Trading strategies

Planning your trade exit

While it is important to learn how to spot trading opportunities and understand the best price at which to enter a market, it is also crucial to understand when to exit a trade.

Every investor is looking to make a profit but it’s important to apply risk management techniques and know when to cut losses so that your account will survive over the longer term.

There are two ways to exit a trade, you can either exit your position with a loss or a profit. In this article we’ll cover how, why and when to do both.

Exiting your position with a loss

Even the most successful investors don’t profit on every trade and you should have a plan for when and if your initial rationale doesn’t work for you.

It is important to exit a trade that isn’t working and not run your losses more than is sensible, hoping for the market to move back in the direction you predicted.

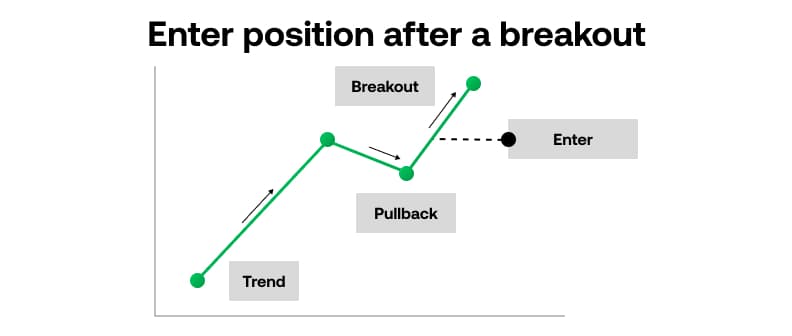

In our "when to enter a trade" section, we looked at how to enter a trade using the trend, pullback and breakout method.

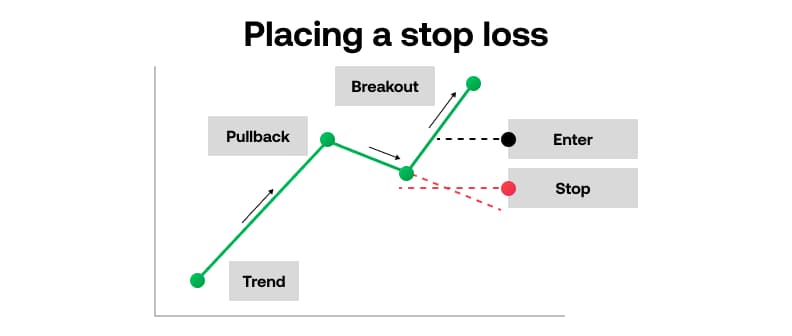

The next step in learning how to trade more effectively and protect yourself against losses, is to trade using a stop loss.

How to trade using a stop loss

You can place a stop loss by selecting the Stop Loss option in the order ticket. To add a Stop Loss at a later stage, navigate to the Open Orders screen.

If you enter the market after a pullback (the pattern highlighted by the blue line in the example), consider placing a stop loss underneath the low of the most recent breakout (highlighted by the red line). This will help reduce potential losses.

Aim to place a stop loss at the point that the market indicates that your initial prediction may have been wrong. This could be when the event that you think is a pullback turns out to be a much deeper pullback or even a reversal.

With this strategy you will be out of a trade with a potentially small loss.

For example if you've decided to go long or buy a market, you could place an initial stop loss below the most recent significant low, as indicated by a key support level. The opposite would be true if you had gone short.

How much should you risk?

A good method used by professional traders is to not risk more than 2% of the total equity in your account on any one trade.

To put this into perspective, if you have $5000 in your account then you shouldn’t risk more than $100 on any one trade and should set your stop loss according to that principle to protect against excessive risk.

Exiting your position with a profit

The other way to exit a trade is with a profit, the outcome that every trader is aiming for.

There are a number of techniques that you can use to decide what level to close our trade out at.

Setting limit orders

A trade can be closed manually or by setting a limit order which will automatically close your position out at a profit level set by you.

This helps you to become more disciplined about trading and will help you stick to your trading plan without trying to overreach on profits.

One technique is to place your profit level at, or a little bit lower, than a significant support or resistance level from the recent past.

You don’t have to come out of the trade in one go. You can gradually reduce your position thereby locking in profit, either manually or by using limit orders.

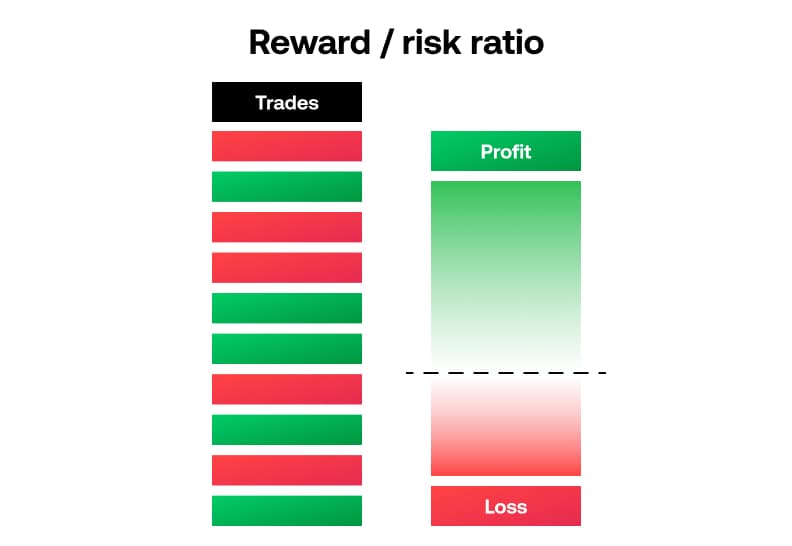

Reward-risk ratio

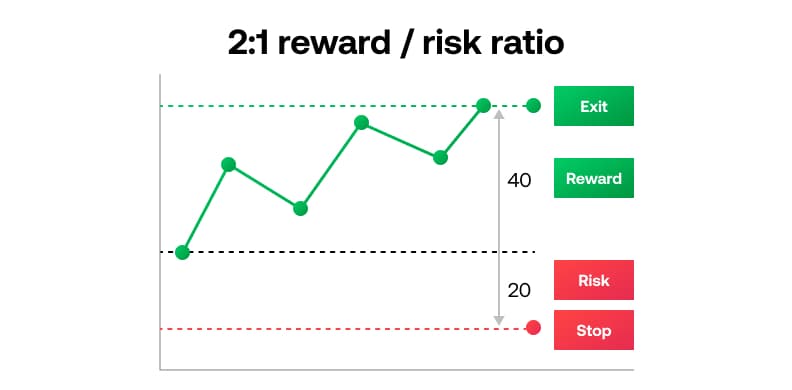

Another strategy is to consider a risk-to-reward ratio and place an exit target at a multiple of your stop loss, such as at a ratio of 1:1, 2:1 or even 3:1 .

For example, if your reward/risk ratio is 2:1 and you’ve set our stop loss 20 points below your market entry then we might look to exit your trade 40 points above your market entry.

For shorter term trading, consider a lower risk ratio of 1:1 or 1.5:1

For longer term positioning, you could consider a higher reward to risk ratio such as 3:1, where you are looking for a reward of 3 times our risk.

This type of reward/risk ratio means you may make individual losses on trades but overall you should aim to insure your trade is successful.

So for example, if you placed 10 trades with a reward risk ratio of 2:1, even if you have a success ratio of 50%, the profit will be double that of your losses even though only half the trades were successful.