The ASX200 trades 22 points higher at 6812 at 2.55 pm Sydney time, ahead of tomorrow's release of earnings from Microsoft and Alphabet as well as Australian Q2 inflation data.

Headline inflation is expected to rise by 1.8% in Q2, taking the annual inflation rate to 6.2%, its highest level since 2001. A print much higher than that, followed by a hawkish Fed would raise the chances that the RBA opts for a 65 or 75bp rate hike when it meets next Tuesday.

Shaking off an after-hours earnings warning from U.S retail giant Walmart, shares in Myer have skyrocketed by 21% to $1.02 following a trading update with full-year net profit for 2022 forecast to double. The consumer discretionary sector is trading 1.5% lower despite Myers's gain. Flight Centre fell 2.9% to $16.93 Wesfarmers fell 1.9% to $46.02, Aristocrat Leisure fell 1.4% to $35.74.

IT stocks have had a mixed day following a second successive fall in the tech-heavy Nasdaq. ZIP added 20% to $1.02, continuing its rebound after terminating its acquisition of Sezzle. Supported also by a strong trading update last week, which showed a solid increase in revenue and customer numbers. Elsewhere Appen added 3.57% to $5.80, Novonix added 2% to $2.47. Afterpay owner Block fell 2.5% to $102.86, and Megaport fell 2.16% to $8.60.

Energy stocks have gained as Russian gas supply to Europe resumed at only 20% of capacity, sending European natural gas and crude oil prices higher. Beach Energy added 3.76% to $1.80, Origin Energy added 2.8% to $5.82, Santos added 2.6% to $7.17, Woodside climbed by 2.5% to $31.48, and coal miner Whitehaven coal added 5.75% to $6.44.

Solid gains also for resource stocks, as South32 added 0.85% to $3.72. FMG gained 1.9% to $18.60, BHP added 2% to $38.12 and, Rio Tinto added 1.7% to $98.83.

The Financial Sector has had a mixed day continuing to consolidate after its 4.39% gain last week. Macquarie Bank added 1% to $175.87. Westpac added 0.6% to $21.17, ANZ added 0.6% to $22.77. CBA fell 0.20% to $96.88. NAB fell 0.3% to $29.78.

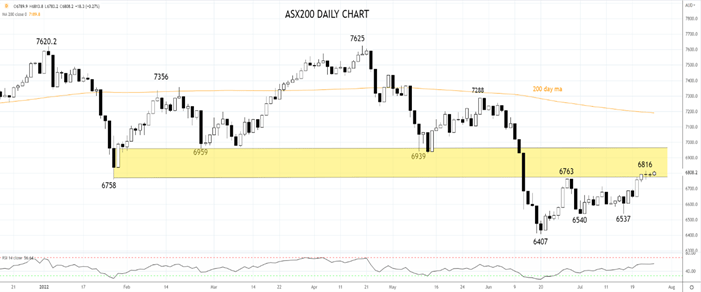

The ASX200 is chipping away at the band of resistance 6750/6950. To negate the technical damage caused by the breakdown in June, a sustained break above 6950 is required. Until this occurs, the rally from the 6407 low is viewed as a bear market countertrend rally.

Source Tradingview. The figures stated are as of July 26th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade