Big events coming up for AUD

The combination of a deteriorating macroeconomic backdrop, the first monetary policy decision from a new RBA governor and threat of market intervention from the Bank of Japan has created an interesting mix for the AUD/JPY this week, especially given its proximity to a long-running support line that’s been in place for most of this year.

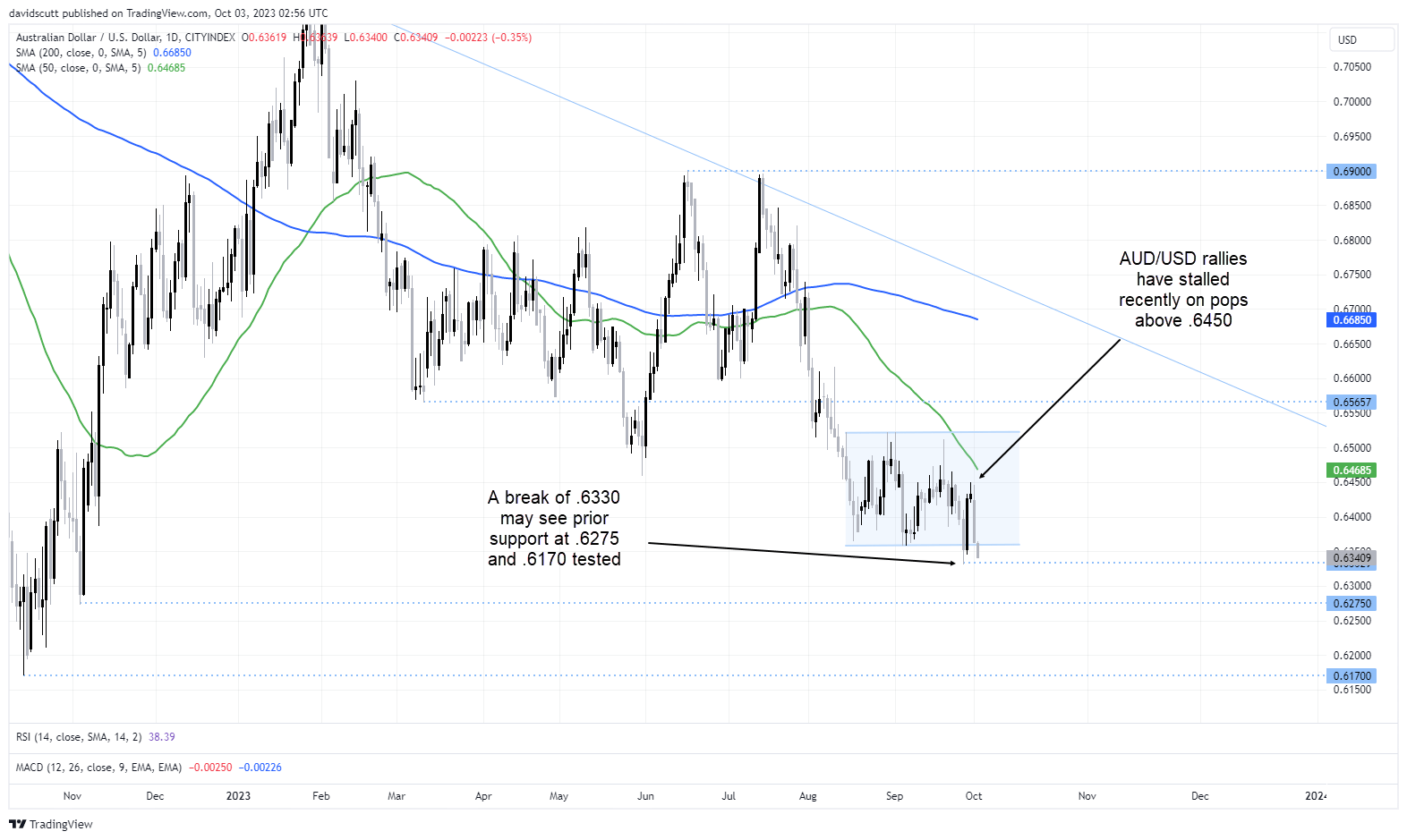

AUD/USD threating to break lower into RBA

With the US dollar and bond yields resuming their uptrend after what now appears to have been position adjustments last week ahead of quarter-end, the impact on global growth is clearly weighing on the performance of cyclical assets in early October, including commodity prices, mining stocks and the Australian dollar, sending the latter scurrying back towards the year-to-date low of .6330 struck in late September.

The increasingly negative macro backdrop coincides with the release of the RBA October monetary policy decision, the first under the leadership of new Governor Michele Bullock. Given there’s likely to be some tweaks to how messaging was conveyed under previous Governor Philip Lowe, the way it is interpreted by markets may deliver an outsized reaction in the AUD, Australian OIS markets which are fully priced for another 25 basis point rate hike by March next year, along with the ASX 200.

Looking at AUD/USD on the daily, it’s now back below prior trend support, leaving it vulnerable to fresh lows should Bullock’s messaging not meet increasingly hawkish market pricing. A break of .6330 would open the door to a move down to .6275 and potentially .6170. Given recent price action, rallies may be capped from .6450 should Bullock discuss concern about the outlook for inflation returning to the bank’s target by the end of 2025, as previously forecast.

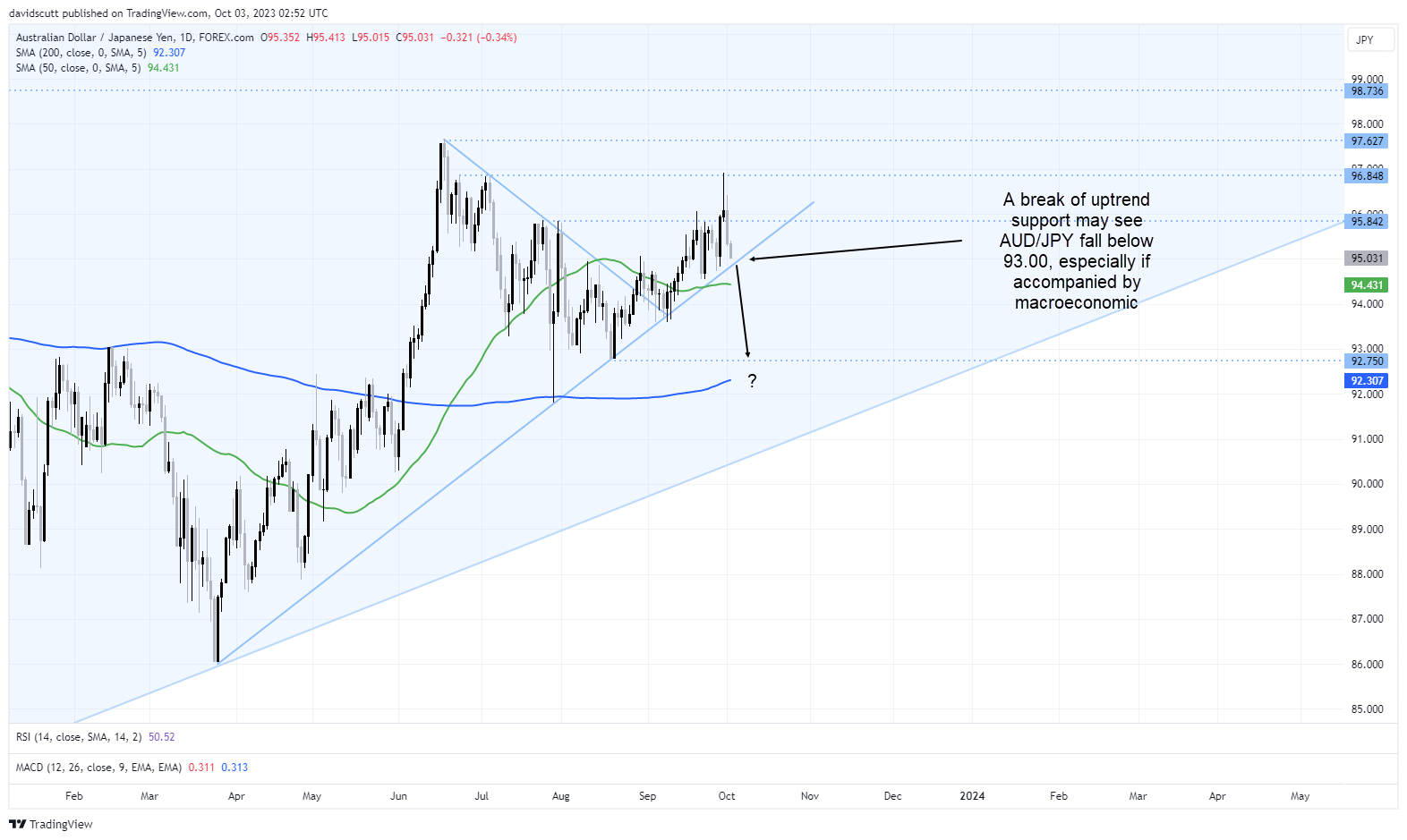

AUD/JPY has extra complication of BOJ intervention threat

Looking at AUD/JPY, it has an extra layer of intrigued overlaid with the Japanese government continuing to make noise about the continued weakening in the Japanese yen against the greenback, increasing the sense of urgency as to whether the Bank of Japan may be instructed to intervene in FX markets to support the yen. Already today we have seen fresh warnings from Japanese Finance Minister Shunichi Suzuki as USVD/JPY approached 150, a level many believe may prompt the government to push back against market forces.

Should intervention occur, it would likely see AUD/JPY break uptrend support running from March, potentially seeing the pair pullback towards 92.75 or even the 200-day MA around 92.31, a level it has respected on plenty of occasions in recent years.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade