GBP/USD holds at a 5-month low after jobs data

- UK unemployment rose to 4.2% from 4%

- UK average earnings eased to 6% from 6.1%

- Federal Reserve Chair Jerome Powell to speak

- GBP/USD steadies at a 5-month low below 1.25

The pound has steadied at a five-month low against a stronger U.S. dollar and after UK jobs data.

Data showed that the UK Unemployment ticked higher to 4.2%, up from an upwardly revised 4%, and rising to a six-month high on signs that the economy is cooling. The unemployment figures show tensive signs that inflationary pressures in the job market are easing.

However, the data also showed that wage growth was 6%, only slightly down from the 6.1% reading in the previous month. The data means that a May rate cut is pretty much off the table, but a June rate cut still looks possible.

Financial markets have tempered expectations of rate cuts over the coming two Bank of England meetings after strong US inflation data and warnings from the Bank of England hawks of similar risks to UK inflation.

The market is still pricing in around two 25-basis point rate cuts by the end of this year, with the first-rate cut fully priced in September and an 80% chance for an earlier reduction in August.

Meanwhile, the US dollar has risen to a 5-month high against its major peers on safe-haven flows amid ongoing Middle Eastern concerns and on expectation that the Fed will keep interest rates high for longer.

Data yesterday showed retail sales rose by more than expected to 0.7%, up from 0.6%. This highlights the resilience of the US consumer, which is supporting the US economy and continuing to add to inflationary pressures. The date comes after US CPI rose for a third straight month last week.

Attention will now turn to Federal Reserve chair Jerome Powell, who is scheduled to speak later today and could provide more clues about the path for US interest rates.

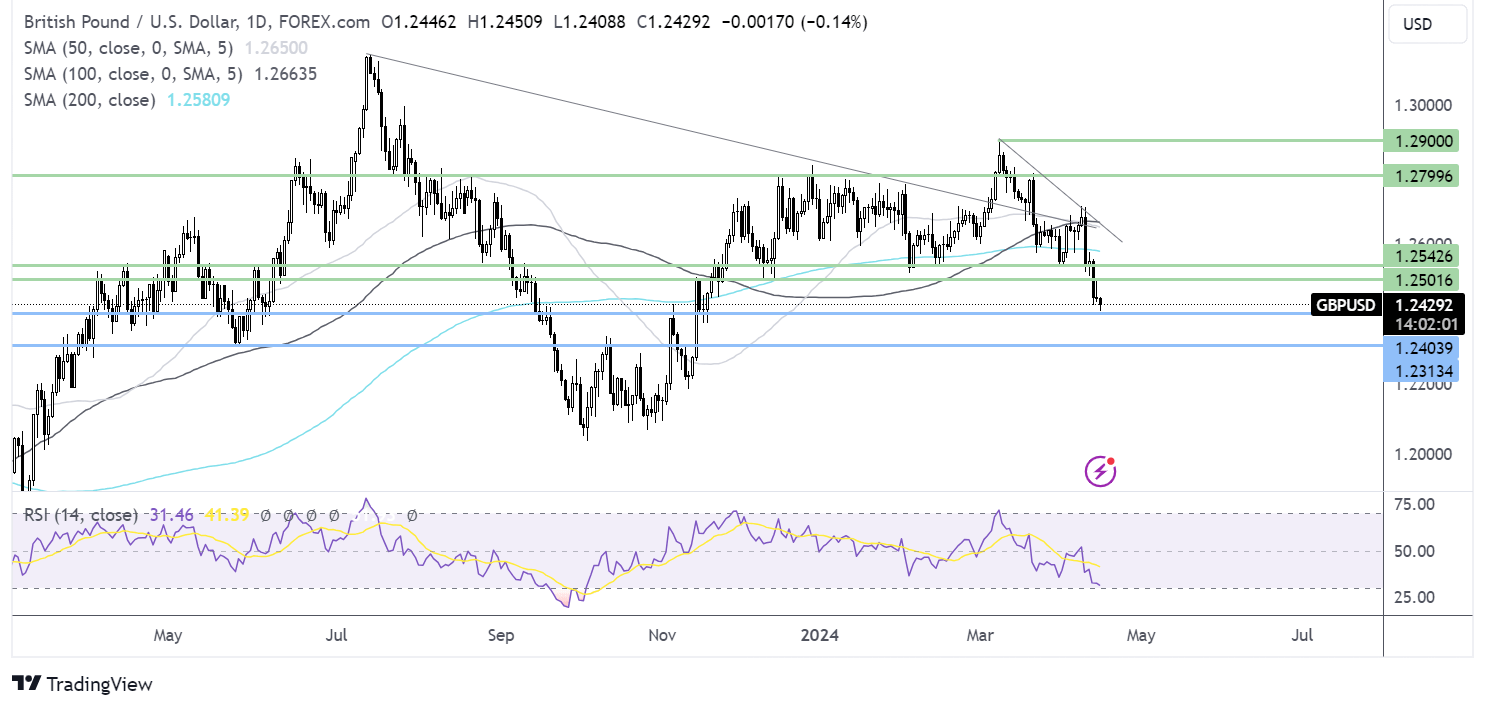

GBP/USD forecast – technical analysis

GBP/USD has fallen to a five-month low. The price broke below 1.25, which, combined with the RSI below 50, keeps sellers hopeful of further losses.

Sellers will look to extend losses below 1.24, the April low towards 1.23, the May 2023 low.

Meanwhile, buyers would need to retake 1.25, the December low, to attempt to rise to 1.2550 and the 200 SMA, 1.2580.

Oil rises after China's GDP growth & amid ongoing Middle Eastern tensions

- China's GDP rose to 5.3% in Q1

- Israel continues to weigh up its response to Iran’s weekend attack

- Oil trades in a holding pattern between 85.00 – 87.75

Oil prices are pushing higher following small losses yesterday after data showed the Chinese economy grew faster than expected amid heightened tensions in the Middle East.

The oil price rose after data showed that the Chinese GDP grew by 5.3% in Q1, well ahead of expectations. However, other Chinese indicators, such as real estate investment, industrial output, and retail sales, which were released alongside the GDP figures, raised concerns over domestic demand at the end of the quarter.

Oil prices trade near a five-month high and remain supported by ongoing geopolitical tensions in the Middle East. Oil prices slipped yesterday as Iran’s weekend attack on Israel was less damaging than feared. However, Israel's response will now determine whether the recent escalation of tensions ends here or ramps up further.

The conflict could be contained if Israel opts against a counterattack. Israel’s war cabinet meeting for a second time in under 24 hours to assess how to respond to the attack is keeping oil markets jittery. However, any further developments regarding retaliation could raise the risk premium on oil, particularly given Iran’s position as OPEC’s third-largest producer.

Oil prices will be watched closely by central banks worldwide as inflation proves to be persistently sticky, particularly in the US. Higher energy prices can quickly infiltrate across industries resulting in widespread price increases.

Looking ahead, attention will be now on API oil inventory data, which is due later today.

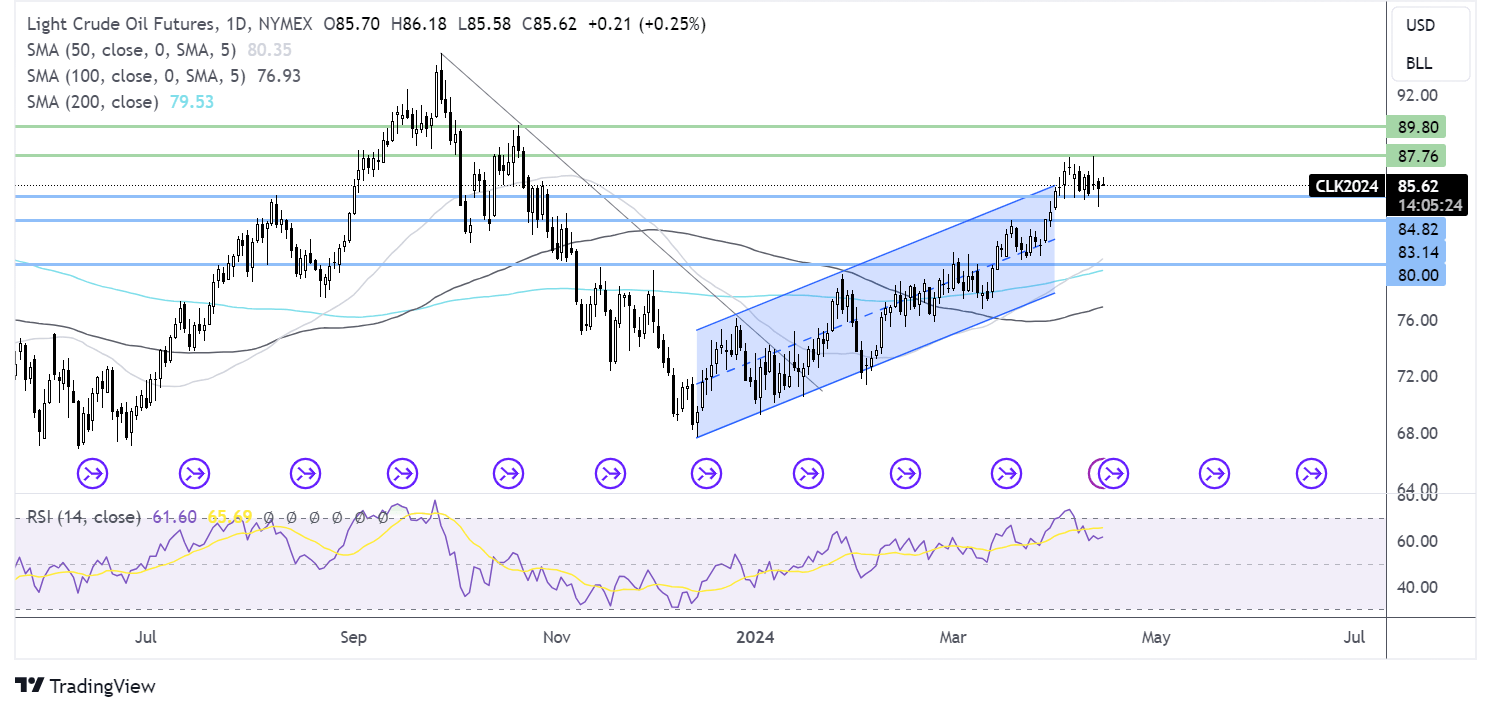

Oil forecast – technical analysis

Oil prices are trading in a holding pattern, capped on the upside at 87.75 and on the lower side by 85.00.

Buyers will be looking for a rise above the 87.75 level to extend the bullish run-up to 90.00, the round number.

Sellers will look to break below 85.00 to extend losses to 83.10, the August high. Below 80.00, the psychological level comes into play.