- Dollar analysis: DXY eyes March high, set to close higher for 10th consecutive week

- BoJ inaction, rising crude oil positive for greenback

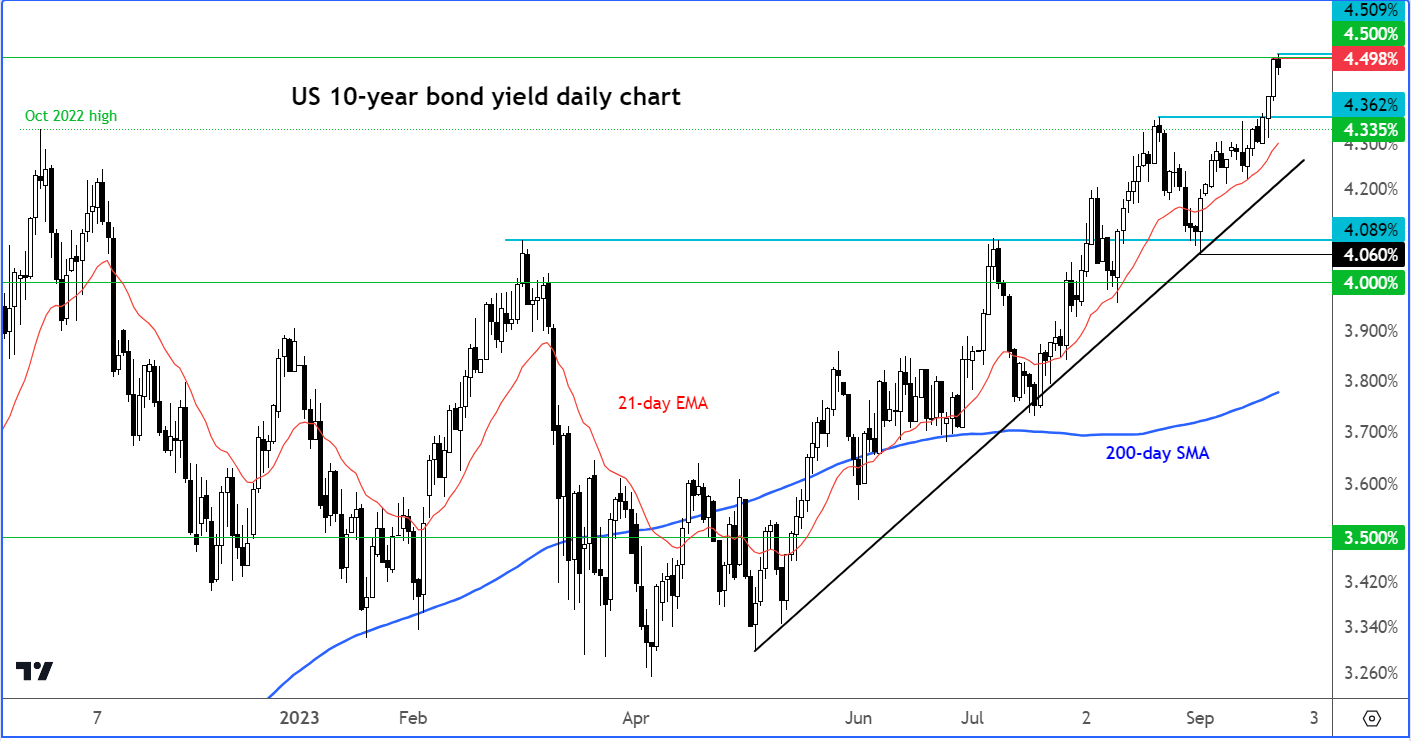

- US 10-year yields hit 4.5% with Fed being more hawkish than BOJ, ECB and BOE

- GBP/USD could fall to 1.20 and EUR/USD towards 1.05

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week’s report, we will focus the US dollar, EUR/USD and GBP/USD.

DXY eyes March high as US 10y yields hit 4.500%

The Bank of Japan inaction overnight meant the USD/JPY would resume its rally, helping to keep the Dollar Index supported and on course to end higher for the 10th consecutive week today – barring a late-day sell-off.

The latest push higher is supported by US 10-year bond yields breaking the 4.5% barrier, thanks to a hawkish Fed.

The dollar continues to find support across the board, especially against the yen, pound and the euro, currencies where the central banks are comparatively more dovish than the Fed. These economic regions are also more vulnerable if there’s another oil shock, than the US, which is an oil exporter. This means that the dollar will likely remain bid if oil continues to ascend. Brent oil has already surpassed the $95 level and could climb towards $100 if the OPEC+ continues to withhold supply.

With oil rising, there is a risk that the deceleration in price pressures could be a slow one. This would encourage the Fed to maintain interest rates elevated around current levels for a long time. While it may be needed to bring inflation down, it is clearly bad news for the economy. One also has to wonder about the potential for another credit event being triggered, and its implications for the global economy and stock markets.

Apart from the fact that the Fed is hawkish, and interest rates are obviously quite high, rising bond yields may also reflect investors growing worried about something much bigger, like the ballooning US debt levels. It makes sense for them to demand a higher rate of return for parking their funds in the so-called “risk-free” asset – especially when you consider that the government will need to keep borrowing and paying more and more to service its debt. Issuing more and more debt is clearly not sustainable and at some point, it will have to be addressed.

Anyway, if yields continue to remain elevated, then this could weigh further on longer-duration equities, those that are expected to produce their highest cash flows in the future. Many of such companies are dominated in the technology sector, putting the tech-heavy Nasdaq 100 into focus, but it could also weigh down on the broader S&P 500 index. In FX space, its impact will be felt on the dollar, potentially keeping it supported for a long time.

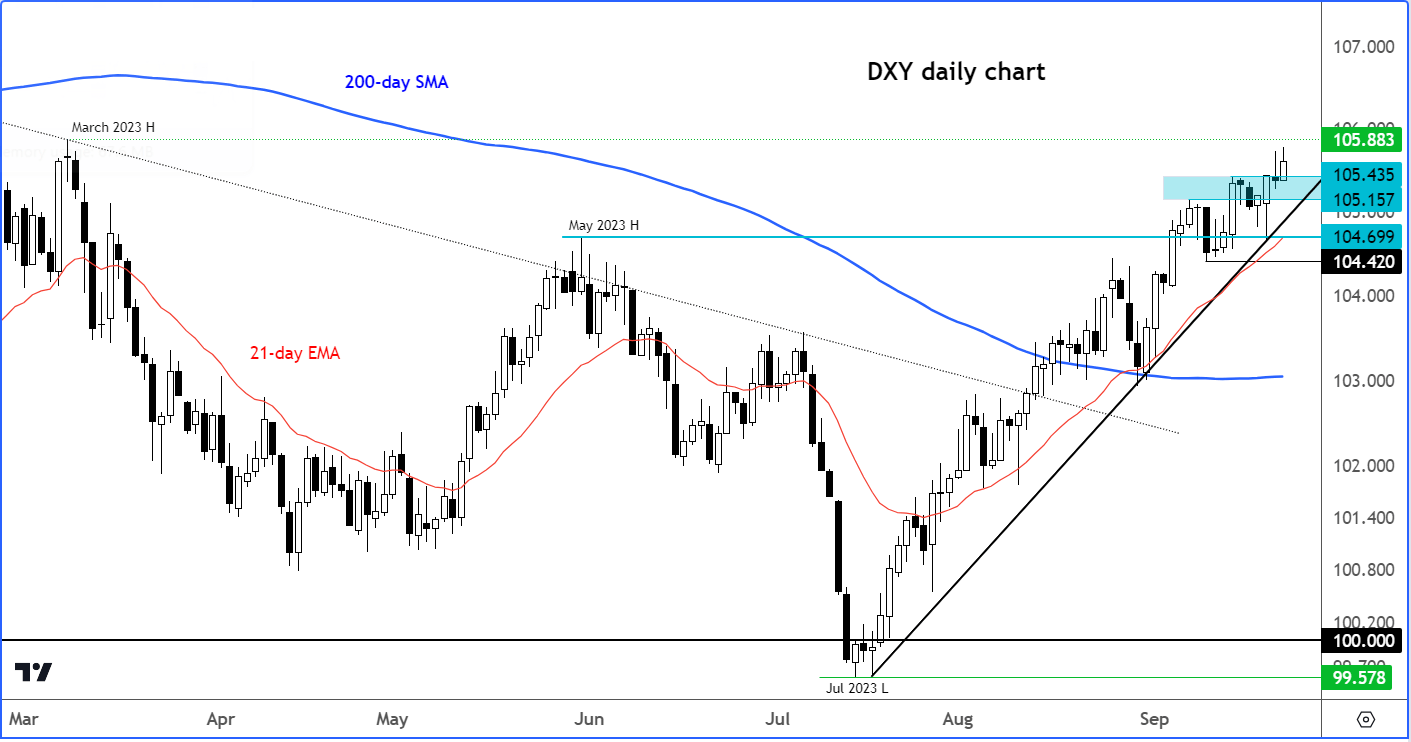

The next immediate upside bullish target on the Dollar Index is the March high at 105.88. Support is seen in the region between 105.15 to 105.43.

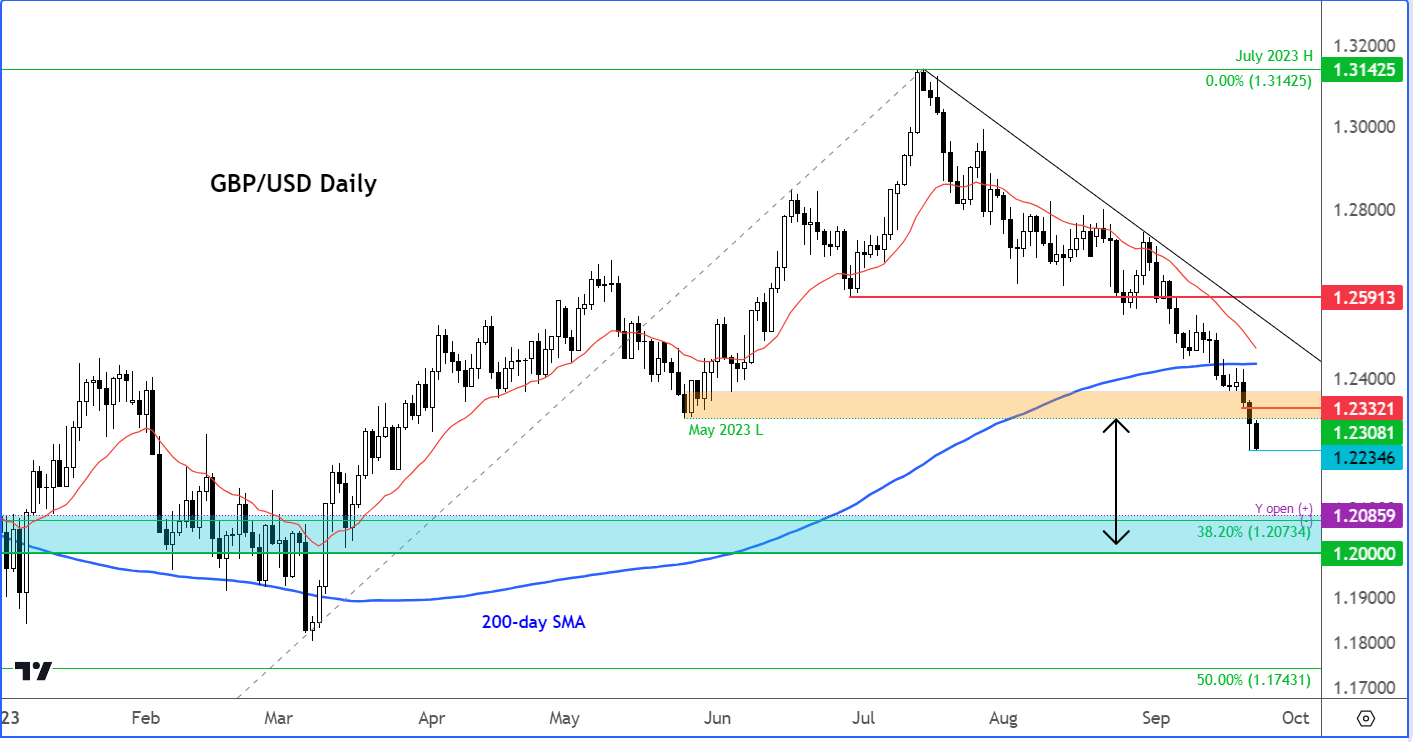

GBP/USD 1.20 is in sight as UK economic concerns grow larger

Among the major pairs, the GBP/USD looks like it has further room to go on the downside. Today, this pair hit a fresh 6-month low near 1.22 handle. Already reeling from BoE's surprise inaction the day before, when some had expected a 25 basis point rate hike, the GBP took another tumble as UK services PMI (47.2) fell deeper into contraction, raising recession fears.

With support around 1.23ish broken, the path of least resistance remains to the downside for the cable. From here, we could see rate decline towards 1.21 and possibly 1.20 in the week ahead. These levels were previously support earlier this year, and is where the long-term 38.2% Fibonacci retracement level comes into play.

On the upside there are now lots of reference points to consider, the most important of which is probably between 1.2308 and 1.2332 – the broken support area. This zone needs to be defended by the bears now if they are to maintain control of price action.

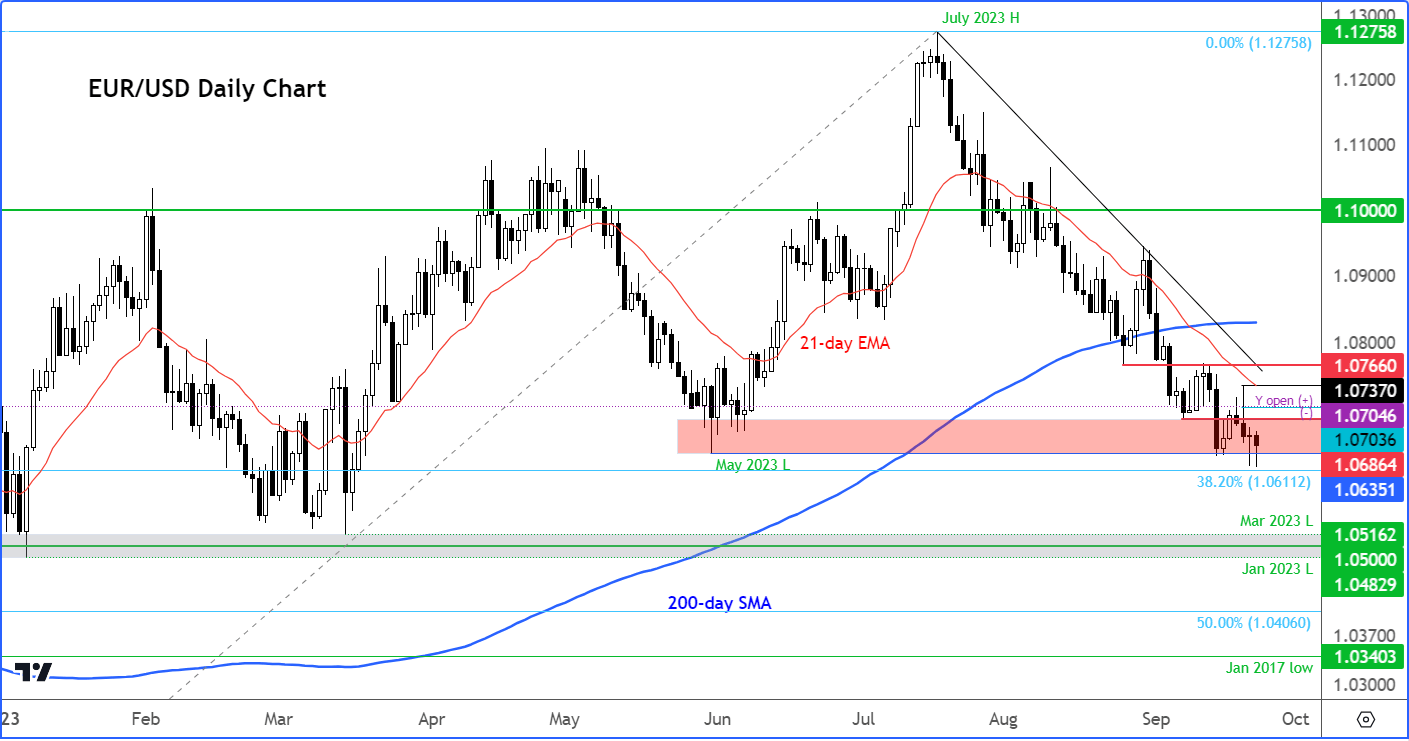

EUR/USD could drop to 1.05

The EUR/USD also struggles to make a comeback, as the latest Eurozone PMIs released earlier today were far from convincing, even if there were a couple of positive surprises such as the German Services PMI climbing almost to the positive territory again (49.8 vs 47.3 last and expected). But manufacturing sector activity fell deeper into contraction, printing 43.4 for Eurozone, down from 43.5. French manufacturing PMI was very poor at 43.6, while the German PMI hardly improved at 39.8.

With economic activity remaining rather poor in the Eurozone, and the ECB having paused its rate hiking cycle earlier than expected, the EUR/USD outlook remains bearish until such a time that Eurozone macro pointers start to improve again, or US data deteriorates so sharply that it brings the time of the Fed’s inevitable rate cuts significantly forward.

For now, the EUR/USD is likely to continue to find sellers at resistance. The next downside target is around the 1.05 handle, which is where the lows of January (1.0483) and March (1.0516) were approximately formed.

Looking ahead to next week

German Prelim CPI

Thursday, September 28

12:00 BST

The ECB was among the more dovish of central banks in September, causing the euro to fall against most major currencies. The single currency will be in focus again next week, with the publication of several Eurozone macro pointers, including German ifo Business Climate (Monday). Perhaps the most important data could be the German CPI which would come a day ahead of the Eurozone CPI (Friday) estimate. The euro bulls would need to see a strong print to help arrest the single currency’s decline.

Chinese manufacturing PMI

Friday, September 29

02:30 BST

Chinese assets have led the declines in recent months, owing to concerns about the health of the world’s second largest economy. While some improvements have been observed in recent data releases from China, this hasn’t helped to provide any meaningful support yet. The manufacturing PMI has printed below 50.0 for the past 5 months, pointing to contraction in the dominant sector. Will we see a more positive print this time?

US core PCE Price Index

Friday, September 29

13:30 BST

This week’s hawkish pause from the Fed triggered a sharp sell-off in stocks and bonds, while lifting yields and the dollar higher. The Fed is worried about inflation and oil prices remaining high. Investors are worried the Fed’s tightening cycle may not be over just yet, after the central bank’s strong inclination towards rate cuts being pushed further out in 2024, with the possibility of one more hike before the end of this year. If the Fed’s favourite inflation measure – the Core PCE Price Index – also mirror the CPI from las week and come in higher, then this should further support the dollar. A noticeable miss is what the dollar bears would be desperate to see.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

Source for all charts used in this article: TradingView.com

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade