DAX rises on China stimulus chatter & ahead of IFO business climate data

- German IFO business climate to slip to 88 from 88.6

- German PMI data raises concerns about a prolonged recession

- China pledges further stimulus

- FOMC meeting begins & US earnings in focus

After a modestly bullish start to the week, the DAX is heading higher for a second day after China stimulus chatter, as investors look ahead to the latest business climate data and as the FOMC kicks off its 2-day meeting.

The DAX continues to hold above 16000 for a sixth straight session despite disappointing German data and rising concerns of a prolonged recession.

German PMI data yesterday showed a bad start to the third quarter for the eurozone’s largest economy, with the composite PMI falling into contraction.

The manufacturing sector continues to lead the downturn. The manufacturing PMI fell to 38.8, falling below 40 and missing forecasts of a rise to 41. Meanwhile, a slowdown in service sector growth continued for a second straight month, with the PMI falling to 52 from 54.1.

The data points to an increased likelihood that the German economy will remain in recession across the second half of the year.

Attention now turns to the German IFO business climate, which is expected to slip to 88 from 88.6 in June. A sharper-than-expected decline in business climate could hurt sentiment.

Whilst the outlook is bleak in Germany, talks of more stimulus in China and optimism that the Federal Reserve could be near the end of its rate hiking cycle are offering support to stocks.

Today the FOMC kicks off its two-day meeting. The Fed is expected to raise rates by 25 basis points, but as this is fully priced in what the Fed guides for in September could be more market-moving.

US earnings remain in focus, with big tech names Alphabet and Microsoft reporting after the close. US earnings are likely to influence sentiment. Any sense that the US could be avoiding a hard landing could boost risk appetite.

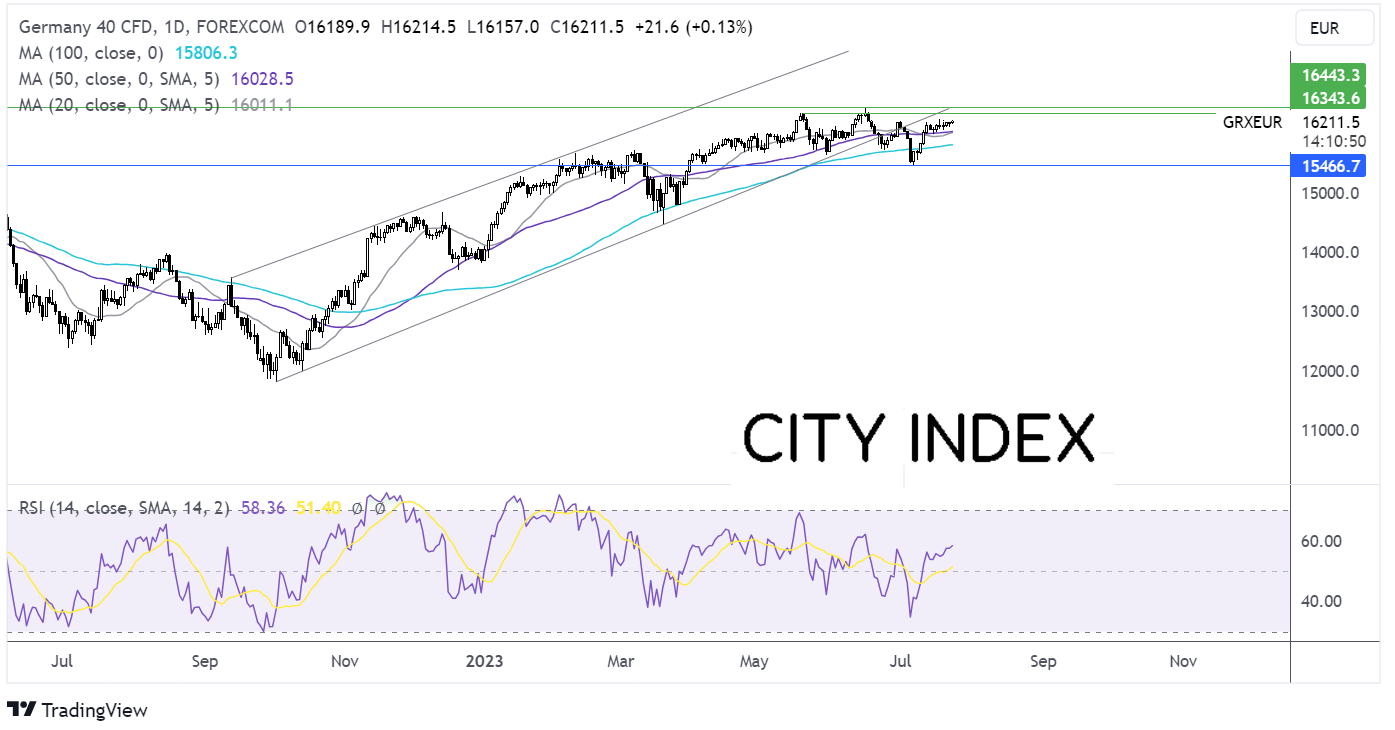

DAX forecast – technical analysis

The DAX trades at the upper end of its recent rage around 16200, supported by the 20 and 50 sma on the downside. The RSI is above 50 and supports further upside.,

Buyers could look for a rise above 16335, the May high, to bring 16430 and fresh all-time highs into focus.

On the downside, 16000, the confluence of the 20 & 50 sma and the round number, offers support. A break below here exposes 15775 the 100 sma, ahead of 15450, the July low.

Oil rises to a 3-month high with API data in focus

- Oil rises on China stimulus chatter

- API inventory data is due to show a 2 million barrel draw

- Oil breaks out above 200 sma & falling trendline

Oil prices are edging higher on Tuesday, rising to a three-month high on optimism of further Chinese stimulus and on signs of tight supply, which are overshadowing concerns of another rate hike from the Federal Reserve.

China’s Politburo, the top decision-making body of the Communist Party, pledged more policy measures to support the Chinese economy over the coming months. Optimism over more stimulus for the world’s largest oil importer is boosting the oil demand outlook.

Meanwhile, supply remains tight as Saudi Arabian and Russian oil production cuts take effect.

The focus will be on US crude oil stockpile data with the API due to release numbers later today, followed by EIA inventory figures tomorrow.

Stockpiles are expected to have fallen over 2 million barrels in the week to July 21, pointing to a constant demand in the US, the world's largest oil consumer.

The FOMC kicks off its two-day meeting today and is expected to announce a 25 basis point rate hike tomorrow. However, this could mark the end of the hiking cycle, which could mean that the US could avoid a hard landing.

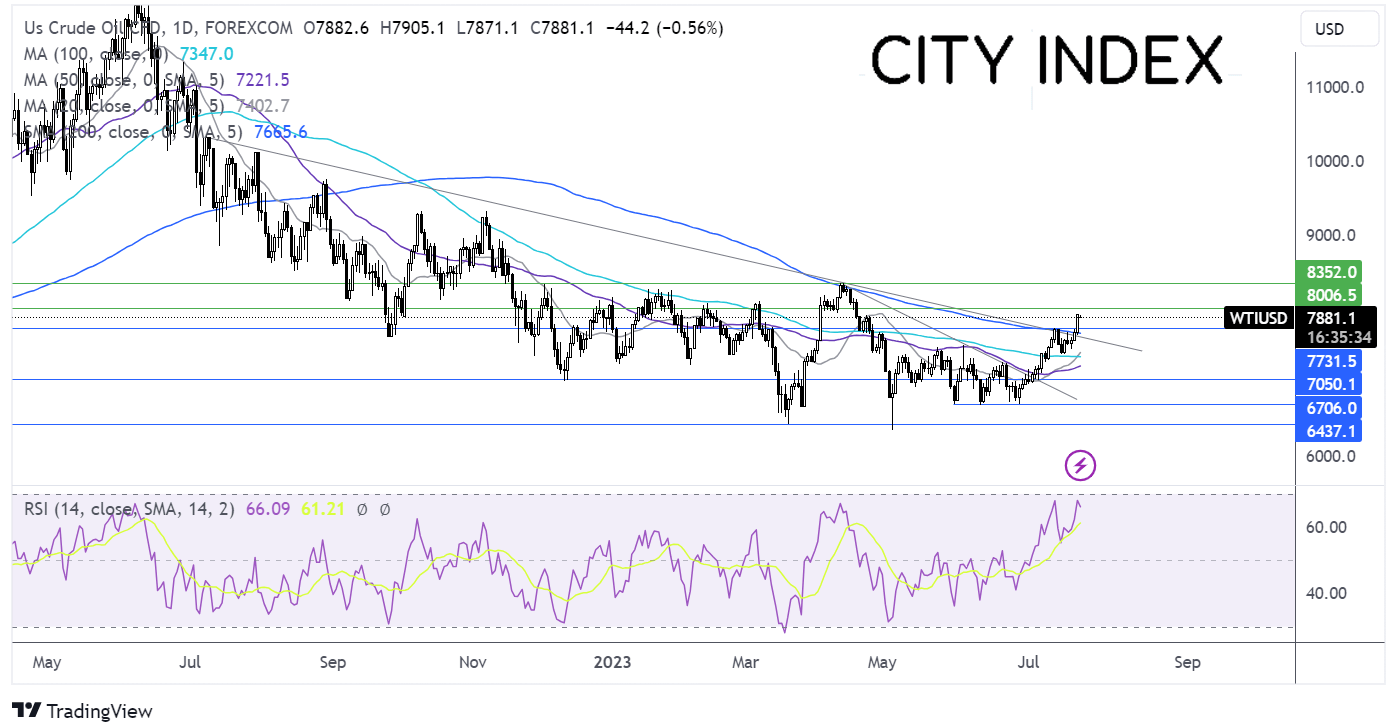

Oil forecast – technical analysis

Oil has broken out above its multi-month falling trendline and the 200 sma, with bulls looking toward 80.00 the psychological level. The RSI supports further upside while it remains out of the overbought territory and the 50 sma crosses above the 100 sma in a bullish signal.

Buyers will look for a rise above 80.00 to bring 83.40, the 2023 high into focus.

On the downside, support can be seen at 77.30 last week’s high and 76.20 the falling trendline support and the 200 sma. Below here 73.75 the 100 sma comes into focus.