Following an impressive gain of 366k jobs in November that captured the full impact of eased restrictions along the Eastern seaboard, December is likely to show a “modest” gain of around 60k jobs.

The unemployment rate is expected to decline to 4.5% from 4.6%, despite a slight increase in the participation rate to 66.2%.

Notably, the survey reference period was November 28th to December 11th, pre the surge in Omicron cases in late December. As such, the impact of Omicron will not be seen until the January and February jobs data and result in a renewed, albeit temporary, hit to employment.

While tomorrow's data will provide further evidence of a recovery in the labour market, larger macro forces are driving equity markets.

Namely a repricing of U.S equity and bond markets, in response to surging inflation and the Federal Reserve’s more urgent shift towards policy normalisation.

Not to mention a disappointing start to the Q4 2021 U.S earnings season as Goldman Sachs, Citibank, and JP Morgan reports underwhelmed relative to expectations. In the current climate of rising interest rates, the pressure on tech stocks to convincingly beat expectations is building.

What does it all mean for the ASX200?

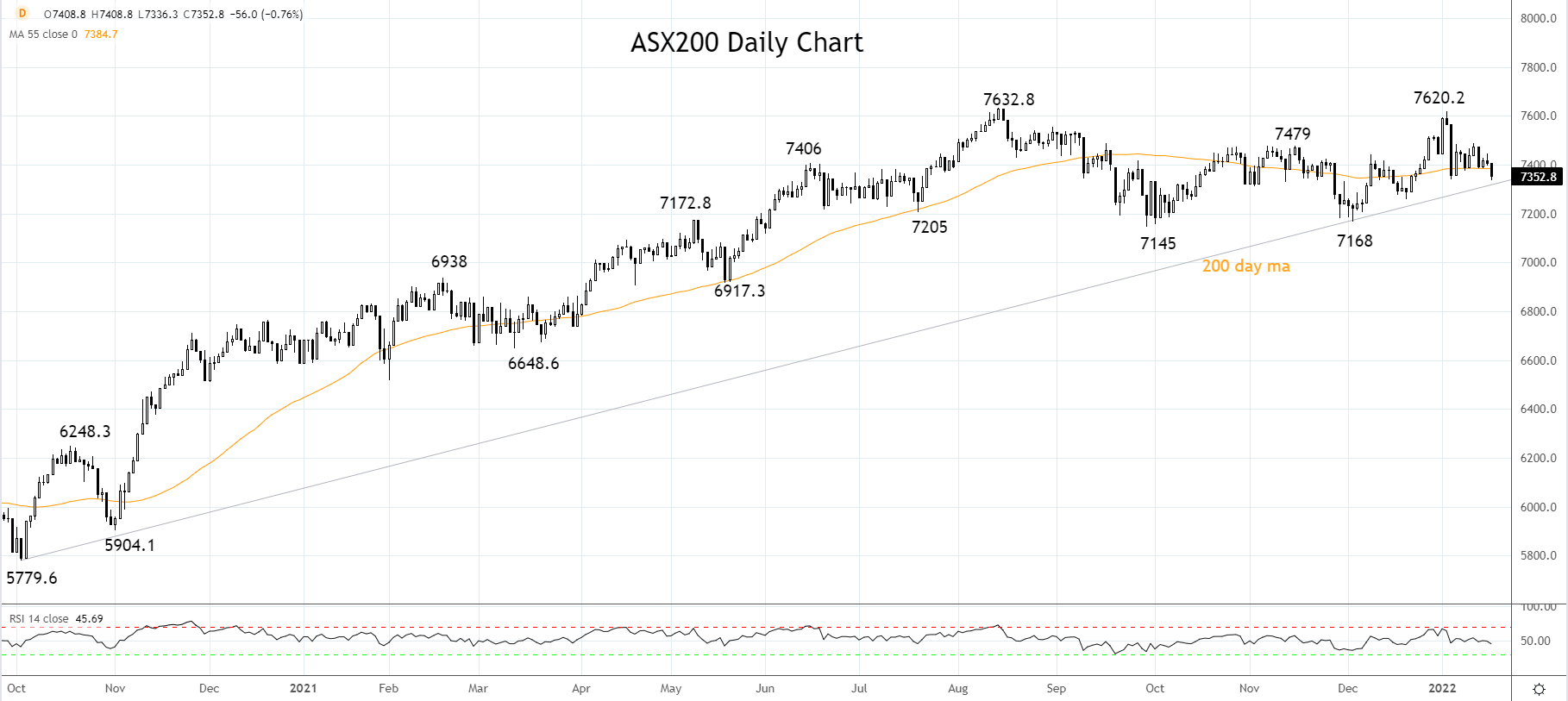

The ASX200 spent the final months of 2021 and the first few weeks of 2022 revolving either side of the 55 day moving average near 7400.

This morning the ASX200 has fallen sharply from 7400 to be eyeing critical support provided by the 200 day moving average and the uptrend drawn from the October 5780 low at 7310/00.

A sustained break below 7310/00 would warn a deeper pullback is underway initially towards 7150 before 7000.Conversely, should support at 7310/00 hold allow for further sideways price action around 7400.

Source Tradingview. The figures stated areas of January 19th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade