make more money on products like loans and mortgages.

This caused net interest income to spike in 2022, adding billions in additional revenue for the banks. Rates are set to continue rising in 2023, although markets are expecting fewer and possibly milder increases. This will improve net interest margins and income further this year, but provide a milder boost than what we saw in 2022. But, for some including NatWest and Lloyds, the margin boost may have already peaked.

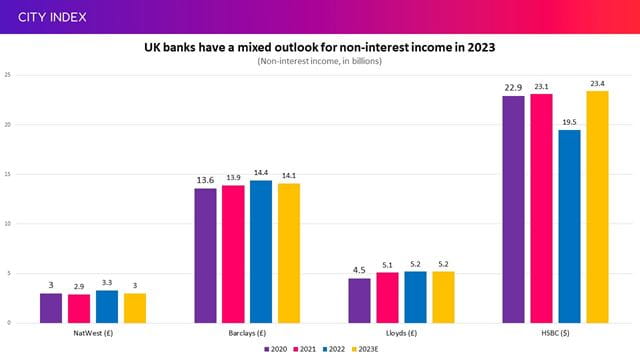

Non-interest income growth to remain muted

The other major source of revenue for banks comes from non-interest income. This represents all the fees banks make for handling accounts, processing transactions as well as providing services to help businesses raise cash, complete deals and go public. It also includes what some banks make through activities like trading.

Analysts believe NatWest and Barclays will see this fall in 2023 while Lloyds will see its income remain flat. HSBC, which saw the biggest drop off in income in 2022 thanks to lower fees and negative market movements for its wealth and personal banking division, is the only one set to see an improvement this year.

(Source: Bloomberg)

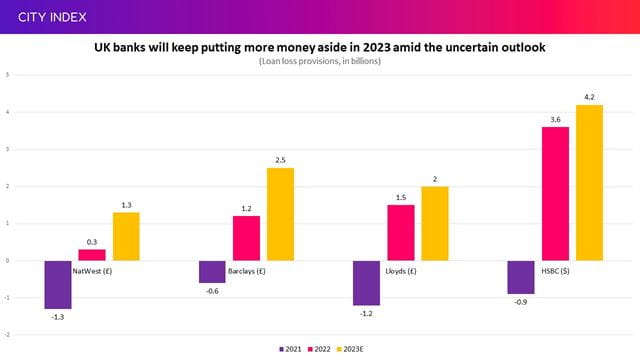

Provisions will rise amid the uncertain outlook

Banks put aside money when the economic outlook is uncertain in case more consumers and businesses cannot afford to repay loans. They then release these reserves when they are more confident. We saw banks initially squirrel away money when the pandemic hit but they released large sums in 2021 as the economy held up better than anticipated. However, we saw the four banks put over £6 billion away in 2022, which was a significant drag on their bottom-lines.

Inflation is easing but is still persistently high and well above where central banks want it to be, which is encouraging them to keep raising interest rates. The combination of the rising costs for consumers and businesses with higher financing rates, making credit more expensive, will put their customers under further strain in 2023. As a result, provisions are expected to jump over 50% this year, with analysts believing the four players will put aside around £10 billion in 2023.

(Source: Bloomberg)

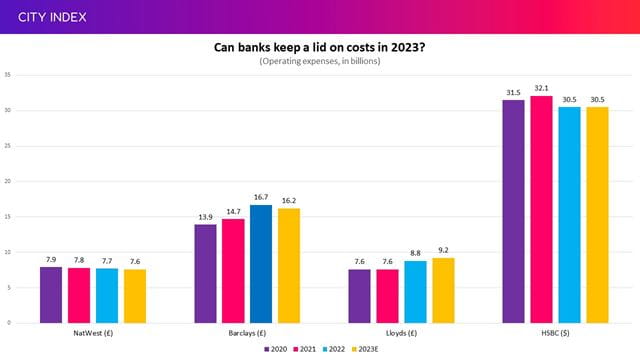

Can banks keep a lid on costs in 2023?

Banks are also grappling with the inflationary pressure being applied to costs, which has heightened the need to become more efficient and prompted them to have a sharper focus on expenses. NatWest and HSBC proved to be the best at limiting expense growth in 2022 while Barclays and Lloyds had a tougher time.

HSBC and Lloyds have both warned that costs will continue to rise in 2023, while Barclays and NatWest are forecast to cut them this year.

(Source: Bloomberg)

It is worth noting that most banks are focused on their cost-to-income ratio, which measures how much income is spent on operating expenses. UK-focused banks Lloyds and NatWest lead the charge on this metric with ratios of 50.4% and 55.5% in 2022, respectively, compared to its more internationally focused rivals HSBC and Barclays, which still have ratios of 64% and 67%, respectively. All of them hope to improve this measure in 2023 and over the medium-term. This shows that costs may still be rising, but should lag behind income growth over the coming years.

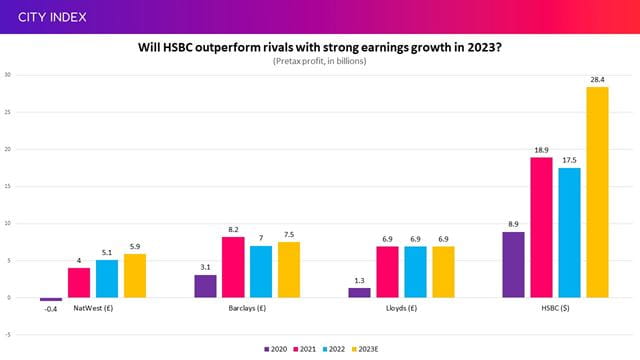

Can bank stocks grow profits in 2023?

Slower income growth, cost pressures and larger provisions will provide a challenge for banks in 2023, but the majority are expected to see profits increase this year. Lloyds is the outlier on the downside as a rise in costs and provisions is forecast to keep profits flat this year, according to consensus numbers from Bloomberg.

Meanwhile, HSBC looks poised to be the standout performer with markets expecting pretax profit to soar in 2023 thanks to a recovery in its wealth & personal banking arm and improved earnings from the rest of the business. This helps explain why HSBC is the only member of the four banks to have seen its share price rise since releasing results, as the outlook looks more favourable, partly thanks to the opportunities presented by the reopening of the Chinese economy this year.

(Source: Bloomberg)

Higher dividends and more buybacks to come?

Dividends were raised in 2022 and we saw more cash returned to shareholders through buybacks. Dividends should continue to grow in-line with their progressive policies and there is scope for buybacks to continue considering all the banks are looking to improve their return on tangible equity – a key measure of profitability – and boast healthy CET1 ratios that show they are financially sound.

Banks currently offer a dividend yield above 4%, which is above the average yield of 3.5% from the FTSE 100. Still, there are sectors offering better returns – housing, tobacco and miners to name but a few - and the level of future buybacks will be dictated by how the economic landscape pans out and how confident management are about dishing out large amounts of cash.

Are UK bank stocks a good investment?

UK-listed banks are currently trading at a discount. They are trading at blended-forward price-to-earnings ratios of around 5x to 7x while the FTSE 100 currently trades at a ratio of 11.3x (which is also below its five-year average of over 25x). All four have also seen their valuations slump compared to their five-year average.

|

BF PE Ratio |

5-yr Average |

|

|

NatWest |

6.1x |

10.1x |

|

Barclays |

5.2x |

7.7x |

|

Lloyds |

6.9x |

8.1x |

|

HSBC |

7.2x |

9.9x |

(Source: Bloomberg)

This signals that markets are applying a discount to UK banks and this can reflect one of two things. Either markets are undervaluing them, or they have fallen out of favour because of the outlook. Right now, it appears to be a combination of both.

The bottom-line

There is little doubt that interest rates will go higher and stay there in 2023, but this also suggests the boost from higher interest rates is approaching its peak. Markets currently believe interest rates will peak in the fourth quarter of 2023 and then be held there before a pivot toward rate cuts starts in 2024.

Therefore, the outturn for the year will be highly influenced by how well banks can keep a lid on costs and how the macroeconomic environment plays out as this will dictate how high provisions will go. The performance of non-interest driven activities, which struggled in 2022 amid volatile market conditions, will also be key.

On the upside, inflation could ease faster than expected and we could avoid a recession or experience a short and shallow downturn, paving the way for cost pressures to ease and allowing banks to start releasing reserves again. However, this could also prompt central banks to start lowering interest rates sooner than anticipated, which would dramatically weaken the income outlook.

On the downside, inflation could remain persistently high and make it harder to manage expenses and the economic outlook could stay clouded and force banks to remain on the cautious side and build their reserves as customers would come under more strain for longer. However, this could lead to the boost from higher interest rates being prolonged if central banks must become more aggressive to bring inflation down.

How to trade bank stocks

You can trade bank stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.