DAX falls in cautious trade ahead of ECB lending survey

Will lending conditions have tightened further?

ECB rate decision on Thursday

DAX tests 200 SMA

The DAX is falling after strong gains yesterday, in cautious trade ahead of crucial US inflation data tomorrow and the ECB meeting on Thursday.

Expectations are for US inflation to edge up slightly for a second straight month, which could mean that the Federal Reserve is less inclined to cut interest rates. Following the stronger-than-forecast US non-farm payrolls, the market has already pushed back June rate cut expectations to below 50%.

Meanwhile, the ECB is expected to leave interest rates unchanged at their current record highs and could signal a potential rate cut in June. Although ECB Christine Lagarde is likely to

Today, ahead of the meeting on Thursday, we have the ECB lending survey. This survey provides information on bank lending and credit conditions in the region and is an important input for the growth outlook.

In the last survey, banks reported a net tightening of credit standards but to a lesser extent than in previous quarters. The survey can also provide some clues on household lending and the strength of private consumption.

The data comes after solid numbers from the region yesterday after the German manufacturing production rate went up to a 13-month high, its second straight monthly gain. Eurozone investor sentiment rose to a two-year peak, marking a sixth monthly improvement. The strong numbers helped the tax rise over 1% on Monday.

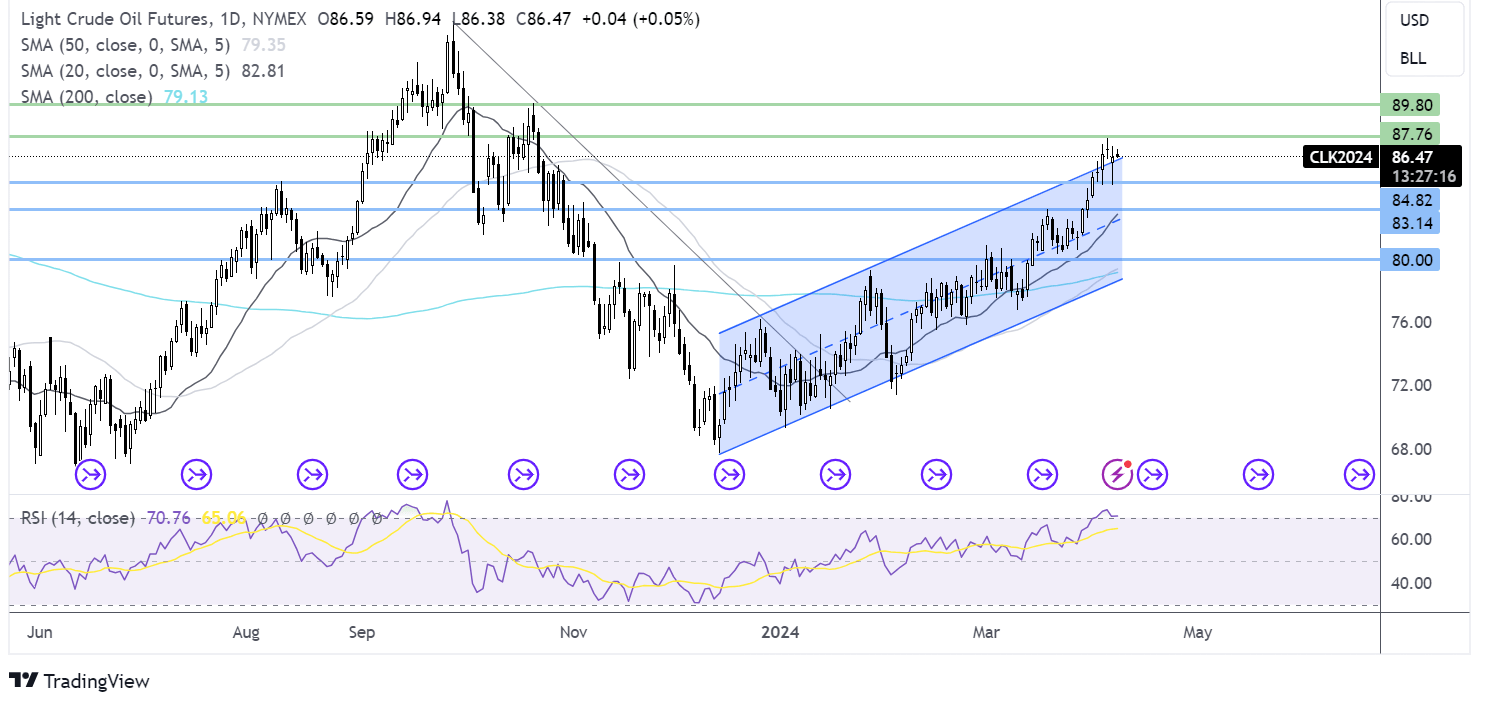

DAX forecast – technical analysis

After running into resistance yesterday at 18325, the DAX is testing support of the 20 SMA at 18200. A break below here could see sellers test the April low of 18085 and the rising trendline support at 18000.

Should sellers gain traction, 17660, the March low could come into focus. However, it would take a move below 17000 to negate the longer-term uptrend.

Meanwhile, buyers will look to rise above 18325, yesterday’s high to rise towards 18640 the ATH.

Oil rises as ceasefire hopes diminish.

Israel-Hamas ceasefire talks fail.

API oil inventory data is due later

Oil looks towards 87.75

Oil prices are heading higher on Tuesday amid diminishing hopes of a ceasefire between Israel and Hamas, fueling concerns that the ongoing conflict could disrupt oil supply in the Middle East region.

Ceasefire talks between Israel and Hamas held in Cairo on Monday pulled oil prices lower after a multi-session rally. However, comments from Israeli Prime Minister Benjamin Netanyahu dampened optimism that a ceasefire could be on the cards.

Both sides have been clear that the proposals have not met the demands required for a ceasefire. Without an end to the conflict, there is an elevated risk that other countries, particularly Iran, OPEC's third-largest producer, could be drawn into the war. As a result, the risk premium on oil increased, supporting the uptrend.

Meanwhile, on the demand side, data showed that India’s demand was at a record high in the 2024 fiscal year, and last week's data showed a surprise return to growth in Chinese manufacturing activity, also supporting the demand outlook.

Looking ahead, API oil inventories are due later after a large draw last week lifted oil prices.

US inflation data on Wednesday could also influence oil markets. Sticky inflation supports the Fed, keeping rates higher for longer, which could hurt the demand outlook.

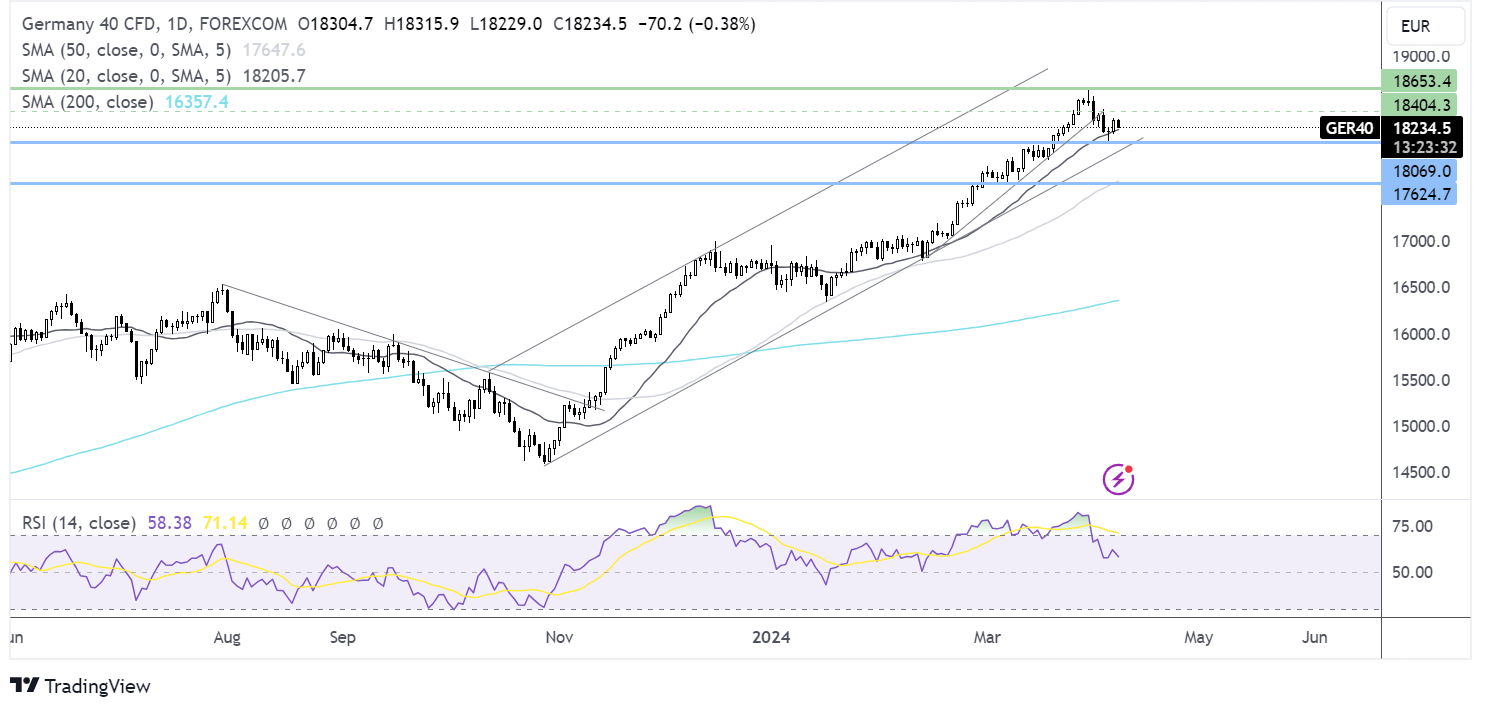

Oil forecast – technical analysis

Oil continues to hold the break out above the multi-month rising channel in a period of consolidation, which is bringing the RSI back out of overbought territory. The long lower wick on yesterday’s candle suggests that there was little selling demand at the lower levels.

Buyers will look for a rise above 87.75, the April high, to extend gains to 90.00.

Support can be seen at yesterday’s low of 84.70, which was also the August high. Below here, the March high of 83.10 comes into play.