GBP/USD attempts to recover after CPI cooled less than expected

- UK CPI eased to 3.2% YoY from 3.4%, above 3.1% expected

- Fed Powell dampens rate cut bets

- GBP/USD rises above 1.2450

The pound is attempting to recover from a five-month low after stronger-than-expected UK inflation data and despite hawkish comments from Federal Reserve chair Powell.

UK inflation eased to 3.2% YoY, down from 3.4%, to the lowest level since September 2021. However, it was above the 3.1% forecast. Core inflation and services inflation also eased but also at a slower pace than forecast.

While UK inflation continues to trend in the right direction, it does so at a slower pace, and there were some upside surprises.

The data has raised some questions about when the Bank of England will be able to start cutting interest rates. There is some nervousness in the markets regarding the timing of rate cuts after US inflation rose for a third straight month, and Federal Reserve Jerome Powell warned that interest rates may stay high for some time.

The market has sharply reassessed rate cut expectations and is now pricing in just one rate cut by the Bank of England this year. The first rate cut is fully priced in for November; the market sees a 30% chance of a second rate cut, down from two to three rate cuts just a few weeks ago.

Meanwhile, the market has also tempered expectations of a Fed rate cut. Now, the probability of a rate cut in September is 69%.

Looking ahead, attention will be on the Fed Beige book and Federal Reserve speakers who could give more clues about when the first Fed rate cut may occur.

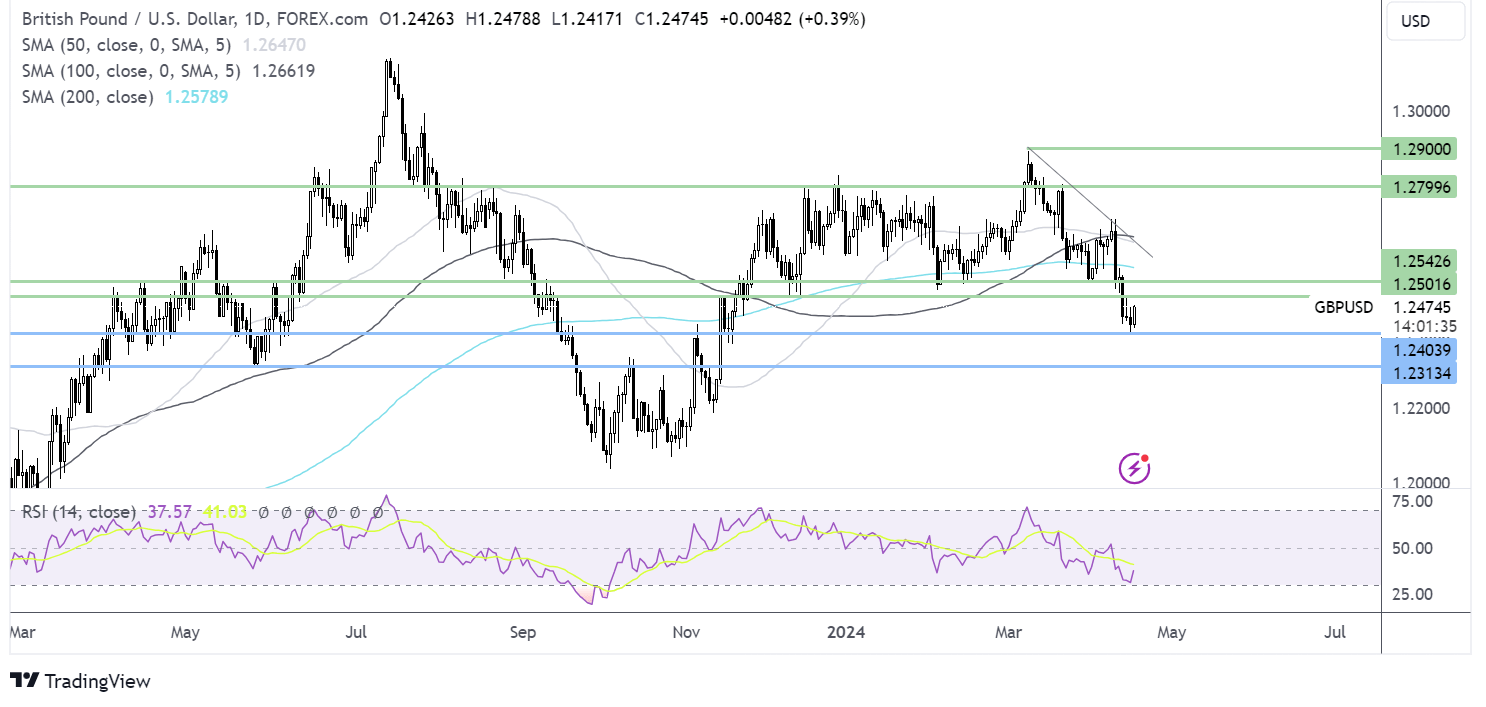

GBP/USD forecast – technical analysis

GBP/USD trades below its moving averages and falling trendline. The pair ran into support at 1.24, a YTD low, and is attempting a recovery.

GBP/USD is rising above 1,2450 as it looks towards the next resistance at 1.25, last week’s high. Above here, 1.2550, the February and early April low, comes into play.

On the downside, support is seen at 1.24, the YTD low. Below here 1.2310, the May 2023 low comes into focus.

DAX struggles ahead of Eurozone inflation data & after ASML earnings

- Fed President Powell dampens rate cut expectations

- Eurozone CPI (final) and ECB President Lagarde speaks

- DAX steadies at 50 SMA

The DAX is inching higher after falling over 1.4% yesterday. The market mood remains cautious after Federal Reserve chair Jerome Powell's shift in tone yesterday. The head of the US central bank raised questions over the likelihood of a rate cut anytime soon.

Powell warned that a lack of progress in cooling inflation could delay rate cuts.

The Eurozone economic calendar is relatively light with inflation data due; however, this is the final CPI reading, so it is often less market-moving. Expectations are for a confirmation of inflation cooling to 2.4%.

ECB president Christine Lagarde is due to speak later. Comments will be closely watched to confirm the ECB's rate cut in June.

Given the relatively quiet economic calendar attention will also be on earnings.

ASML, the largest equipment supplier to computer chip makers, posted weaker-than-expected new bookings in Q1 earnings, pulling its shares 4% lower.

Net sales were €5.29 vs €5.39 forecast and net profit came in at €1.22 billion vs €1.07 billion forecast. Net bookings fell 4% YoY but plunged almost two-thirds versus December's quarter.

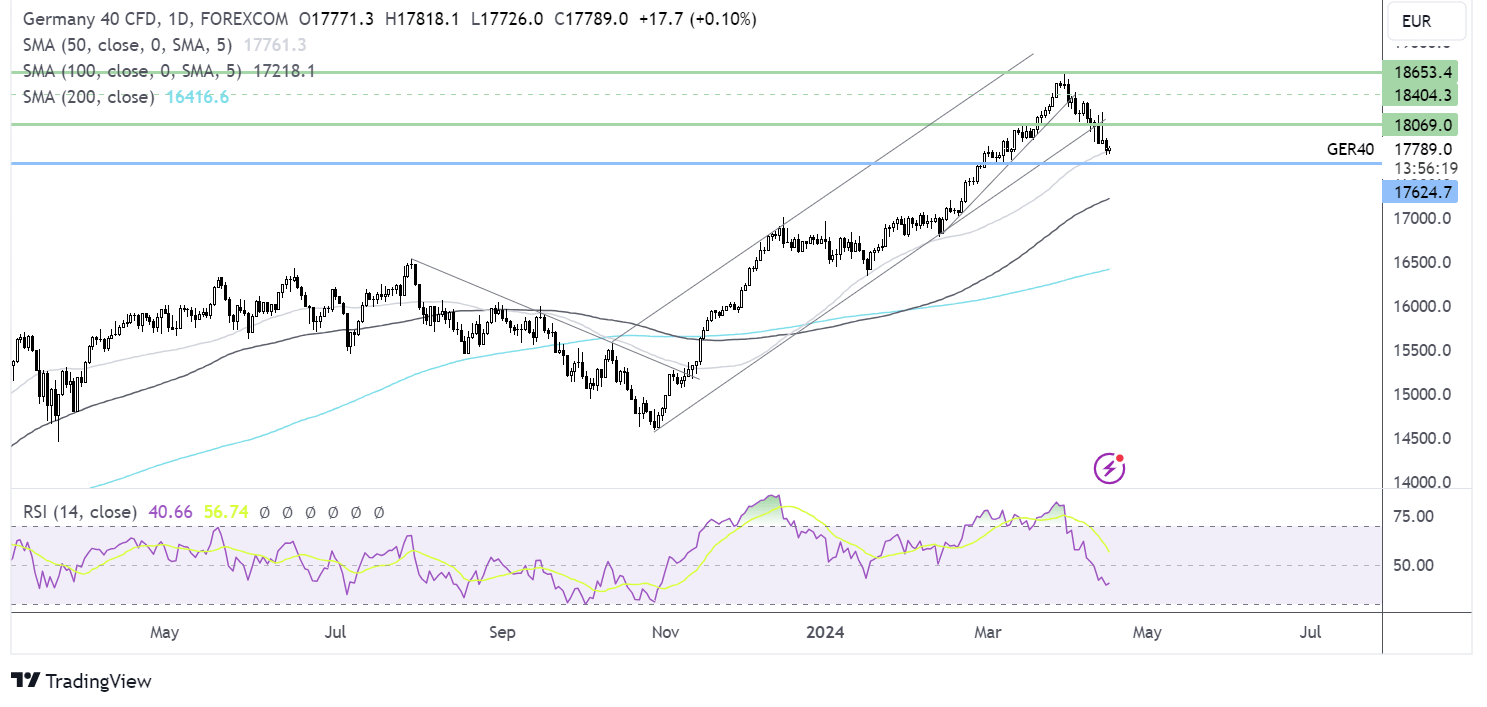

DAX forecast – technical analysis

After reaching an all-time high of 18461, the DAX rebounded lower. The selloff has steadied, finding support at 17760, the 50 SMA.

Sellers, supported by the RSI below 50, will look to take out 17760 to extend losses towards 17600, the March low. Below here, 17000 comes into focus.

Should buyers successfully defend the 50 SMA, a rise towards 18000, the psychological level could be on the cards.