Rolls-Royce under pressure

Rolls-Royce, the engineering group, announced that 1H underlying net loss widened to 3.33 billion pounds from 28 million pounds in the prior-year period and underlying operating loss amounted to 1.67 billion pounds, citing 1.2 billion pounds one-off charges in Civil Aerospace related to COVID-19 and compared with an underlying operating profit of 203 million pounds a year ago. Also, revenue dropped 24.4% on year to 5.56 billion pounds. The company added: "While our actions have helped to secure the Group's immediate future, we recognise the material uncertainties resulting from COVID-19 and the need to rebuild our balance sheet for the longer term. We have identified a number of potential disposals that are expected to generate proceeds of more than £2bn, including ITP Aero and a number of other assets."

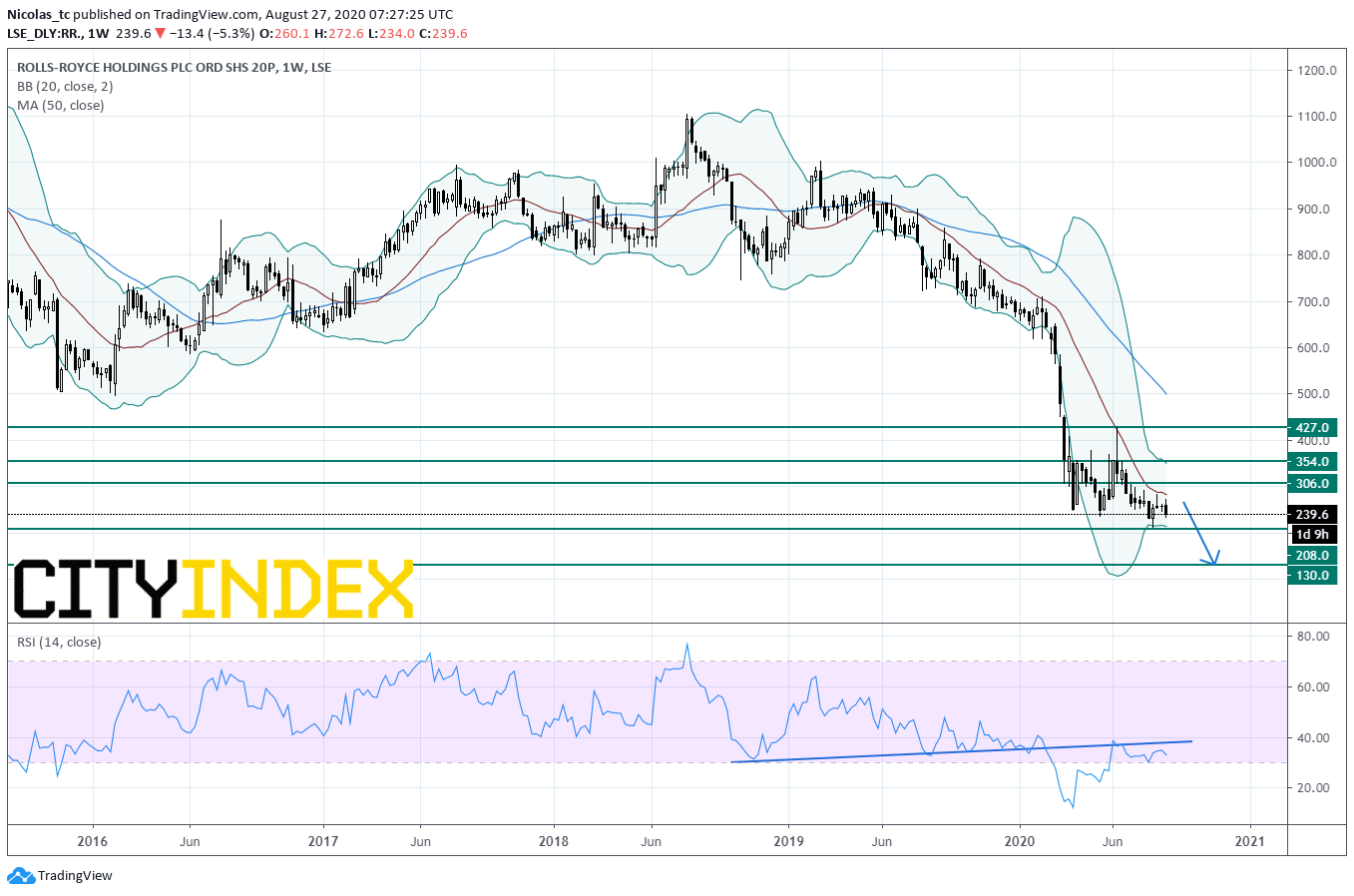

From a technical point of view, the stock price remains in a downtrend, capped by the declining 20WMA since May 2019. The weekly Relative Strength Index (RSI, 14) remains below a former rising trend line and below 50%. As long as 306p is resistance, the risk of a break below Aug 3rd low at 212.1p will remain high. This would open a path to see 130p. Alternatively, a push above 306p (breakout confirmation of the 20WMA) would call for a recovery towards 354p and 427p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM