Nasdaq 100 analysis: AI drives best performance since 1999

The tech-heavy Nasdaq 100 rose 37% in the initial six months of 2023, marking its best first-half performance since 1999. Tech was the place to put your money in the first half. The index significantly outperformed the wider market considering the broader S&P 500 booked a gain of just 14% (and this too was largely thanks to a handful of tech firms) while the Dow Jones Industrial Average - geared more toward the likes of healthcare, banks and retail - rose just 2%.

Some of the outperformance of the Nasdaq 100 is down to a rebound in tech stocks following the rout we saw in 2022. But this has been helped along by the eruption of interest in artificial intelligence (AI), with bullish optimism that it can transform the world softening the blow from an otherwise gloomy economic picture dominated by increasing recession risks as inflation and higher interests continue to bite.

Is there an AI bubble?

The race for AI supremacy has only just begun, but questions are already being asked about whether or not AI is the next bubble as markets are haunted by the dot com crash in 2000.

AI has driven lofty valuations for some individual stocks but, broadly speaking, we are nowhere near the extremities we saw in the dot com bubble. For example, the tech-heavy Nasdaq 100 was trading 175 times ahead of trailing earnings just before the dot com bubble burst in 2000. Today, that sits at around 33x, which is below its 10-year average.

Today’s ratio sits even lower at 28x based on earnings expectations over the next 12 months. That suggests two notable things. Firstly, that expectations remain fairly tempered and that investors have not flooded into the next big thing too quickly like they have in the past. Secondly, it suggests AI is yet to drive an upgrade in earnings estimates in the broader market as companies and investors try to find their footing in this new rapidly-developing industry.

With this in mind, markets should be very focused on valuations. Some of the earliest beneficiaries will see their premium valuations tested and are at risk of seeing these fall away if they fail to live up to the hype, while there will also undoubtedly be more companies thrusted under the AI spotlight and driven higher as they find new use cases, especially financially-rewarding ones.

AI stocks: What companies will benefit first?

Semiconductor stocks have been among the best performers in 2023. Earnings at companies like NVIDIA, AMD and Micron have all been under pressure over the last year as the explosion in demand we saw when tech came into its element during the pandemic unwound and markets were left with a glut of chips, which in turn hurt prices and profitability. However, markets have been banking on conditions improving and anticipating a recovery in the second half of 2023 – and markets believe this will be accelerated by AI.

Chipmakers will be among the first to reap significant financial rewards from AI, alongside other hardware providers, as companies need the most advanced and pricey equipment to meet the power needs of the energy-hungry technology. The other group to consider is the huge infrastructure providers such as cloud computing companies that are essential to providing both the servers and technology to allow AI applications to be unleashed on businesses and consumers. Those equipped with large volumes of quality data are best positioned to train new AI models.

It will not necessarily just be tech-savvy businesses that create new breakthrough tech using AI that will reap rewards. Many will benefit by using it to improve efficiency, cut costs and speed-up processes. Those that can automate the quickest can gain a significant competitive edge over their competitors, especially in an inflationary environment.

NVIDIA stock: Wall Street’s favourite AI play

NVIDIA has earned a significant lead in the race to become the chip company of choice for those building the systems needed to drive AI, having signalled that AI chips will add billions of dollars to sales this year. That has propelled NVIDIA to the top of the gainers in both the Nasdaq 100 and the S&P 500 this year by a wide margin, and allowed it to become the first chipmaker to join the $1 trillion valuation club – almost triple the size of the next largest US chipmaker.

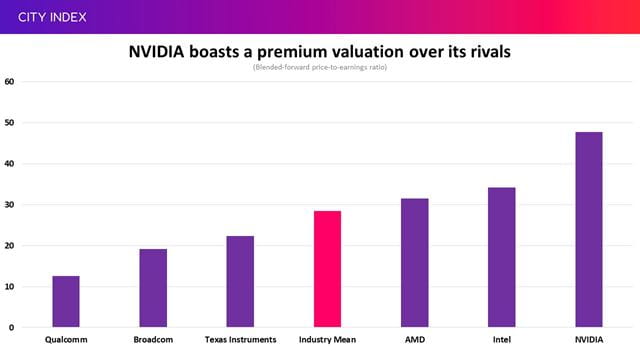

However, that has resulted in NVIDIA demanding a valuation multiple some 67% above that of its rivals and, although it is likely to retain its premium thanks to its market-leading position, this could narrow when/if other chipmakers catch up over time.

The surge does raise the question of how many years of AI-induced growth have already been priced-in? Its valuation has jumped by over $650 billion in just six months and NVIDIA’s price-to-earnings ratio shows it would have to pay out all its forecasted annual earnings over the next 12 months for the next 48 years for you to get your money back if you paid today’s price. Sometimes the cost of admission is too high regardless of the ride on offer. That multiple is likely to improve as AI accelerates growth over the longer-term but is still vulnerable to a pullback, which could represent an opportunity for longer-term investors. Still, there is better value to be found elsewhere right now. NVIDIA has an advantageous lead, but the market and opportunity appears far too large for it to dominate it alone over the longer-term.

(Source: Bloomberg as of 28/06/2023)

What stocks will lose out to AI?

AI has gripped the imagination of the markets and how it can revolutionise virtually every industry, but that isn’t good news for every company. We have seen the investment case for some equities tested because of the threat posed by AI.

For example, online education firm Chegg has more than halved in value since warning in May that more students were using ChatGPT and closing their accounts, which has since prompted the firm to cut jobs and vow to ‘fully embrace and utilise’ AI as it tries to reposition itself as a potential winner rather than a loser.

Alphabet stock: Yet to shine as an AI play

Alphabet is another prime example that is suffering a similar problem. The once untouchable monopoly Google has over internet search is being threatened by the array of AI chatbots that are coming onto the market. Alphabet has its own chatbot named Bard, but markets have not been impressed because Alphabet was slow and reluctant to show off its technology, only to be proven rightly cautious after investors were left disappointed because of one mistake during the promo for Bard earlier this year.

Much of the attention has instead gone to Microsoft-backed rival ChatGPT, which is the fastest-growing app ever invented after securing over 100 million users in its first two months! The tech that underpins ChatGPT is now being wielded as a weapon by Microsoft after CEO Satya Nadella declared war on Google. Microsoft’s strategy is to revive its Bing search engine and infuse AI tools in the hopes of offering a superior product while also undercutting Google by accepting lower margins, believing Google has to protect profitability of its core business.

Alphabet’s valuation multiple has remained below its five-year average for the entirety of 2023. Although up 34% in the first half, it has been the only member of Big Tech to underperform the wider market in the first half and it continues to trade at a discount to both the S&P 500 and the Nasdaq 100, making it the cheapest member as we enter the second half. Brokers are more pessimistic on Alphabet versus other Big Tech rivals and their rating on the stock is at its weakest level in over a year. Risks posed from AI are very real, but Alphabet has been among those working on AI for the longest. Now it needs to show it can be a leader in the space and convince markets that AI is a huge opportunity rather than a threat which, if it can achieve, could lead to a correction.

Adobe stock: A speedy AI turnaround

One company that has already managed to swiftly convince the markets that AI is a tailwind is software firm Adobe. The stock lost ground in the first five months of 2023 as AI ripped through Wall Street and investors became worried that the tech could threaten its business model. ‘Is AI the Adobe killer?’ was one headline published in April.

Now, having leant in and launched its own platforms that can use AI to generate text and images for its business customers, Adobe has entered the top fifth of performers in the Nasdaq 100 and risen over 45% year-to-date. All of those gains have been made in just six weeks. It has allayed fears that AI could undermine its software and convinced markets it will only improve it. The case also shows how quickly sentiment can turn in what is proving to be a fast-moving market.

Will we see more AI regulation?

Governments and leaders of AI companies have called for the technology to be regulated given the huge impact and implications it could have on society - from undermining school exams and providing inaccurate information to copyright infringement and the displacement of jobs.

The main problem governments have is that they want to regulate so they can control the technology’s development, but run the risk of falling behind other countries if they adopt a stricter stance.

The potential rewards on offer, twinned with the sheer complexity of AI, suggests initial regulation will look to mould and support development rather than stifle it, but regulation remains a risk in both the short-to-long term.

Conclusion

AI has become the hottest word on Wall Street in 2023 and will remain a mega trend that won’t be going away anytime soon. One of the reasons there has been little pushback against the prospects of AI is because it has real-life applications that can be implemented today, unlike many other creations that have temporarily excited the markets such as the metaverse or Non-Fungible Tokens (NFTs). Essentially, it has staying power.

The mania has provided a much-needed boost to the tech market as inflation, rising interest rates and recessionary risks provide a challenging economic backdrop. But there are questions about whether it will progress quickly enough to fully counter the impact of the lagging effects of monetary policy as we move into the second half.

Valuations across the tech space are much higher today compared to the start of the year to suggest the second half of 2023 will be tougher for the wider equities space. Still, valuations at the index level, while far from subdued, are not at extreme levels and suggest there is room for the AI rally to continue in the second half of 2023, although some individual stocks have gone too high, too quickly.

Therefore, some of the first stocks to see their valuations explode this year will be under severe pressure to show they are gaining significant momentum and earnings from AI if they want to keep their multiples. New AI-inspired inventions will provide catalysts for companies that have so far remained under the AI radar while highlighting new threats to others, so buckle up for a rollercoaster ride that will have many twists and turns.

How to trade AI stocks

You can trade AI stocks and indices with City Index using the four easy steps below. City Index also offers two AI-focused ETFs. The first is the LG Artificial Intelligence ETF and the second Global X Robotics Artificial Intelligence ETF, which has a more concentrated group of companies but is more diversified in terms of industries and larger than the other ETF.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock or instrument you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.