Facebook manged to claw back 2% in trading on Monday, after shedding 10% across the previous week. The stock is down marginally in pre trading today.

Facebook is fielding mounting criticism from a rising number of consumer companies over harmful content on its website.

Facebook is fielding mounting criticism from a rising number of consumer companies over harmful content on its website.

The Stop Hate For Profit campaigns has accused Facebook of not doing enough to remove hateful or racist content from its platform. It has convinced many big consumer brands to boycott advertising on Facebook in protest.

A single advertiser won’t make much difference to Facebook's advertising revenue. However, action by a group of big names and big ad spenders could make the tech giant stand up and listen.

Starbucks was the latest to join other big names such as Diageo, Coca Cola and General Motors, who have said that they will cut back on their advertising spend at Facebook in an attempt to increase pressure on the tech giant to do more to limit hate speech.

This threat to Facebook's main revenue stream, combined with the reduced spends stemming from the coronavirus pandemic could hit Facebook where it hurts and hard. These fears drove the stock down 10% last week.

No lasting damage?

The fact that the stock rallied 2% in the previous session shows just how resilient Facebook is and raises the question whether Facebook will be able to recover relatively quickly from this disruption?

The fact that the stock rallied 2% in the previous session shows just how resilient Facebook is and raises the question whether Facebook will be able to recover relatively quickly from this disruption?

This is not the first boycott on a social media company. 3 years ago major brands announced that they would boycott advertising on YouTube after advertising was placed around racist videos. YouTube tweaked some ad policies and 3 years on it is barely remembered, whilst Google, the parent company Is performing well – no lasting damage there.

Secondly, whilst the big names are important, most of Facebook’s advertising revenue actually come from thousands of small and medium sized businesses. So far, the majority of medium sized companies have not signed up and it is doubtful whether they will given that they need Facebook as much as Facebook needs them.

Thirdly, most firms have only signed up to a one-month boycott rather than anything longer, capping losses.

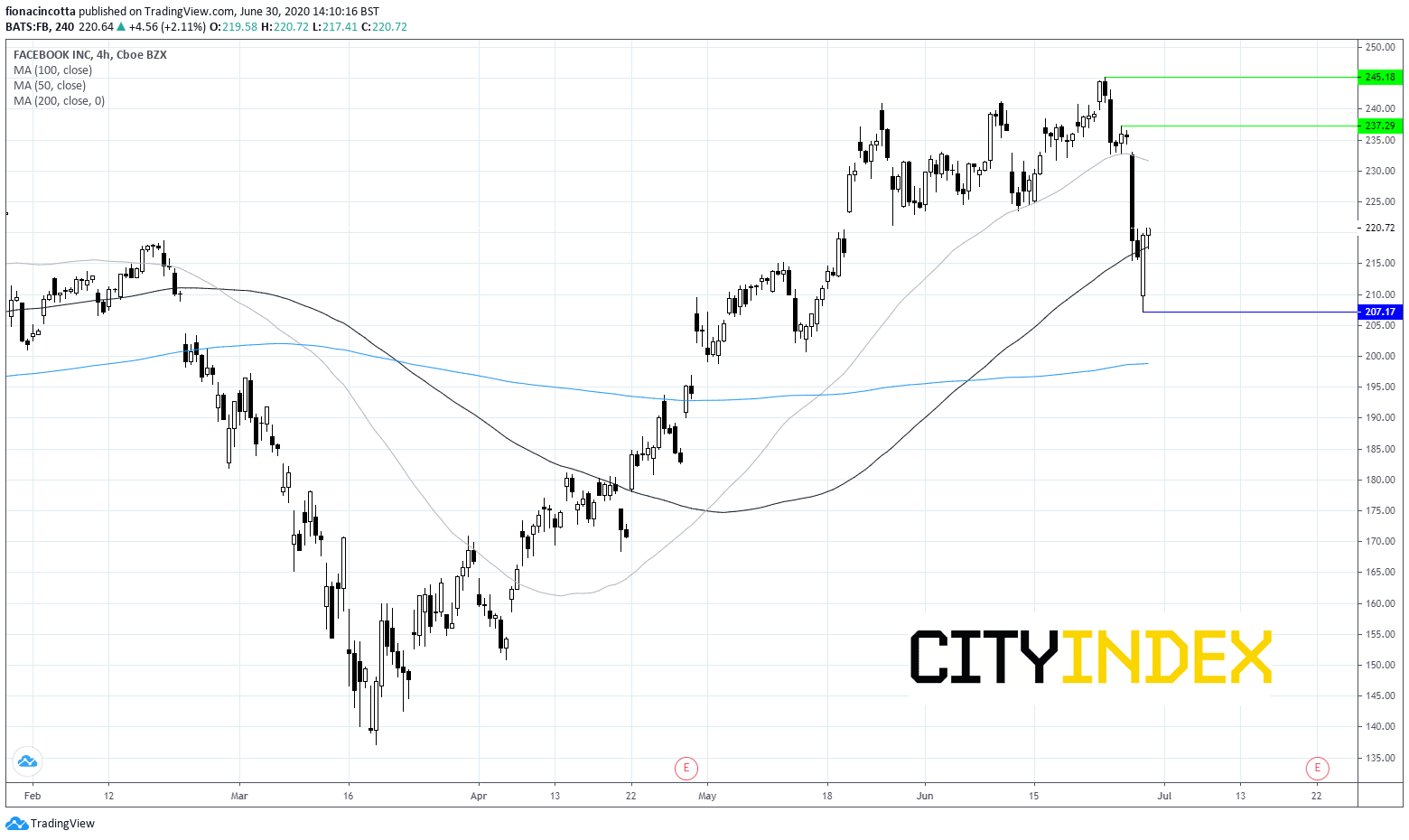

Chart thoughts

The stock is set to open marginally lower on Tuesday -0.5%, which would still be outperforming the broader market.

The stock trades below the 50 sm on the 4-hour chart. However, it remains above its 200 asma and the 100 sma id offering immediate support at $217.00.

A breakthrough the 100 sma at $217.00 could see the stock attach support at 207, yesterday’s low, prior to the 200 sma and psychological level $200 - $198.00.

On the upside, should the 100 sma hold, Facebook could advance back towards the 50 sma at $230.00 and resistance at $237.00 (high 2th June).

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM