US futures

Dow futures -0.34% at 38930

S&P futures -0.18% at 5128

Nasdaq futures +0.04% at 18305

In Europe

FTSE -0.73% at 7631

Dax 0.01% at 17733

Stocks ease from last week’s record high

The mood is cautious ahead of Powell & NFP later in the week

Macy’s jumps on a revised take over bid

Oil falls after OPEC+ extends output cuts

Fed Powell, ISM services data & NFP this week

U.S. stocks are heading for a slightly softer open after last week's record-high rally showed some signs of cooling. Investors await cautiously for more cues on the Federal Reserve monetary policy outlook.

US indices rose to record highs on Friday on continued support from an AI rally and tech stocks and as manufacturing activity contracted, boosting bets that the Federal Reserve will cut rates in the coming months.

This week's main focus is squarely on a testament from Federal Reserve chair Jerome Powell in a biannual event before Congress. Powell is largely expected to echo the thoughts of several Fed officials over the past few weeks that rates need to remain high for longer in the face of sticky inflation.

Still, investors will be looking for clues over the timing of the first potential rates, with the markets expecting the Fed to start loosening monetary policy in June.

US ISM services PMI is due tomorrow and will be in focus as services PCE inflation rose to a 12-month high. Non-farm payroll data is also out on Friday and could offer further insight into the labor market's health, which is a key factor for policymakers at the Fed.

Corporate news

Cryptocurrency stocks such as MicroStrategy and Coinbase are in focus as Bitcoin surges above $65,000, bringing the record high of $69,000 into focus on strong ETF flows and ahead of April’s event.

Macy's is jumping premarket after an investor group, including Arkhouse management and Brigade Capital, hiked its offer to take the department change store private. The group is offering $24.00 per share, up from its previous offer of $21.00, representing a 33% premium on Friday’s close.

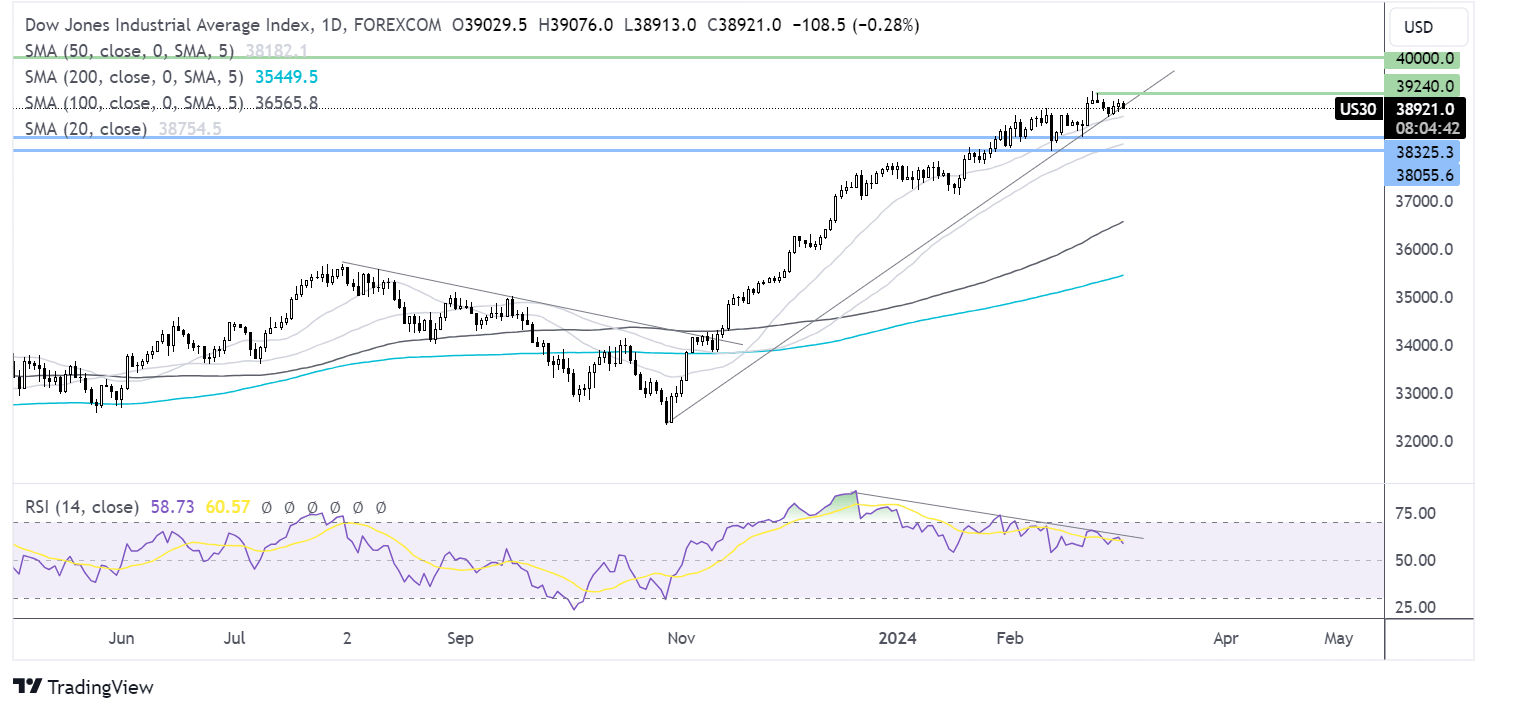

Dow Jones forecast – technical analysis.

After hitting an all time high of 39284 last week, the Dow Jones has eased lower, slipping below 39000 as it continues to hug the rising trendline and remains supported by the 20 SMA. However, the RSI bearish divergence could keep sellers hopeful of further losses towards 38335 the Wednesday 21 low and 38000 the February low. Byers will look for a rise above 29284 to book fresh record highs.

FX markets – USD rises, EUR/USD steady

The U.S. dollar is inching higher after modest losses last week, and as the market looks cautiously ahead to a busy week, which could provide more cues on when the Federal Reserve will start to cut interest rates.

EUR/USD is holding steady in cautious trade ahead of a big week for the pair, which sees the Federal Reserve chair Jerome Powell testifying before Congress and the ECB interest rate decision. The ECB is expected to leave rates on hold at 4% and policymakers have recently suggested that it's premature to talk about rate cuts even as inflation calls to 2.6%. ECB President Christine Lagarde raised concerns about the tightness of the labor market fueling inflationary pressures.

GBP/USD is rising with the UK chancellor's budget in focus on Wednesday. Chancellor Hunt has downplayed speculation of significant pre-election tax cuts, saying there's been a worsening economic outlook, although he has hinted there will be help for some voters.

Oil slips after OPEC+ extends output cuts as expected

Oil prices are slipping lower after solid gains across the previous week despite OPEC+ announcing that it will extend voluntary oil cuts in Q2 of this year.

This is a case of buy the rumor, sell the news as the market rallied 3.5% last week on expectations that the group will push out voluntary cuts of 2.2 million barrels per day to cushion the market. This move comes amid concerns over the demand picture as central banks keep interest rates high for longer.

Russia also said that it would cut exports by an additional 471,000 in Q2, which caught some analysts off guard, although that hasn't impacted the price much.