Selloff overdone

After tanking over 13% on Friday oil is rebounding on Monday, trading almost 5% higher at the time of writing. Friday’s Omicron inspired selloff looks rather overdone, particularly given that not much is known about the new covid strain.

Omicron risk

Over the weekend the World Health Organization said that it would take time to understand the severity of the newly discovered, highly mutated covid strain. However, anecdotal evidence from South Africa suggest that it could be more contagious but less severe, which is helping to lift risk sentiment in the market. That said it is still very early days and governments across the globe are tightening travel restrictions as a pre-caution.

Strategic reserves release

The latest injection of volatility into the oil markets comes after the announcement of a US led a coordinated release of strategic oil reserves earlier this month. The release of such reserves could be unnecessary should the Omicron variant result in more mobility restrictions. A combination of more supply entering the market combined with a clouding demand outlook could see oil prices struggling to gain from here.

OPEC+ meeting

OPEC+ are due to meet this week on Wednesday and Thursday to decide whether to enact the planned 400,000 barrel per day increase in the face of the planned release of strategic reserves and rising covid risks. The technical meeting has been postponed in order to have more time to assess Omicron’s impact on demand.

The group is expected to adopt a cautious stance with demand likely to weaken over the coming winter months. OPEC have already warned of a potential supply glut next year, even before the Omicron discovery. Hopes that OPEC+ could pause the planned increase in production is helping to boost the price.

Learn more about trading oilWhere next for WTI oil prices?

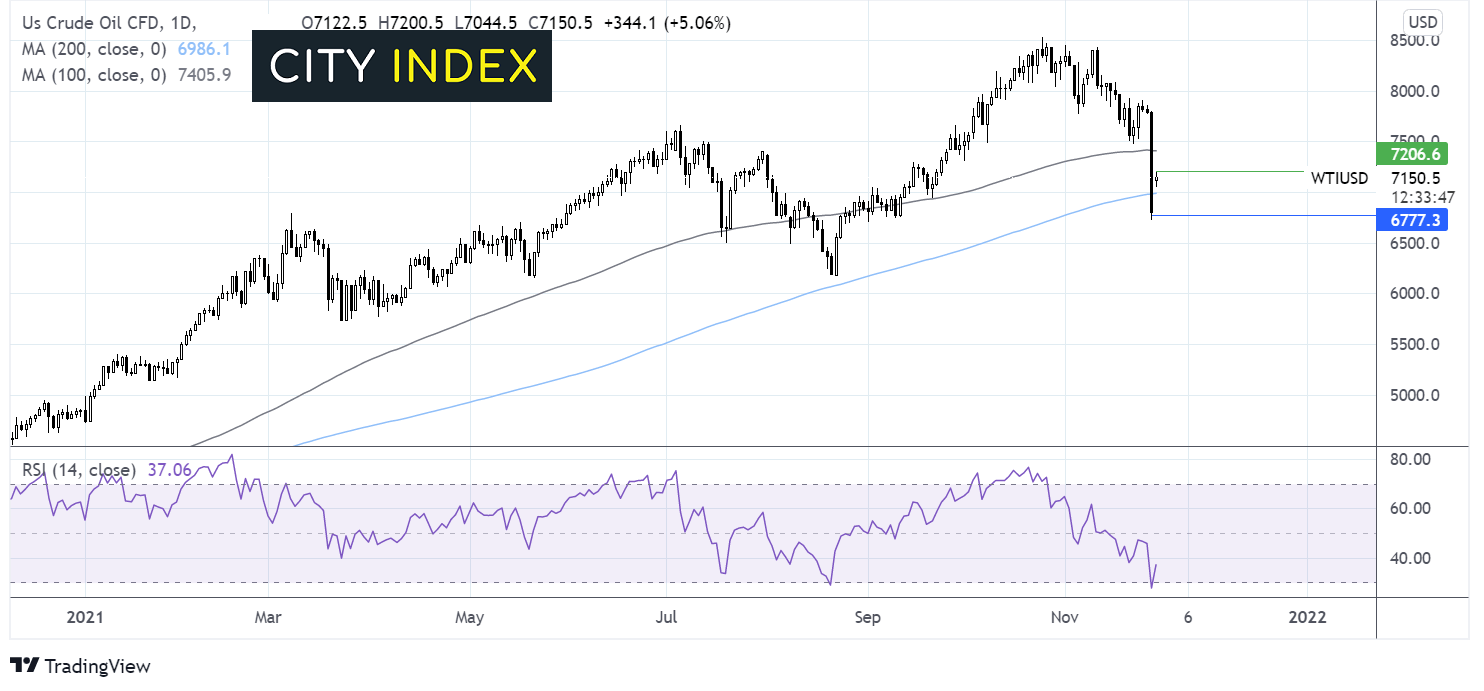

WTI oil is attempting a solid rebound from Friday’s low of $67.31, retaking its 200 sma at $69.75. A daily close above here would support the bulls case. However, the RSI remains firmly in bearish territory supporting the case of further downside.

Any meaningful recovery needs to retake the 72.00 today’s high in order to expose the 100 sma at 74.00.

Meanwhile sellers will be looking for a move below 70.00 round number to test the 200 sma again at 69.70.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.