Crude Oil Key Points

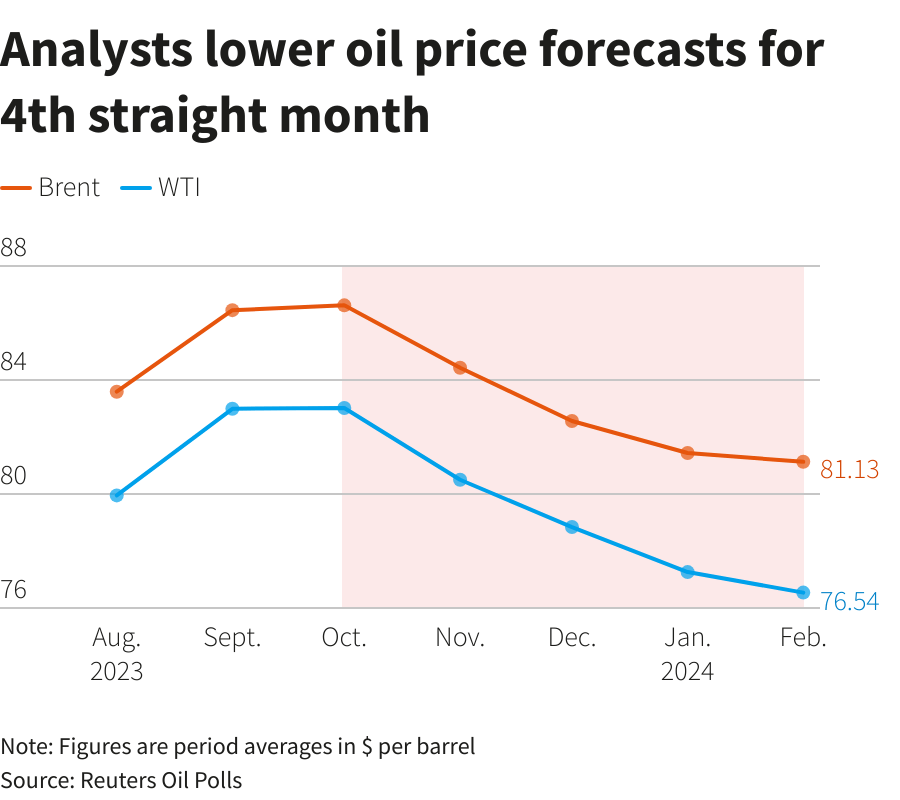

- A Reuters poll published earlier this week showed that global oil supplies are expected to keep prices around $80 a barrel this year.

- International Energy Week in London may also bring some headlines for the oil market.

- This week will be a key one for WTI, with a bullish break above 80.00 potentially setting the stage for a quick continuation toward the mid-80.00s.

As of writing on Friday afternoon, oil prices are putting the finishing touches on a strong week, with the US benchmark West Texas Intermediate (WTI) price rising more than 4% from last weekend.

Looking ahead, a Reuters poll published earlier this week showed that global oil supplies are expected to keep prices around $80 a barrel this year despite ongoing tensions in the Middle East. With spare capacity at a multi-year high and various geopolitical factors at play, the oil market remains torn between ample global supply and strategic cuts from OPEC+:

Source: Reuters

Russia’s Influence on the Oil Market

As is often the case, Russia was in the energy news of several fronts last week. First, we learned that Russia has imposed a six-month halt on gasoline exports starting March 1 to stabilize domestic prices amidst election season and necessary refinery repairs. This decision is a pivotal moment for Russia, as the country aims to mitigate the internal pressures of rising energy costs while also meeting international demand in the global market.

In a dramatic twist in global energy politics, six U.S.-sanctioned Russian oil tankers are inching their way towards Chinese ports, potentially easing Russia's oil overflow but leaving the world hanging on China's decision. Will China help Russia smooth out its oil dilemma, or will the rejection deepen Moscow's sanctions woes? The decision could have a big influence on both the geopolitical backdrop in the region as well as the underlying supply-demand balance in the broader oil markets.

International Energy Week in London

For the uninitiated, International Energy Week is a significant global gathering that follows the first UN Global Stocktake and outcomes from COP28 in Dubai, aiming to address and overcome the challenges hindering the global energy transition.

The event, organized by the Energy Institute, assembles industry leaders, investors, government representatives, academics, and NGOs to share strategic insights and collaborate, featuring keynotes, panel discussions, and networking over three days. This year’s event focuses on a wide range of topics including human and social aspects of energy transition, achieving a just and inclusive shift, reducing living costs through energy solutions, spotlighting Africa's energy landscape, addressing workforce skills for future energy challenges, promoting diversity and inclusion, and exploring innovations and technology impacts in the energy sector.

Much like a G20 meeting or Davos conference, this event is unlikely to have an immediate market impact, but it could still influence factors like policy influence, investment redirection, technological adoption, strategic partnerships, and market sentiment.

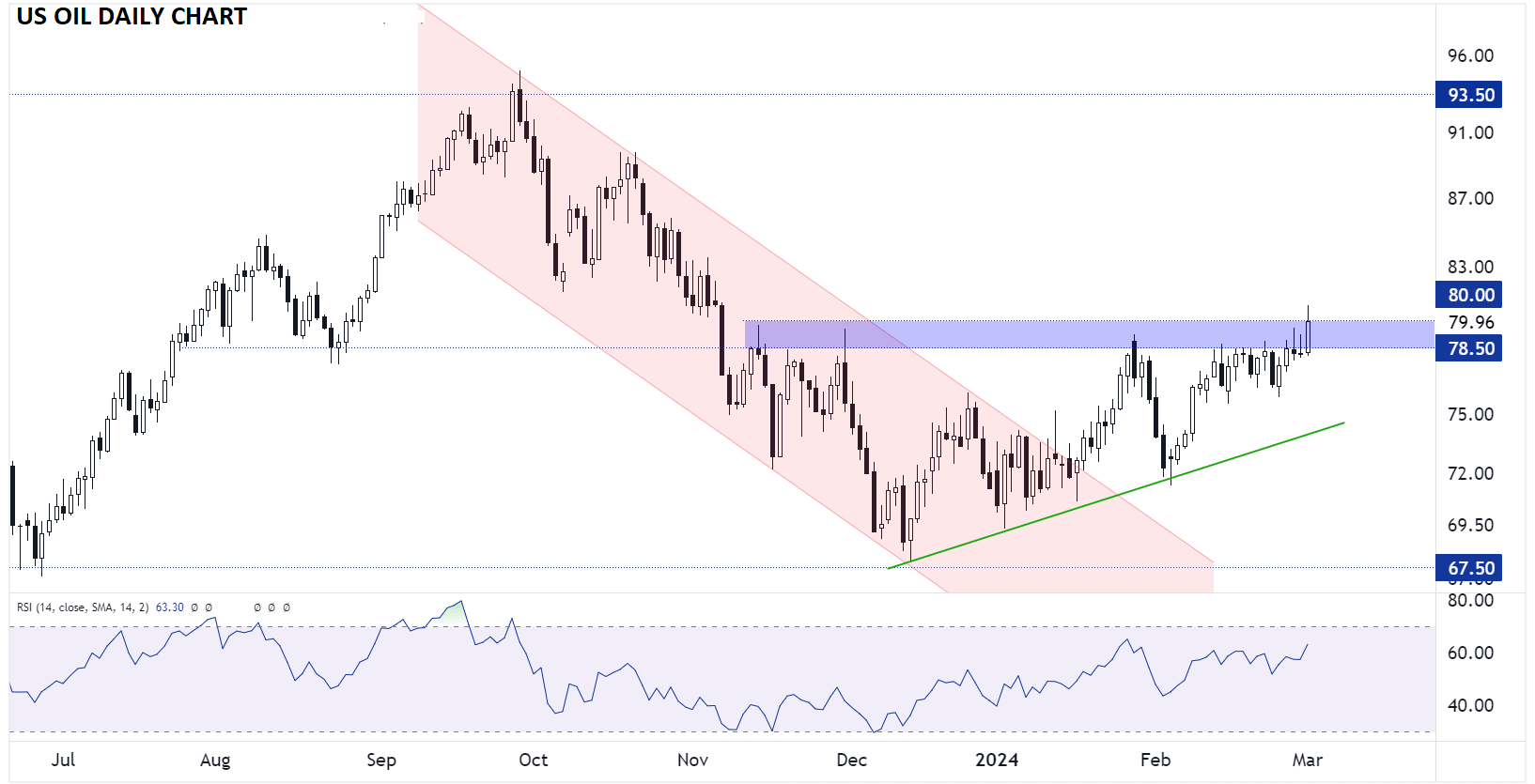

Crude Oil Technical Analysis – WTI Daily Chart

Source: TradingView, StoneX

As the chart above shows, WTI is testing a key resistance zone, and 3-month highs, in the 78.50-80.00 area. The commodity has stretched somewhat away from its rising trend line, so a near-term pullback can’t be ruled out, but the two-week consolidation range just below that resistance area hints at strong buying pressure.

This week will be a key one for WTI, with a bullish break above 80.00 potentially setting the stage for a quick continuation toward the mid-80.00s. Meanwhile, traders may be willing to buy dips into the 75.00-76.00 range if they emerge.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX