EUR/USD falls on concerns over the German recovery & on hawkish Fed comments

- German industrial output falls -3.3%

- Fed speakers see rates unchanged in 2024

- EUR/USD tests 1.0750

EUR/USD is under pressure, falling for a second straight day amid strong U.S. dollar and concerns over Germany's economic recovery.

German industrial production slumped again in March, falling 0.4% month over month from 1.7% in February. Across the year, industrial production fell -3 %. The data comes after factory orders unexpectedly dropped yesterday and is a reminder that despite the recent batch of encouraging data over the last few weeks, the bottoming out of the German economy does not automatically result in a strong recovery.

Highlighting concerns over the outlook for the German economy, the economic institute IW warned that growth in the eurozone's largest economy is likely to stagnate in 2024 despite a stronger start to the year.

Meanwhile, the US dollar is pushing higher for a second straight day, supported by hawkish Federal Reserve comments and as the post-Fed meeting weakness fades.

Fed speakers overnight supported the view that the Fed will keep interest rates high for longer. Minneapolis Fed president Neel Kashkari suggested that the US central bank may not cut interest rates at all this year due to stubborn inflation.

His comments were in contrast to those of Federal Reserve Jerome Powell, who said that while the process of cooling inflation is taking longer than anticipated, he still considered that the Fed will cut this year.

A lack of U.S. economic data in the coming days means that the main focus will be on fed speakers, with several more officials due to speak later today.

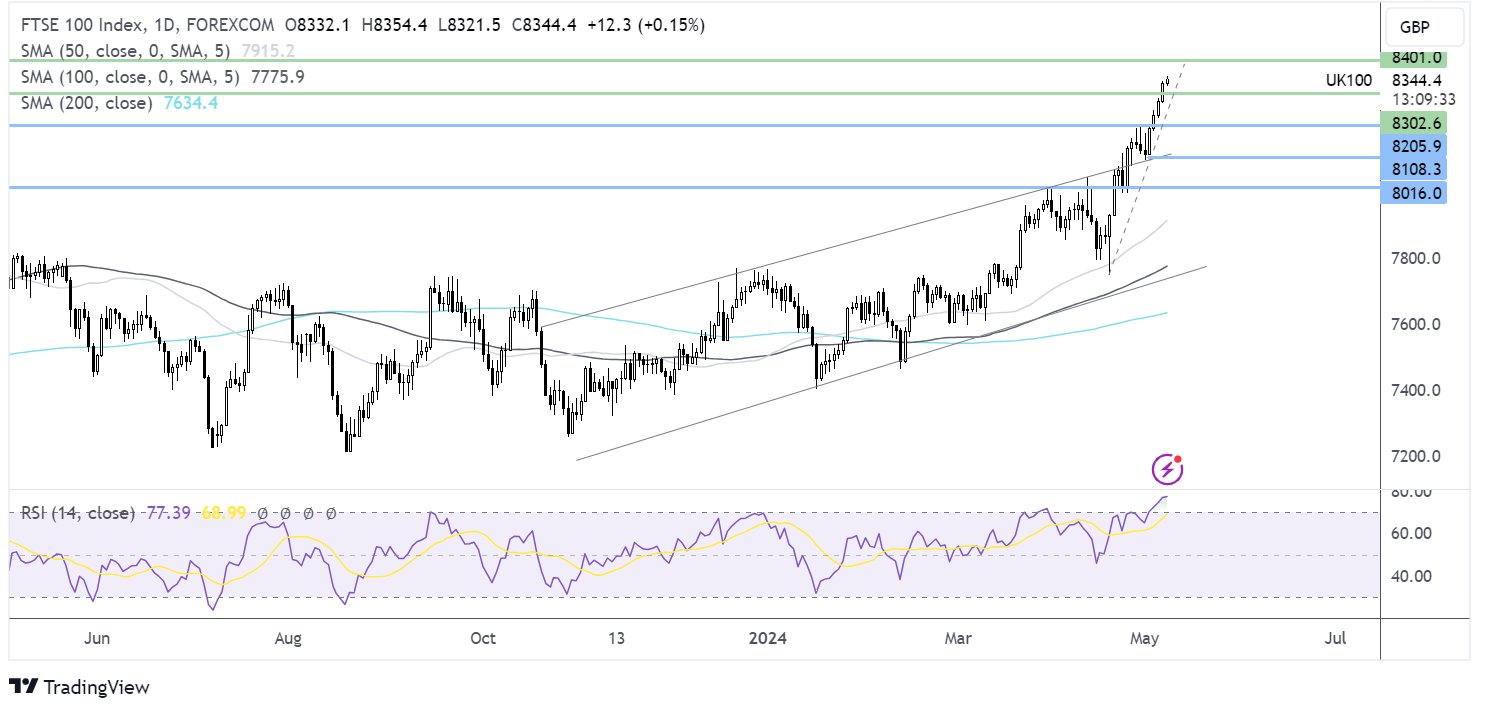

EUR/USD forecast – technical analysis

After facing rejection at 1.08, the 200 SMA, EUR/USD has fallen lower and is retesting the 1.0750 late April high. The RSI is neutral, giving away a few clues.

Sellers, encouraged by the long upper wicks on recent candles suggesting that demand was weak at the higher prices, will look to take out 1.0750 to extend losses towards 1.07, the February low. Below here, 1.0640 comes into play.

Should buyers successfully defend 1.0750, a recovery will need to retest 1.08, the 200 SMA and last week’s high, to extend gains towards 1.09.

FTSE rises to fresh all-time highs ahead of the BoE rate decision tomorrow

- A diverse range of companies lift the index

- BoE rate decision is tomorrow no change is expected

- FTSE rises above 8350 to a record high

The Footsie 100 has risen to a fresh all-time high, boosted by a diverse range of blue chip stocks, and nd ahead of the Bank of England interest rate decision tomorrow.

The UK index has risen over 5% across April as it's finally come into its own. The FTSE index, which lacks tech stocks, has lagged behind its peers, missing out on the rally in Q4 of 2023 and Q1 of 2024. Instead, the FTSE is heavily weighted in financials and commodity stocks, which have recovered recently thanks to the improvement in Chinese economic data and on optimism that interest rates could soon be cut.

The FTSE is also benefiting from signs that the UK economy is starting to recover after yesterday's construction PMI rose to 53 in April, a 14-month high, whilst the services PMI released last week also recorded strong growth.

This week, attention is on the Bank of England's interest rate decision, which could potentially pave the way for a rate cut as early as June.

The Bank of England will meet tomorrow, and while a rate cut is not expected, attention will be on forward guiding and messaging. If the Bank of England were to start cutting interest rates in June, then we could see a tee-up for such a move in the May meeting.

In the March meeting, the central bank left rates unchanged at 5.25%, but the vote split was less hawkish than expected, with no hawkish descents for the first time since last September. Currently, the interest rate markets are pricing in a 45% probability of a 25 basis point rate cut in the June meeting, with a 25 basis point rate cut fully priced in for August.

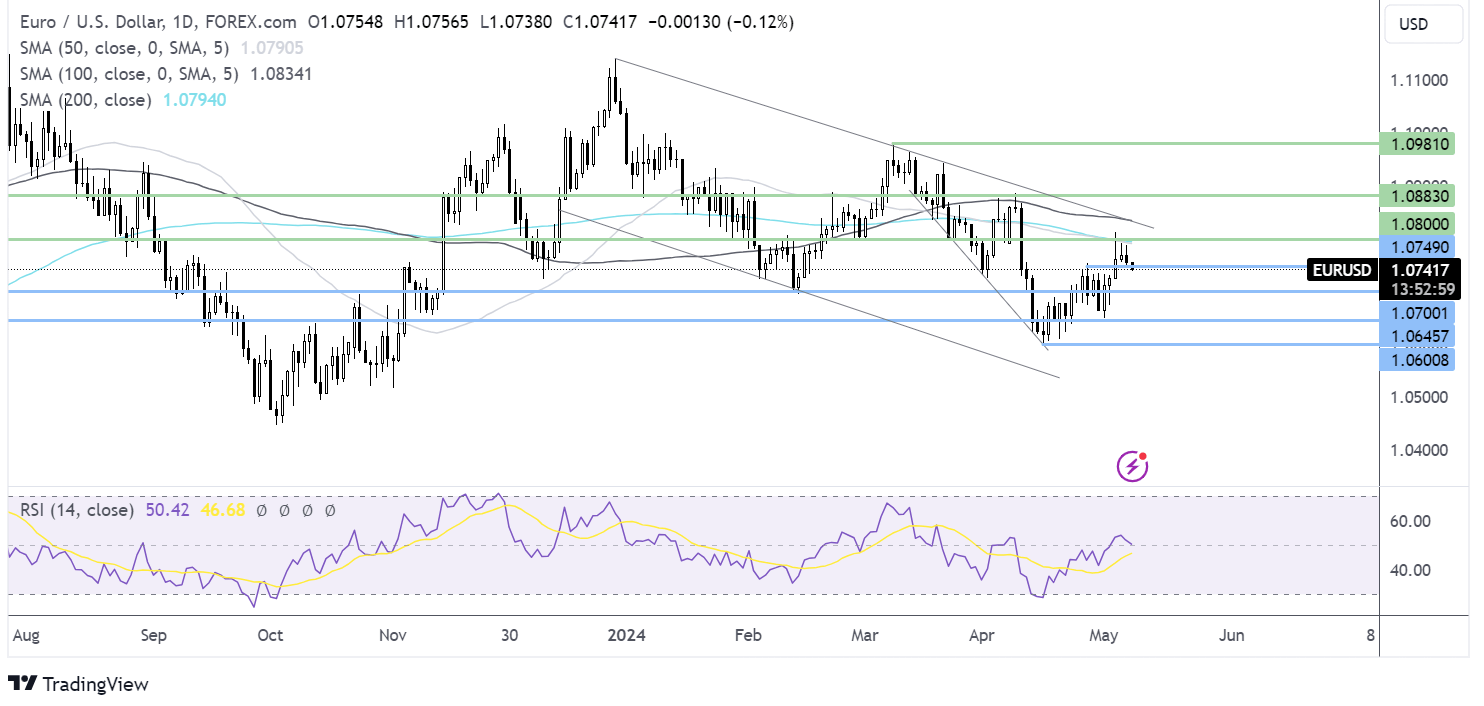

FTSE forecast – technical analysis

After breaking out of the rising channel and above 8300, the FTSE is in unchartered territory and heading towards 8400. The RSI is in overbought territory, so buyers should be cautious. A pullback could be on the cards.

Immediate support could be seen at 8300, the round number. Below here, 8200 comes into play; a fall below this level could negate the near-term uptrend.