FTSE rises as the economy returns to growth

- UK GDP rose 0.2% MoM in January

- UK recession may be short-lived

- FTSE tests 7765 resistance

The FTSE is edging higher, supported by an upbeat mood after data showed that the UK economy grew in January, raising hopes that the recession was short-lived.

UK monthly GDP rose 0.2%, which is in line with expectations, rebounding from a contraction in the previous month.

Going deeper into the figures, services and construction posted gains offset a drop in industrial production.

The data suggests that the UK is on track to grow in the first quarter of 2024, ending last year's recession.

The data comes as recent comments from the Bank of England suggest that the policymakers are in no rush to ease monetary policy, and signs of a rebound could mean that we wait a little longer for confirmation that inflation is falling to 2%.

The data comes after figures yesterday showed that the UK labor market is easing as wage growth cooled to a two-year low and job vacancies fell for a 20th straight month. Unemployment also rose to 3.9%.

The UK index is starting to show some signs of life after it underperformed versus peers such as the DAX and US stocks, which trade around record highs.

A lack of tech stocks and a stronger pound have prevented the index from taking off.

FTSE forecast – technical analysis

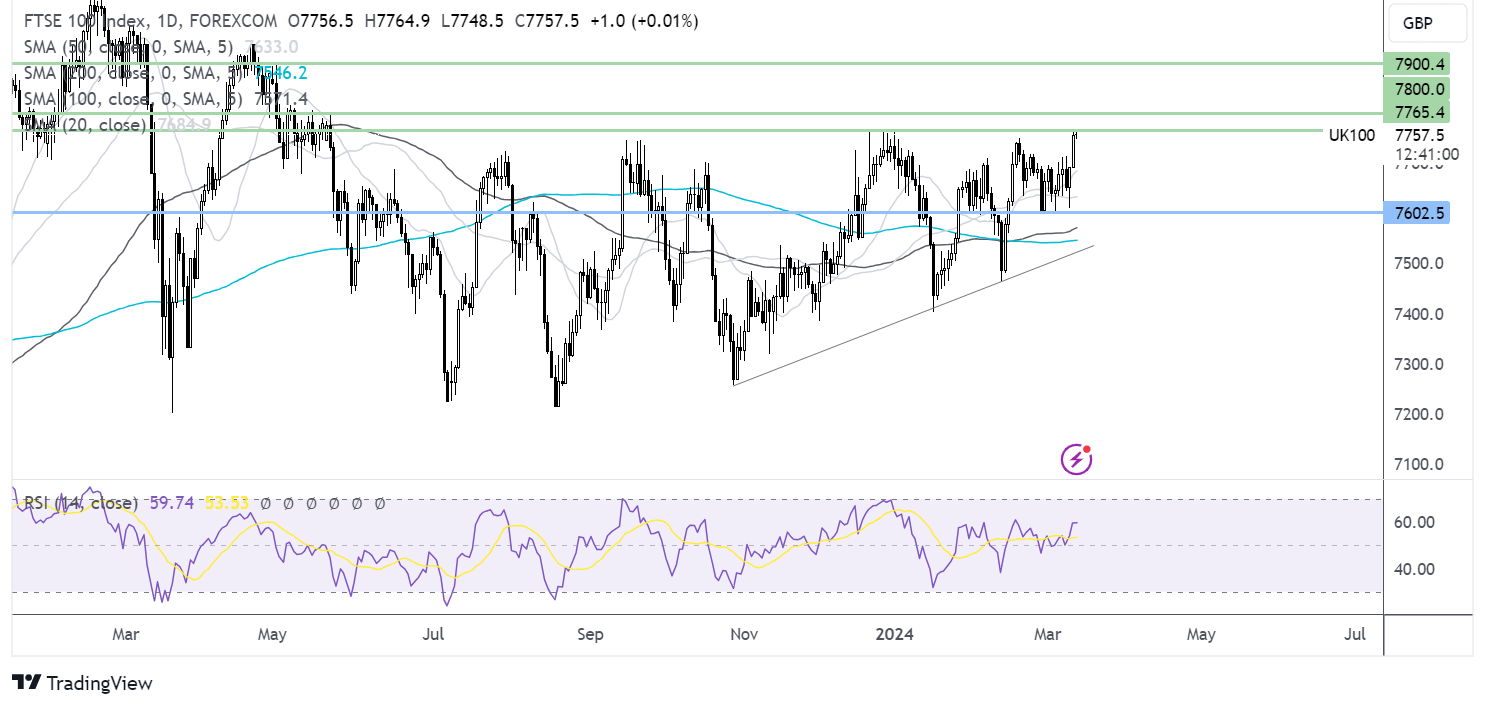

The FTSE has seen a series of higher lows since the start of the year. More recently, the price recovered from 7600 support and is testing resistance at 7765, a five-week high.

Supported by the RSI above 50, buyers will look to rise above 7765 and 7800, the May 2023 high, to bring 7900 into focus.

Should the FTSE face rejection at 7765, support can be seen at 7600. A break below here exposes the 200 SMA at 7544 ahead of the rising trendline support at 7510.

EUR/USD holds steady with ECB speakers & industrial production data due

- Eurozone industrial production is set to fall -1.5% MoM

- USD steady after yesterday’s inflation data

- EUR/USD uptrend remains intact

EUR/USD is holding steady after three days of modest losses as attention turns to eurozone industrial production and ECB speakers.

The pair showed resilience yesterday despite US inflation coming in hotter than expected, raising questions over whether the Federal Reserve will be able to cut interest rates three times this year as it predicted in December.

Meanwhile, German inflation cooled in line with forecasts To 2.5%, its lowest level in two years.

Even so, the euro is finding support from relatively hawkish comments from ECB policymakers, such as Francoise Villeroy de Galhau, who said that the ECB is more likely to cut rates in June than in April. Meanwhile, Austria's Robert Holzman said an April rate cut might be premature.

Attention now turns to eurozone industrial production, which is expected to fall 1.5% month over month after rising 2.6% the previous month. Weaker-than-expected industrial output could raise concerns over slowing growth in the region.

Meanwhile, the US economic calendar is quiet ahead of retail sales data tomorrow.

EUR/USD forecast -technical analysis

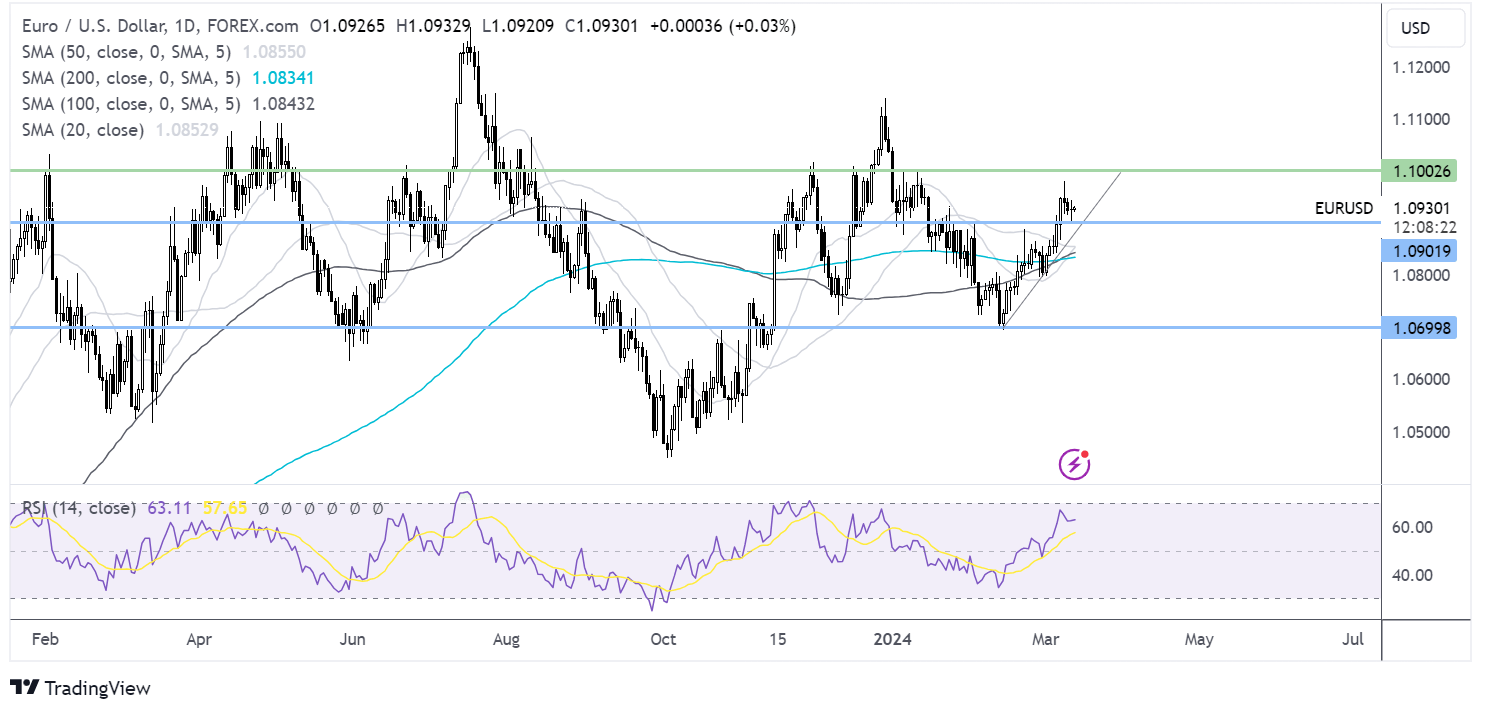

EUR/USD rose to a high of 1.0980 last week before easing back and consolidating around 1.0930.

The price continues to trade above its rising trendline, and the 100 SMA is crossing above the 200 SMA, keeping buyers hopeful of further gains.

Buyers will look to rise above 1.0980 and head towards 1.10.

Sellers will look towards 1.09 round number. A fall below the 200 SMA at 1.0830 could see sellers gain momentum.