Good news today for the Australian economy as the employment report for June stunned with across-the-board strength.

The economy added 88,400 jobs in June to a new peak of 13.6million, well above expectations for a 30,000 increase. Today's increase was the eighth consecutive rise since lockdown restrictions were eased in the final months of 2021.

The unemployment rate fell from 3.9% to 3.5%, the lowest since 1974, despite the participation rate rising to a new record of 66.8%. The underutilization rate remained at 9.6%, staying at its lowest since April 1982. The only blemish, the underemployment rate went up to 6.1% from May's near 19-year low of 5.7%.

While it's easy to get caught up in today's data, red lights are flashing. The RBA forecast that the unemployment rate would not reach 3.5% until June next year.

The earlier arrival of the unemployment rate at 3.5% suggests that the labour market is hotter than expected. And with the unemployment rate set to edge lower in the second half of this year, the RBA will be keen to curtail its impact on wages inflation and inflation expectations.

As a result, the RBA will likely raise rates by 50bp at its meeting in August (with a real risk of a 75bp rate hike) and by 50bp September, which would take the cash rate to 2.35%, near to the nominal neutral rate thought to be around 2.5%. From there, another 25bp of tightening in October, November and December is expected which would take the cash rate to 3.1% by year-end.

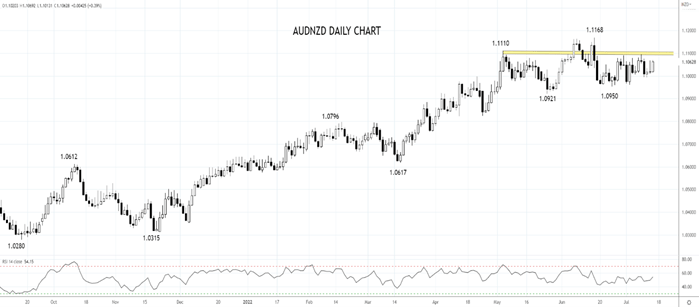

To take advantage of the above-mentioned factors and to take the surging U.S dollar out of the equation and global recession fears, we like buying dips in the AUD/NZD to 1.1040/20, leaning against a band of support 1.0950/20.

A break of near term resistance at 1.1100/10 would open up a retest of the June 1.1168 high with scope to 1.1300.

Source Tradingview. The figures stated are as of July 14th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade