- Hong Kong’s Hang Seng is trading down nearly 3% today

- The index has broken another layer of technical support, leaving the pandemic lows in play

- China’s population declined by 2 million last year while new home prices slumped by the most in nearly a decade last month

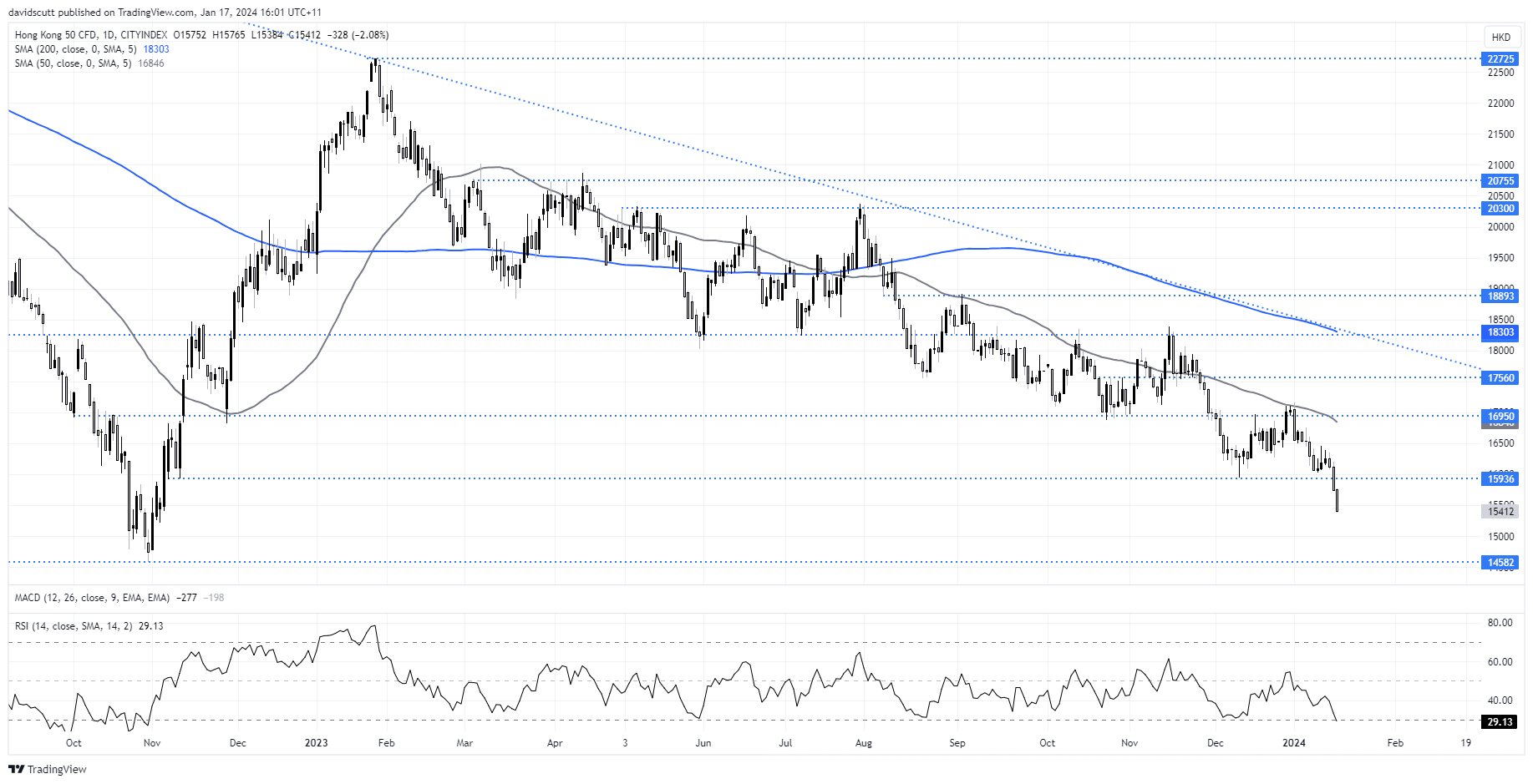

Hong Kong’s Hang Seng is arguably the ugliest index chart in the world right now, tumbling again on Wednesday, moving it closer the pandemic lows hit in October 2022. A technical break, combined with news China’s population fell by two million people last year while home price slumped at the fastest pace in nearly a decade, taking its toll on financial and property developer stocks.

While markets were initially fixated on the nation’s GDP growth, industrial output and retail sales figures released on Wednesday, it was headlines showing China’s population decline accelerated further in 2023 that really did the damage, coming hot on the heels of a sperate report showing new home prices skidded 0.4% last month, the fastest drop since early 2015.

The worrying headlines, adding to already ample concerns about the health of China’s property sector, arrived the day after the Hang Seng broke yet another layer of technical support, likely exacerbating the scale of the decline.

You can see why I describe it as one of the ugliest charts going around right now. The index has now halved from the highs hit in early 2021, reflecting policy, geopolitical, earnings and credit risks.

It would have been optimal to have shorted the index following the technical break on Tuesday, but with the index now oversold on RSI and stimulus chatter only likely to ramp up following the data dump, selling now is a high-risk setup. But if we were to see a squeeze back towards prior support at 15936, it will improve the risk-reward ratio for those considering shorts targeting a move to 14582, the pandemic lows of 2022. Below that, we’re talking GFC lows.

While some may be willing to take the punt and go long on hopes for a stimulus speculation squeeze, remember additional measures are likely already factored in. The index is also a clear sell-on-rallies prospect right now.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade