- EUR/USD analysis: German economy stagnates, investor sentiment plunges

- S&P 500 analysis: Will the trend line break?

- USD/CNH outlook: China’s yuan lead EM sell-off

Welcome to Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike.

In this edition of Technical Tuesday, we will analyse the EUR/USD, USD/CNH and, first, the S&P 500…

S&P 500 analysis: Will the trend line break?

The major US indices were off their lows after testing fresh 4-week lows shortly after the cash market opened earlier, failing to hold their tech-fuelled rally from the day before and joining a global stock market rout. Sentiment has been hurt by weak Chinese data, rising bond yields and valuation concerns, while the lack of fresh bullish catalysts is also discouraging the bulls to buy this latest dip. China’s central bank has cut interest rates but so far this has not helped to offer too much support. Will things change later, or will the selling gather pace?

Well, looking at the S&P 500 chart, it is starting to look a bit heavy, and it may break below 4450 key support today. A decisive move below this level would trigger a bunch of stops that would undoubtedly be resting below this level and may trigger a sharp move to the downside.

What happens next from a technical point of view will depend, to some degree, on how the markets will close today’s session. A weak close will probably encourage the stock market bears even more and that could lead to more selling pressure. Conversely, if we see a sharp, late-day, recovery then this will boost the S&P’s appeal in the short-term outlook.

All told, the risks appear to be skewed to the downside from here. However, the bears must be careful not to chase the markets lower too aggressively given the extent of the declines we have already seen on the session, and the fact that longer-term trend is bullish.

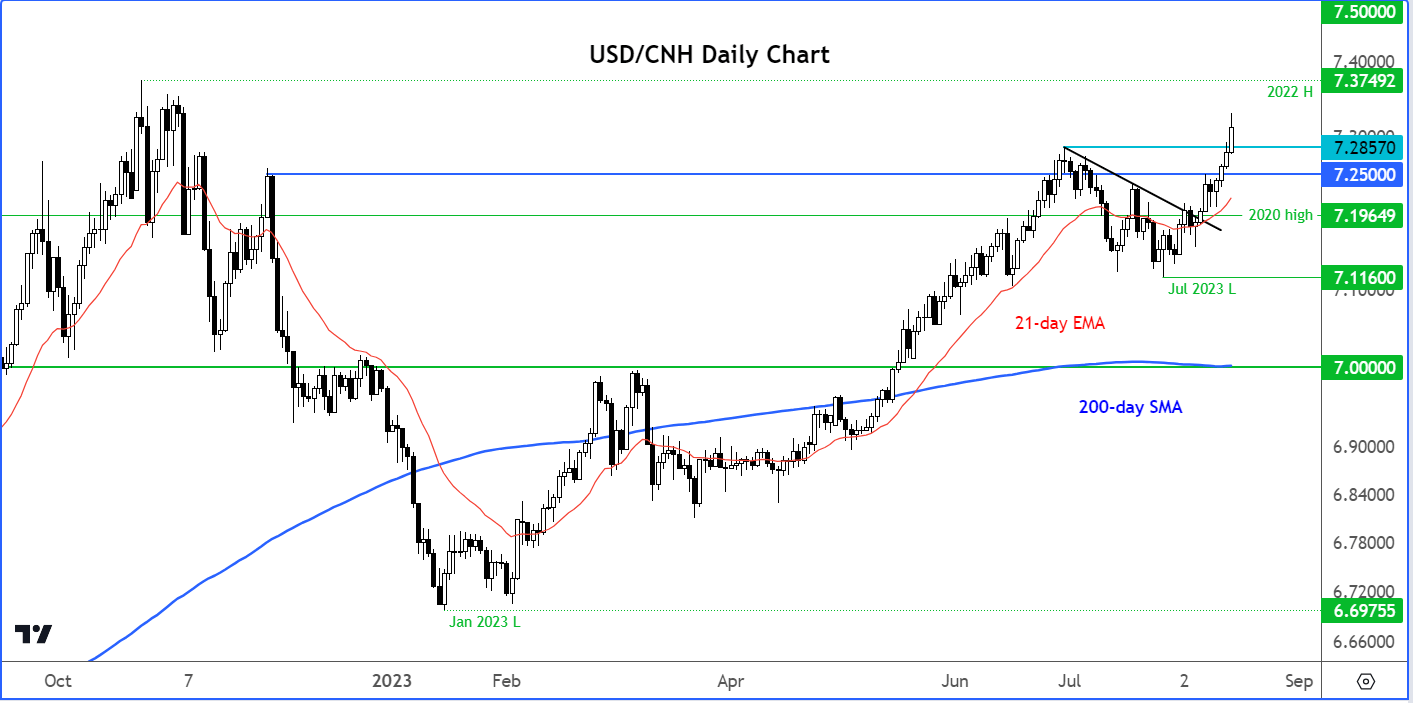

USD/CNH outlook: China’s yuan lead EM sell-off

The loss of risk appetite is also evident in falling emerging market currencies, led by China’s yuan with the USD/CNH (0.5%) reaching its highest level since November 2022 today. The US dollar continues to find support amid haven flows – albeit the likes of the EUR/USD and GBP/USD were trading slightly higher at the time of writing, with the latter being boosting by surprisingly strong UK wages data.

Still, the fact that copper and crude oil prices have weakened also reinforces the view that China is struggling, where private sector demand remains rather weak, even if air travel has picked up slightly.

So, it was hardly a surprise that the PBOC cut two key wholesale interest rates overnight, following the release of softer-than-expected inflation and credit data last week. And that decision was justified as retail sales, industrial production and fixed asset investment, all undershot expectations by some margin today.

It is not just the yuan. We have seen several other EM currencies weaken, helping to keep the dollar bid, with the greenback supported further by US bond yields remaining high. Market continues to see US dollar as a worthy safe haven asset, especially as it continues to be supported by data – retail sales came in strong today.

With the PBOC cutting rates in China and market sentiment being sour, we could see the USD/CNH break out to fresh highs on the year and take out last year’s high at 7.3750. Key support comes in at 7.2500, while the June high at 7.2857 is also a key level to watch now. For as long as these levels hold, the path of least resistance would remain to the upside.

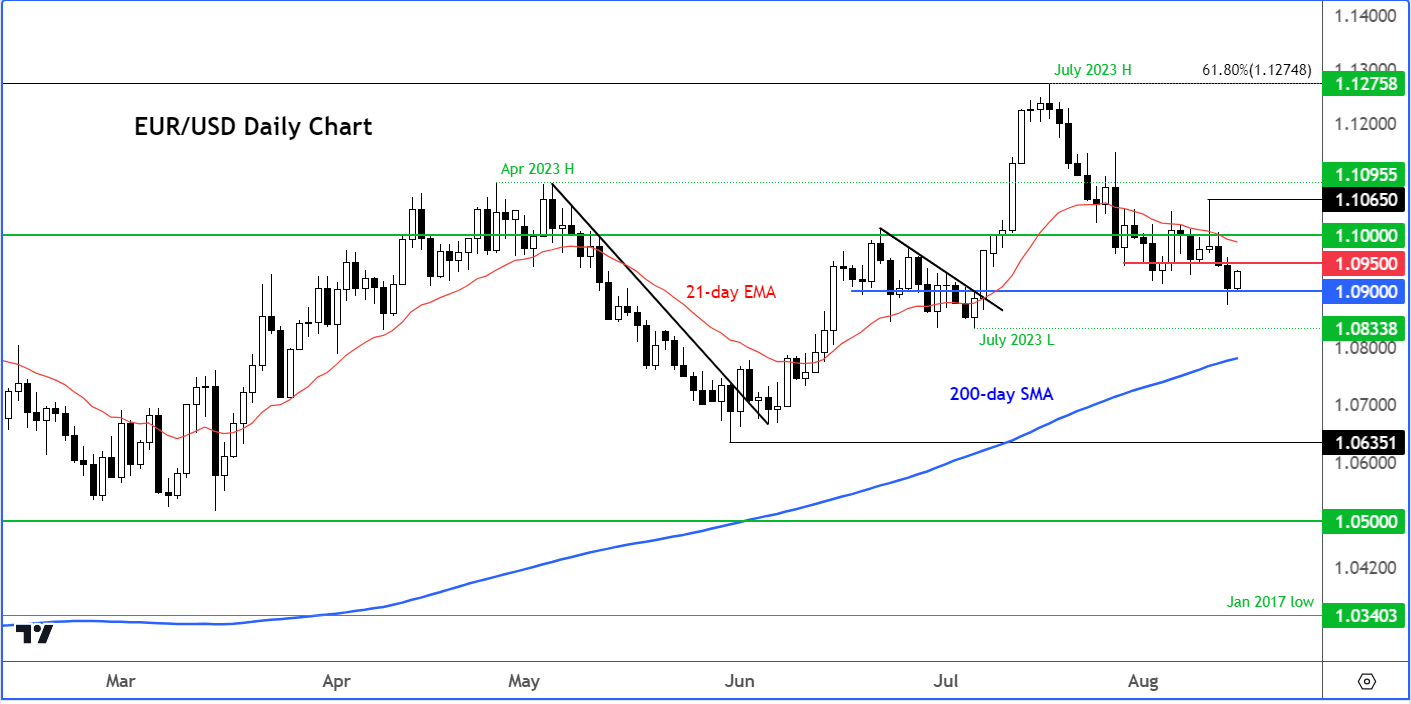

EUR/USD analysis: German economy stagnates, investor sentiment plunges

The EUR/USD was higher testing key resistance around 1.0950, previously support. Given the recent bearish bias on this pair, and a weak macro picture, I wouldn’t be surprised if the sellers step in here and cause the pair to trend lower again.

Support at 1.0900 as held firm so far, but if this level gives way on a closing basis then the July low at 1.0833 could be the next target for the bears, with the 200-day average being the subsequent target around 1.0785.

Domestically, the German economy is struggling. The nation’s economic ministry on Monday said: “…the expected cautious revival of private consumption, services and investment development are showing the first rays of hope, which are likely to strengthen over the course of the year. At the same time, the still weak external demand, the ongoing geopolitical uncertainties, the persistently high rates of price increases and the increasingly noticeable effects of monetary tightening are dampening a stronger economic recovery.”

Indeed, a leading survey of about 300 German institutional investors and analysts revealed that current conditions have deteriorated further, even if they are less pessimistic about the future. The German August ZEW survey current conditions printed -71.3, its lowest level since October. A reading of -63.0 was expected compared to the last print of -59.5. A reading below zero indicates pessimism. So, the fact that we saw a negative seventy-one reading goes to show how pessimistic investors are, which bodes ill for the German DAX index. That said, there was some improvement in the Expectations index to -12.3 vs -14.7 expected and -14.7 last. However, it too continues to remain in negative territory.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade