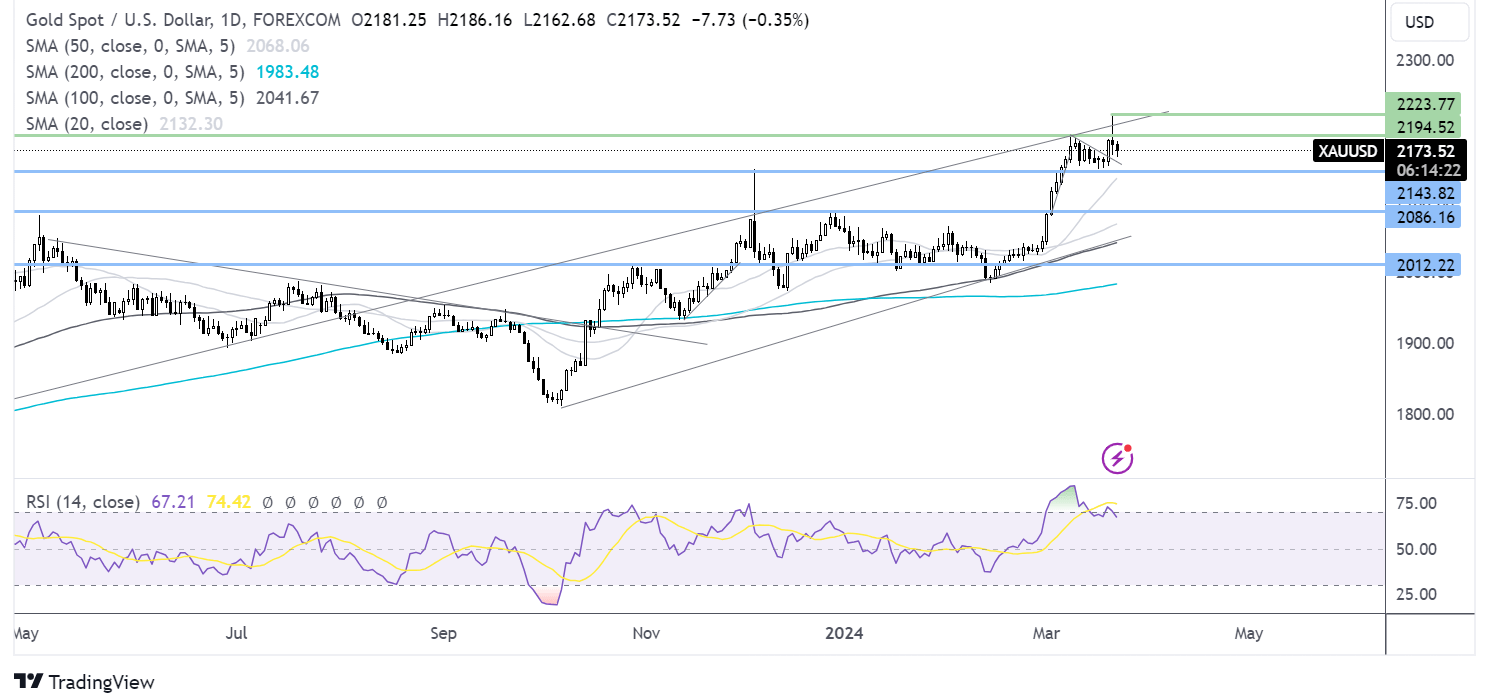

- Gold spiked to an all-time high post-Fed last week

- USD strength pulled Gold lower

- Gold looks to core PCE for the next move

What a week for Gold last week. With five major central banks delivering decisions, there was plenty for gold traders to digest. This week could be less volatile.

Weekly round-up

Gold rose to a fresh all-time high following a slightly less hawkish-than-expected Federal Reserve meeting. The central bank maintained its guidance for three rate cuts this year, defying expectations of a downward revision to two rate cuts. Following the meeting, yields fell, pushing the US dollar lower and helping gold rise to 2222 per oz.

However, the spike higher was short-lived after the Swiss National Bank surprised the market by cutting interest rates by 25 basis points to 1.5%, down from 1.75%. This, in turn, drives the Swiss franc lower, making the US dollar the only high-yielding, low-risk currency currently, lifting demand for the USD. As a result of the stronger U.S. dollar, gold prices fell at the end of the week, leading weekly gains to just 0.5% and closing below the previous all-time high.

US inflation data

Looking ahead, next week is relatively quiet after last week's deluge of central bank decisions. However, this allows investors to mull over some of last week’s surprises.

Gold’s focus at the end of the week will be on U.S. data, particularly core PCE, the Federal Reserve's preferred inflation gauge, released on Friday. It's worth noting that Friday is a Good Friday public holiday in many countries, so trading volumes could be low.

Core PCE is expected to ease slightly in February to 0.3% MoM, down from 0.4%. Further signs of cooling inflation could support rate-cut expectations.

However, it's worth remembering that the USD is trading around monthly highs. So, immediate gains in gold could be limited until the USD starts to fall lower.

Central bank buying & safe haven flows

On a longer-term basis, gold prices remained supported by ongoing central bank purchases in countries like India and China as the latter shifted its reserves away from U.S. dollars.

Safe-haven flows have also supported Gold prices amid elevated geopolitical tensions between Russia and Ukraine, Israel, and Hamas. On Friday, a UN resolution calling for a Gaza ceasefire was not passed. Any sense of rising geopolitical tensions could further underpin Gold.

Gold forecast – technical analysis

Gold broke out of the falling triangle, surging to a record high of 2222. However, it spiked lower and closed the day below the previous all-time high of 2195. This is now the level that bulls need to beat to bring the all-time high back into focus.

On the downside, 2146 is the support that sellers will need to break down the previous all-time high. Below here there isn’t that much in the way of support to 2086, the December high.