- DAX analysis: Sluggish start to Q2 after a sharp 5-month rally

- Correction risks linger after big rally

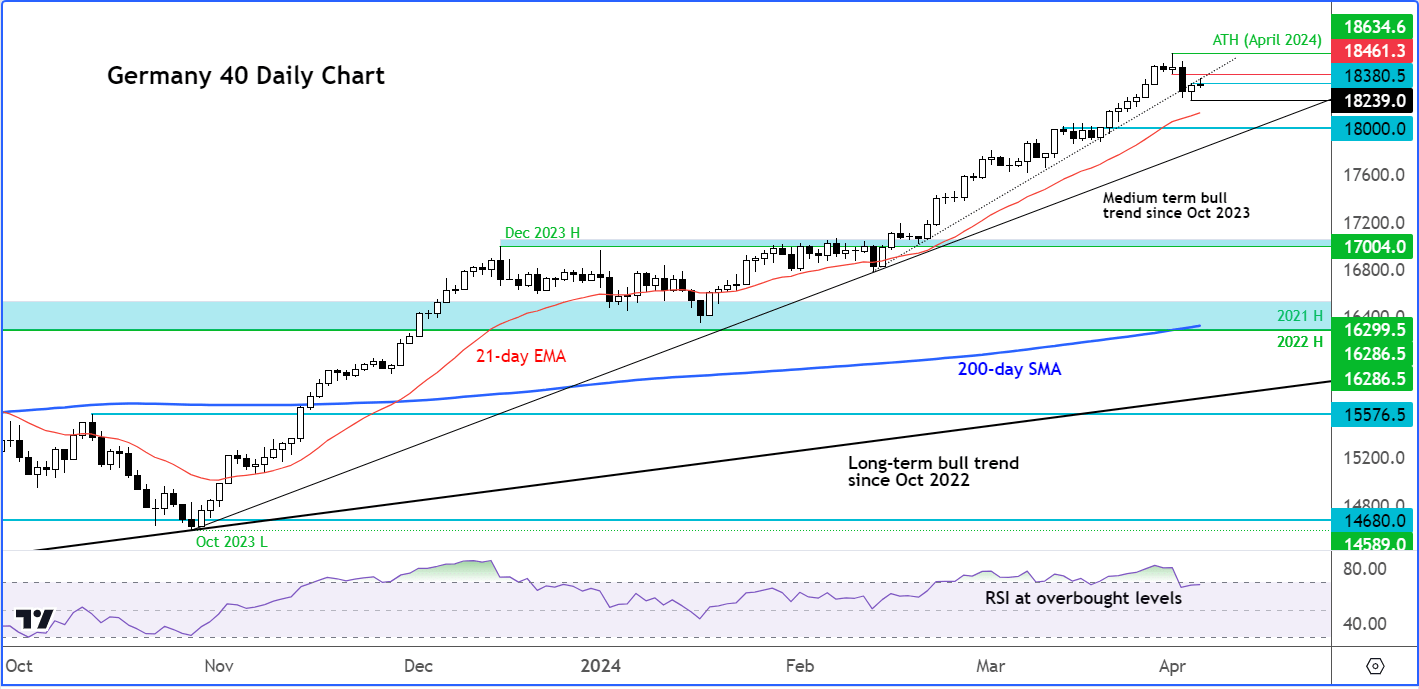

- DAX technical analysis: Key levels to watch

DAX analysis: Sluggish start to Q2 after a sharp 5-month rally

After rising for 5 straight months and climbing for about 10 consecutive weeks, the German DAX index has started the new month and first week of Q2 on the backfoot. Clearly, profit-taking has been a contributing factor behind this week’s decline, with investors now even more confident that the ECB will cut rates in June with Eurozone inflation falling more than expected to 2.9% annual rate in March from 3.1% in February. Another reason behind the sluggish start to the new quarter is that fresh bullish catalysts are diminishing, and question marks over valuations remain – not just for German stocks, but the wider Eurozone and US markets too. Domestically, the German economy has been struggling for a long time now, and for markets to keep pumping stocks higher, we will need to see the return of growth and fast to justify high valuations. While some indicators have improved for the German and Eurozone economies, further improvement in data is needed. So, the risk of a correction remains high, but before we turn tactically bearish on the DAX, we will need to see further evidence that the bullish trend is over on the charts.

DAX analysis: Correction risks linger

Boosting the risk of a correction in stocks is crude oil prices with Brent almost at $90 and WTI at $85 per barrel. Rising oil prices should be bad news for the economy, as they increase input costs and import prices. What’s more, rising levels of debt across the west with elevated yields, means governments are facing rising cost of servicing their debt. As yields remain elevated, this is making it increasingly difficult to continue borrowing without raising the debt-to-GDP ratios to alarming levels. So far in 2024, these worries and concerns about over-stretched valuations have been shrugged off by investors. Let’s see if that changes as we head deeper into Q2 and 2024. But the big rally in gold despite rising bond yields suggests some investors are getting worried about the alarming rise in US debt levels. At some point, governments will need to reduce deficits in order to stay on a fiscally sustainable path, something which has not been addressed by success governments.

DAX technical analysis: Key levels to watch

Source: TradingView.com

The DAX sold off on Tuesday to break its short-term bullish trend line that had been in place since mid-February. The index had hit a fresh record high just the day before. So, despite that drop, more evidence is needed to suggest the market has topped.

Indeed, on Wednesday, the German index formed a small hammer candle to suggest the bullish trend may be about to resume. But let’s see if there will be any upside follow-through now that we are trading around the high of Wednesday at 18,380. A failure to hold this level could pave the way for a fresh drop to take out liquidity resting below this week’s low at 18,239.

Key support below this week’s low comes in around the 18,000 level. This psychologically-important level also converges with a bullish trend line and the base of the mid-March breakout zone.

On the upside, Monday’s low at 18461 is a potential resistance level to watch, although if the sellers do not show up there then that could pave the way for a run to a new all-time high above 18635.

There’s no doubt though that the index remains near extreme overbought levels, as evidenced by the Relative Strength Index (RSI) in the sub-chart, moving above 80 earlier this week. At the time of writing, the RSI was still holding around the 70.0 threshold, suggesting that more time (i.e., consolidation) or downward price action was needed to work off those overbought conditions.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade