- Keep future annual inflation between 1 and 3 percent over the medium term, with a focus on keeping future inflation near the 2 percent mid-point

- Support maximum sustainable employment, considering a broad range of labour market indicators and taking into account that maximum sustainable employment is largely determined by nonmonetary factors

As mentioned in our preview yesterday, inflation is running at its highest level in a decade, and forward-looking indicators warn of further gains. Higher inflation was touched on several times in the statement, including the extract below.

“While the sources of higher inflation were largely as expected, the size of price movements were greater than anticipated.

The RBNZ expects inflation to peak at 5.7% in 4Q 2021 before falling back towards the 2% midpoint over two years. Earlier this month, the unemployment rate dipped to a record-equalling 3.4%, noted by the RBNZ as lower than sustainable.

“We assess employment as being above its maximum sustainable level, with many of our labour market indicators near or at record levels”

Easing the need to raise by 50bp, the RBNZ noted that higher wholesale rates had resulted in tightening financial conditions and that higher wholesale rates are being passed on to both business and mortgage holders.

“The 1-year mortgage rate has increased to around 130 basis points above its low this year. For longer-term fixed mortgages, increases have been larger. For example, the 5-year mortgage rate has risen 185 basis points from its lowest point this year.”

In the way of forward guidance, the RBNZ projects the cash rate to reach 2.00% by the end of 2022 and raised the OCR track to 2.6%, a little less than the 3.00% expected.

All in all, a more dovish RBNZ than the market was braced for, and worth noting a lot can happen between now and the RBNZ’s next meeting on February 24th.

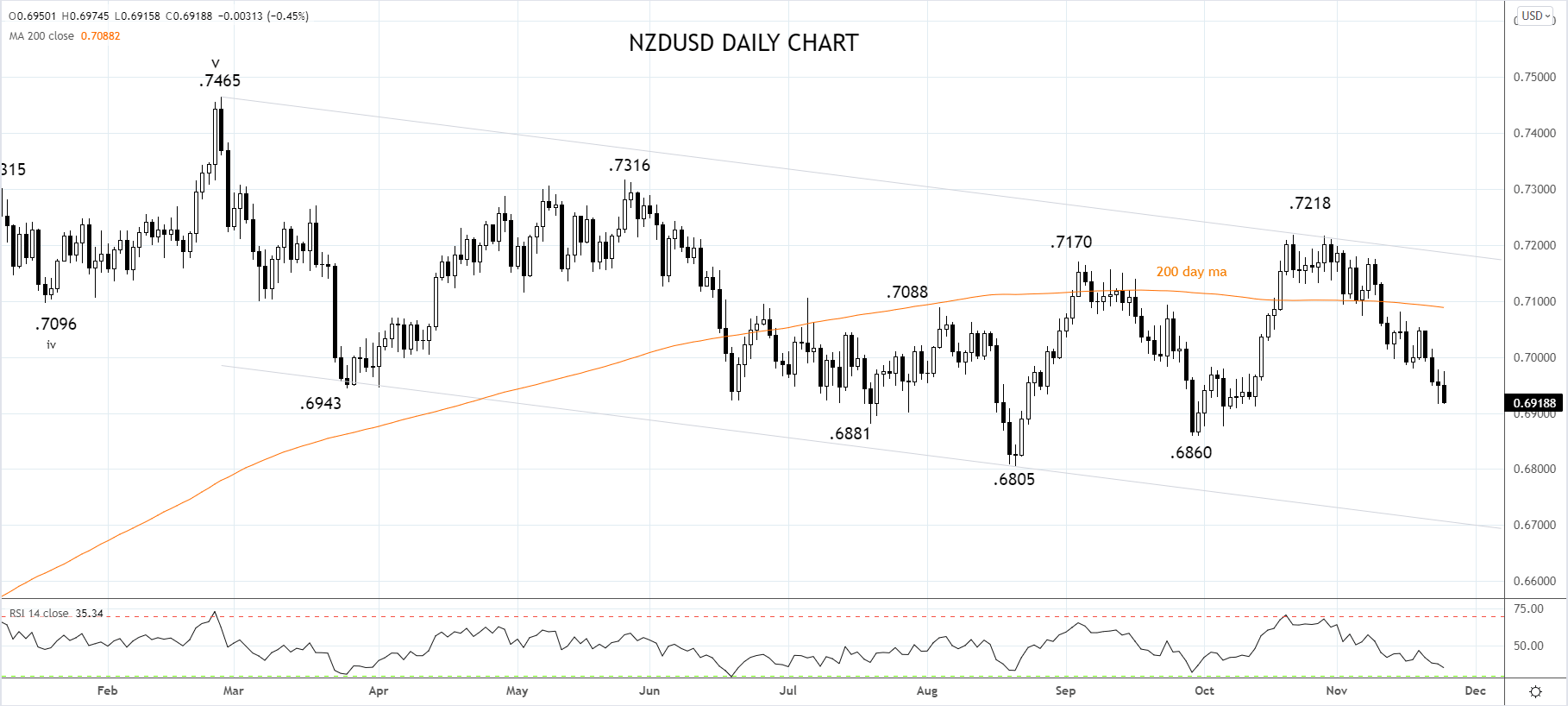

After heading into the meeting near .6950, the NZDUSD dropped to a low of .6915 before settling back near .6930. Bounces should be well contained towards resistance .6980/00 as traders look for a retest of the September .6860 low with scope to the August .6805 low.

Source Tradingview. The figures stated areas of November 24th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade