US futures

Dow futures -0.31% at 38805

S&P futures -0.7% at 5118

Nasdaq futures -1% at 17840

In Europe

FTSE -0.06% at 7734

Dax +0.28% at 17998

- Hotter inflation raises worries about higher rates for longer

- FOMC rate decision next week

- Will the Fed lower the dot plot to 2 hikes this year?

- Oil is set for a weekly rise of 3%

Inflation concerns rise ahead of next week's Fed meeting

U.S. stocks are edging lower on Friday after hotter-than-expected inflation data this week, which has unnerved investors ahead of next week's FOMC meeting.

Both the US CPI and PPI inflation data came in stronger than expected for a second straight month in February, ramping up worries that the Federal Reserve will need to keep interest rates high for longer to tame inflation towards its 2% target.

The Federal Reserve is expected to leave interest rates unchanged in the March meeting. The market is pricing in a 60% probability of a rate cut in June down from 73% just a week ago.

The focus next week will be on the dot plot, where the Fed may show fewer rate cuts this year, lowering it to two rather than the three it indicated in December.

Corporate news

Adobe is trading lower, dropping over 12%, after the software giant provided weaker-than-expected Q2 revenue guidance amid higher competition and soft demand for its AI offerings.

Bitcoin-related stocks such as MicroStrategy and Marathon Digital are falling as Bitcoin drops almost 5% from its recent highs.

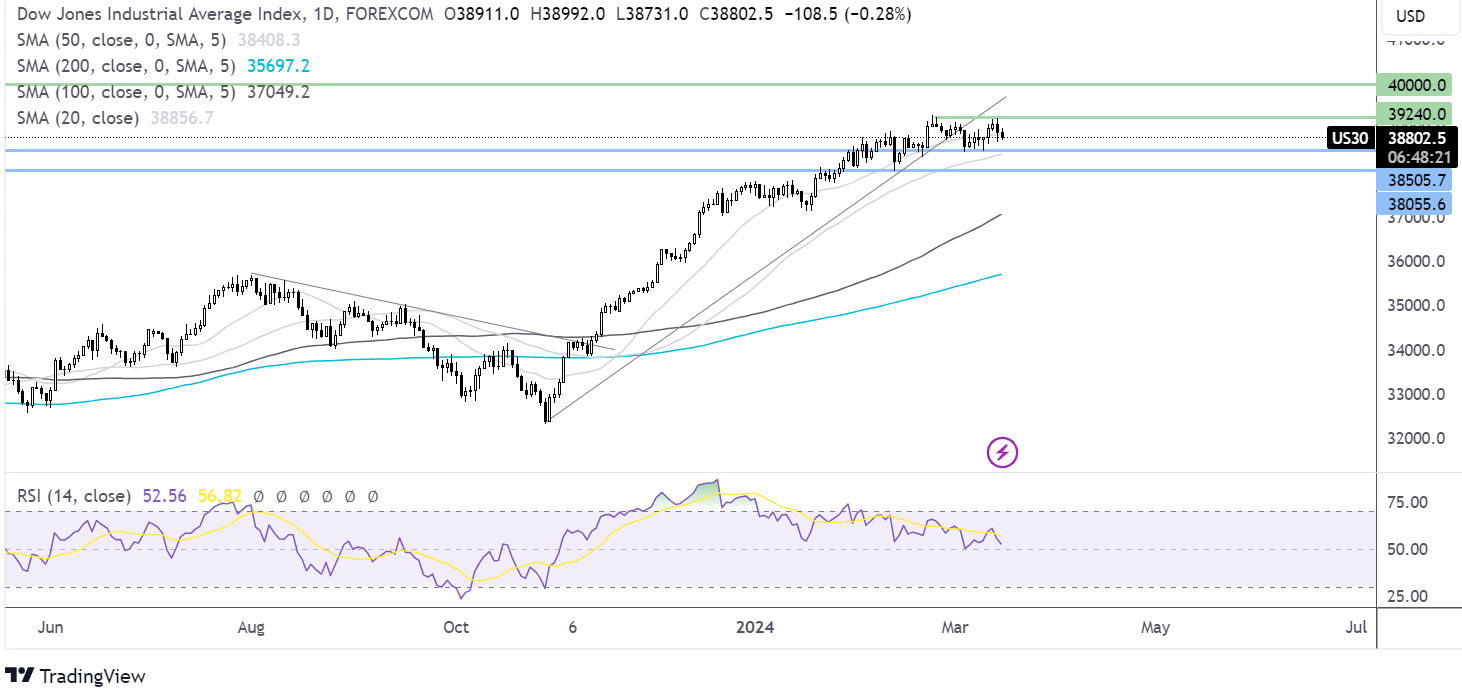

Dow Jones forecast – technical analysis.

The Dow Jones is trading in a holding pattern, capped on the upside by 39284, the all-time high reached in February, and by 38500, the March low, on the lower side. Sellers will look to break below 38500 to extend losses to 38000, the February low. Resistance is at 39284 for fresh all-time highs towards 40000.

FX markets – USD holds steady, EUR/USD flat

The US dollar is holding steady today but is trading higher across the week after sticky inflation raises questions over whether the Federal Reserve will be able to cut interest rates three times this year and whether it will kick off rate cuts in June as the market expects.

EUR/USD is holding on to yesterday's losses after ECB policymaker Ollie Rehn confirmed that the central bank has started to discuss when to cut interest rates. At last week's ECB meeting, President Christine Lagarde signaled to a rate cut in June.

GBP/USD is inching lower after UK inflation expectations fell to a two-year low, dropping to 3%, down from 3.3%. The data comes ahead of the Bank of England interest rate decision next week, where the central bank is expected to leave rates unchanged, and it's unlikely to provide clues over when it might start cutting rates. That said, the market has brought forward rate cut bets marginally after data this week showed that wage growth slowed to its lowest level in two years.

Oil is set to rise 3% over the week.

Oil prices are edging lower but on track to gain over 3% across the week, boosted by signs of a tighter oil market.

The International Energy Agency upwardly revised its oil demand outlook for the fourth time since November. World oil demand is expected to rise by 1.3 million barrels per day in 2024, up 110,000 from the previous month. It also forecasts a small supply deficit.

Elsewhere, U.S. oil inventories unexpectedly fell as refineries ramped up processing, and gasoline inventories slumped as demand rose heading toward the US driving season.

The stronger U.S. dollar and expectations that the Federal Reserve could keep interest rates high for longer could limit the upside.