Introduction to financial markets

Trading cryptocurrencies

Entering the cryptocurrency market can be daunting regardless whether you are new to trading or an experienced trader. Here we aim to break the process down into manageable sections so that you understand the cryptocurrency market and have the necessary information to start trading cryptocurrencies with City Index.

How to trade Cryptocurrencies?

There are two ways to trade cryptocurrencies.

- Crypto trading via an exchange

Here you buy a cryptocurrency or a portion of a cryptocurrency outright via an exchange. The full purchase price is required upfront. You hold it in a digital wallet with the hope that the price appreciates. - Crypto trading via CFD’s

When trading crypto currencies as CFDs you do not own the underlying asset. You are speculating on the price movement of the cryptocurrency. You do not need a digital wallet. If you think that the price of the cryptocurrency will increase you buy or go long. If the price moves in your favour you make a profit. However, if the price declines you make a loss.

Perhaps the most significant difference between buying cryptocurrencies through an exchange and storing in a wallet compared to trading cryptos through CFDs is the ability to go short.

Making money in a falling market

If you think that the price of the cryptocurrency will decline you open a sell trade*, also known as going short. Should the price of the cryptocurrency decline, you make a profit. However, should the price go against you and increase, you make a loss.

The ability to go long or short at any time is very useful when trading a volatile asset such as cryptocurrencies, particularly as analysts are divided as to where cryptocurrency prices are going. Using CFDs you can trade the price swings on a short-term basis, instead of just purchasing at a price and holding long term, hoping for the price to appreciate. This means you have more flexibility with your trading.

* check on the website for details on which cryptocurrencies you can short

Trading on margin

Trading using margin and leverage can be more flexible than buying cryptocurrencies outright. This is especially the case when trading the more expensive cryptocurrencies such as Bitcoin.

Trading cryptocurrencies using leverage enables you to take a position with a smaller initial outlay. Instead of depositing the entire value of the trade to open the position, you put forward a smaller percentage, known as margin. Trading using margin means that your gains are magnified. However, your losses are as well. Remember increased leverage means increased risk.

Using orders

Finally, trading cryptocurrencies through CFDs enables you to use orders to enter, exit or protect a trade. These risk management tools are not available if you buy through an exchange. However, they can be extremely useful to protect positions in volatile markets. It is not unusual for cryptocurrencies to move over 10% in a day.

5 Steps to trade cryptocurrency CFD’s

- Select which cryptocurrency - Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin cash.

- Do your research – understand what moves the crypto you are trading.

- Decide to go long or short – do you think the market will rise or fall?

- Plan your exit strategy – Plan your stop loss level and a profit target.

- Place your trade.

How Cryptocurrency markets works?

Before starting crypto trading, it is important to understand how cryptocurrency markets work and what moves them.

Cryptocurrency is a digital currency that is transferred between peers, transactions are then recorded on the blockchain. There is no middleman and it is decentralised. This means that it is controlled by its users and computer algorithms; unlike fiat currencies which are controlled by a central bank.

Crypto currencies are "mined". This is the process by which transactions are verified and added to the blockchain ledger. The supply of cryptocurrencies is controlled, and most have maximum total supply.

Cryptocurrencies are also traded like stocks or fiat currencies. Like other currencies the value of cryptos is measured against what they are worth against other currencies such as the dollar, the euro or the pound.

What moves cryptocurrency markets?

There are many factors that can affect the price of a cryptocurrency and very quickly. Here is a list of factors to watch:

- Software upgrades

- Public hype

- Wallet improvements

- Platform applications

- Government regulation

- Support from big industry players

Examples

Below are two examples of how to trade cryptocurrencies and the possible outcomes.

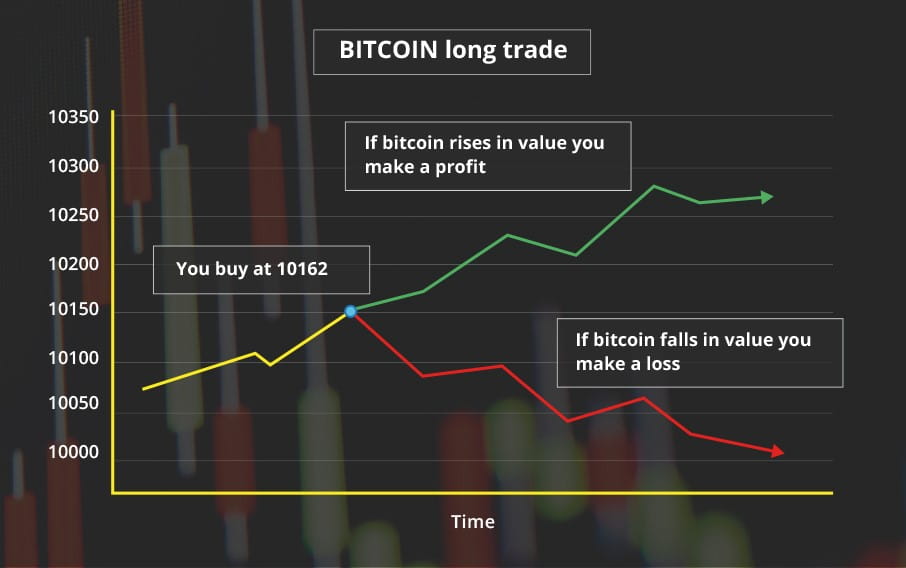

Example 1: Buying (going long) Bitcoin

Bitcoin/USD is trading at:

10127 (to sell) | 10162 (to buy)

Let’s suppose that you think that the value of Bitcoin will increase. You decide to take a long position. You buy 3 Bitcoin CFDs at the buy price of 10162.

The value of you trade is 3 x 10162 = $30,486

Suppose the margin requirement for Bitcoin is 25%. You will need to have $7,621.5 in your account in order to open the position, excluding trading costs.

Bitcoin price rises

The price of Bitcoin rises 120 points to 10282 (sell price). You sell your position to close. You make a profit. This is calculated as:

120 (points in your favour) x 3 CFD’s = $360 profit

Bitcoin price falls

Had the price of Bitcoin moved against you and dropped 100 points to 10062 (sell price) you would have made a loss. This would be calculated as:

100 (points against you) x 3 CFDs = $300 loss

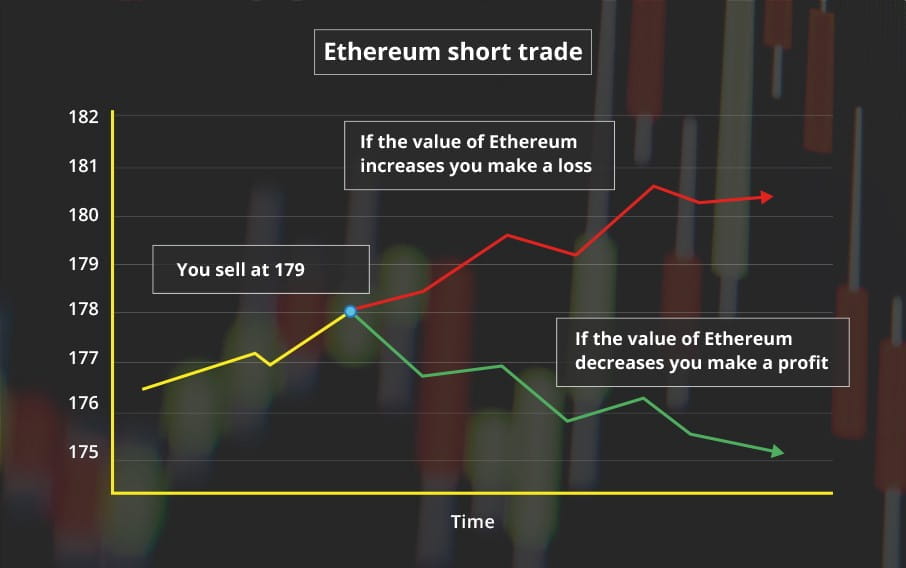

Example 2: Selling (going short) Ethereum

Ethereum is trading at:

179 (to sell) | 180.2 (to buy)

In this example you believe that the value of Ethereum will decline against the US dollar. You decide to go short Ethereum, selling 1000 CFDs to open at the sell price of 179.

Ethereum price falls

After placing your trade, the price of Ethereum falls. You buy to close at the buy price of 176. You profit is calculated as:

3 (points in your favour) x 1000 CFDs = $3000

Ethereum price rises

Had you made a wrong call and the price of Ethereum moved against you, you would have made a loss. Image Ethereum rose to a buy price of 182. Your loss would be calculated as:

3 (points moved against you) x 1000 CFD’s = $3000.

Summary

Crypto trading has grown in popularity since exploding onto the scene in 2017. Whilst there are now thousands of cryptocurrencies, the most popular are Bitcoin, Bitcoin cash, Ethereum, Litecoin and Ripple.

Crypto currencies can be traded via an exchange or through CFDs. Trading cryptocurrencies through CFDs enables you to:

- Make money in rising or falling markets

- Trade using leverage

- Use orders, trade alerts and stop losses to protect your position

Cryptocurrencies are notoriously volatile and should be traded using a sound risk management strategy.