Key takeaways

- Tesla delivered far fewer cars than expected in the third quarter

- Production shortfall blamed on factory downtime, but elevated inventory levels suggests demand is more muted

- That is raising fears that more price cuts will be needed, leading to lower margins

- Profitability is already under pressure, leading Wall Street to lower earnings estimates in the near-term and for 2024

- Cybertruck, work on new batteries, Dojo, Full-Self-Driving and Robotaxis all popular topics among investors ahead of update

- Tesla shares have been trading in a wedge that is narrowing, and the results could provide the catalyst needed for a breakout

Tesla Q3 earnings date and time

Tesla is scheduled to release third quarter earnings after US markets close on Wednesday October 18. A live Q&A session will be held with management on the same day at 1630 CT (1730 ET).

Tesla earnings consensus

Revenue is forecast to climb 13.6% year-on-year to $24.37 billion, based on a Bloomberg-compiled consensus. Adjusted EPS at the bottom-line is forecast to fall 29% to $0.74.

Tesla earnings preview

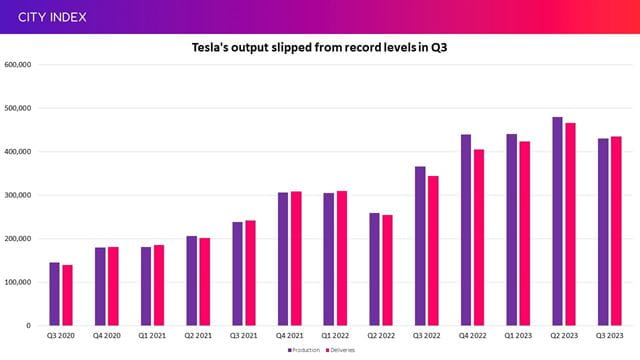

We already know that Tesla delivered far fewer cars in the third quarter than expected. It sold 435,059 electric vehicles in the period, over 20,000 below the Wall Street forecast! That was blamed on factory downtime, including the adjustments that have been necessary to introduce the newly-revamped Model 3 and the upcoming Cybertruck.

(Source: Company reports)

However, there are signs that demand is weakening. Tesla sold more cars than it produced for the first time in 18 months during the quarter, but only just. That means inventory levels remain elevated, which may raise questions about why Tesla didn’t make more sales even if production was disrupted.

With that in mind, Wall Street analysts have understandably become more cautious ahead of the financial results, not only because of the big delivery miss but also over fears that more price cuts will be needed to keep demand growing. That has seen Wall Street lower its earnings estimates in both the near-term and for 2024.

The series of price cuts Tesla has been taking is already hitting profitability. Its operating margin is seen coming in at just 9.5% this quarter compared to over 17% the year before, which is forecast to see operating income plunge 37% to $2.31 billion.

Tesla is aiming to deliver at least 1.8 million vehicles this year. Wall Street remains confident it can achieve that despite the big miss in the most recent quarter, but that leaves little room for error in the final quarter, when analysts believe it can sell over 492,000 vehicles. Regardless, Tesla is set to fail to grow deliveries by an annual rate of 50% for yet another year. It last achieved that goal in 2021, and analysts are becoming less and less convinced that it will ever hit that level of annual growth again.

The update on the long-awaited Cybertruck, which is expected to enter full production before the end of 2023, will also be key as investors hope they will finally see the pickup truck hit the market following years of delays. The most upvoted question submitted for the Q&A session by a country mile is about how many Cybertrucks will be delivered in 2024.

Other popular questions to be posed by investors focus on the outlook for deliveries in 2024, progress with its new batteries and how they can improve performance and lower costs, the ramp-up in capacity at its newest factories and plans to open new sites, and around Full Self-Driving and its Robotaxi.

Where next for TSLA stock?

Tesla shares have been pinging between a wedge formed by two dominant trendlines. This wedge is narrowing and the chance of a breakout is therefore rising, and the results have the potential to provide the necessary catalyst.

The falling trendline has been in play since Tesla shares peaked at their all-time high just under two years ago. To break above it, the stock would need to close above around $277 this week.

The rising trendline has been providing support for six months, although the 100-day moving average that is tracking above it, currently at $250.80, has been a reliable source of support in recent weeks. The fact the 50-day moving average has also converged here bodes well.

Wall Street is currently sceptical about how much upside there is over the next 12 months. The 45 brokers that cover the stock currently have an average Hold rating on Tesla and a target price of $237, about 4% below current levels.

Nasdaq 100 analysis: Where next?

Tesla carries a 3.2% weighting in the Nasdaq 100, making it the index to watch ahead of the update. It also has the potential to influence other smaller electric vehicle stocks, such as Rivian and Lucid.

The Nasdaq 100 is also trading within a wedge that is narrowing. The index slipped below 15,000 and below both the 50-day and 100-day moving averages on Friday. Only the 20-day moving average at 14,890 stands in the way of it testing the supportive trendline again. A break below here would bring the support zone between 14,560 and 14,440.

A return above 15,000 is the immediate job and then it can try to close at a new higher-high above 15,265. That would then being the falling trendline into play at around 15,300.

How to trade Tesla stock

You can trade Tesla shares and indices with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock or instrument you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.